The price of Bitcoin has remained above $20,000 for the past 9 days; But the deterioration of other markets has caused traders to doubt whether this area will become an important support for the continuation of the upward trend. Additionally, new data suggests that the trading positions of professional traders could lead Bitcoin to face resistance at $21,000.

According to Cointelegraph, the Bank of England on November 3 (November 12) increased the interest rate by 0.75 percentage points to 3%, this was the highest increase in the interest rate since 1989. Also, as the monetary policy committee tried to curb inflationary pressure, the risks of a long-term economic recession also increased.

The UK monetary authority noted that the latest growth and inflation forecasts present a very challenging outlook for the economy. In a statement, the committee added that high energy prices and tighter fiscal conditions will increase spending and this will put negative pressure on employment data.

The United States central bank also increased the interest rate on November 2 (November 11); This was the fourth consecutive increase by the Federal Reserve, which has raised the interest rate to the highest level since January 2008. The adoption of a conservative approach by central banks partly explains why Bitcoin failed to break through the $21,000 resistance on October 29 and has seen its value decline by about 3% since then.

Examining derivatives market indicators helps to better understand the status of trading positions of professional traders in current market conditions.

Option traders are not bullish

A delta deviation of 25% is a telltale sign of when market makers and arbitrage traders pay more to avoid an upward or downward movement in price.

In bear markets, option traders use higher coefficients on price declines, which causes the Skew indicator to reach above 10%. On the other hand, in rising markets, they tend to lead the Indicato Skew below the negative 10% area; This means that bearish put options are traded at a discount.

The delta deviation was in the upper 10% range until October 26 (November 4), which indicated that option traders are less inclined to prevent the price from falling. The situation became more balanced after October 26; But the attempt to break through the $21,000 resistance on October 29 was not enough to reassure option traders.

Currently, the 60-day delta deviation is 6%, so whales and market makers use similar coefficients to push prices up or down. However, as Bitcoin nears the $20,000 support zone, other data is also showing low confidence among traders that the uptrend will continue.

Lourage traders ignored the recent price rally

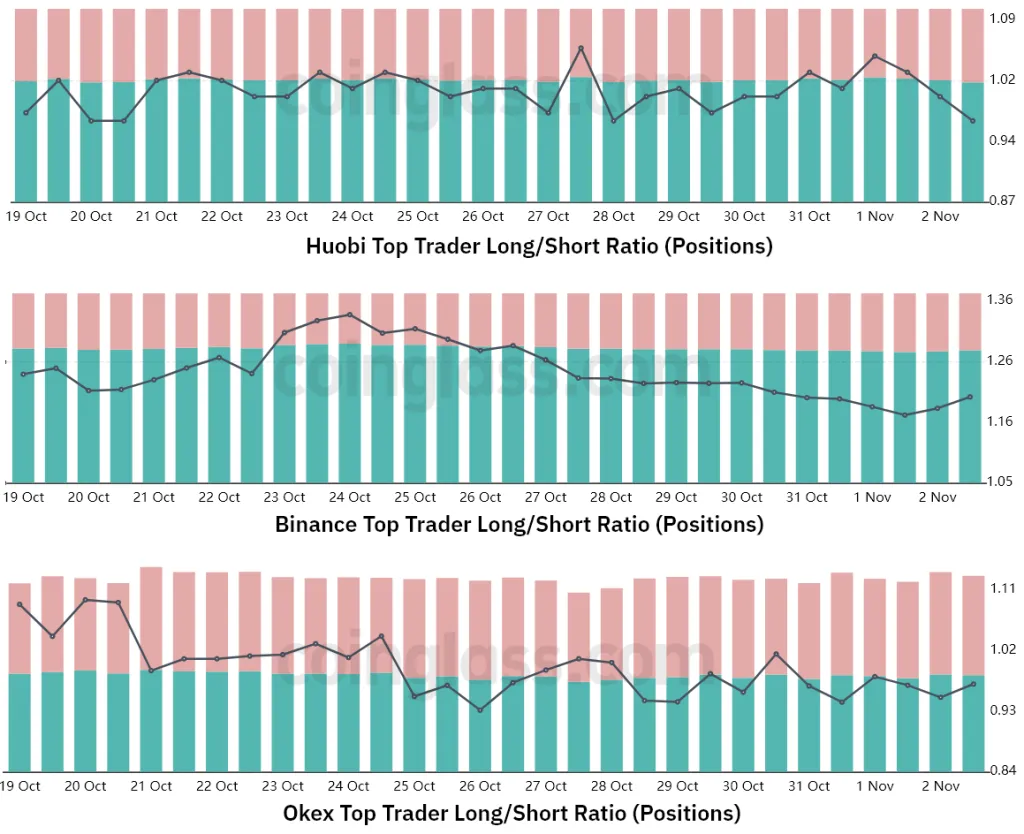

The ratio of long to short positions index excludes external factors that may have influenced the options markets alone. It also collects data from exchanges’ trading positions in spot, futures and three-month futures contracts. As a result, this indicator provides better information about the trading positions of professional traders.

Different exchanges sometimes have differences in the data collection method, so instead of checking the figures, you should consider the changes in the data.

According to the long to short indicator and despite the 9% growth of the Bitcoin price between October 22 and 29 (October 30 to November 7), professional traders have slightly reduced the volume of their leveraged long positions.

For example, this ratio has increased somewhat for traders after starting at 1.25; But at the end of this period it reached 1.22. By reducing this indicator from 1.03 to 1 in the 7 days ending October 29 (November 7), Hubei Exchange witnessed a slight decrease in the ratio of long to short transactions.

This ratio in OKX exchange also decreased from 1.01 on October 22 (30 Mehr) to 0.94 on October 29 (7 November). This means that, on average, traders were not confident enough to add leverage to long positions.

$20,000 support is not powerful; But traders do not have a bearish view

Examining two derivatives market indicators, Options Skew and the ratio of long to short trades, shows that the correction of about 3% of the price of Bitcoin since trying to cross the $21,000 resistance on October 29 (November 7) is supported by the level A moderate level of mistrust of leveraged buyers occurred.

Building more bullish sentiment could push the 60-day delta into negative territory, possibly increasing the long-to-short ratio. It is important to note that even professional traders can have a wrong analysis of the market. However, the current review of the Bitcoin derivatives market indicates that the $20,000 support is weak.

Looking optimistically, there is no indication that professional traders are expecting a bearish move for Bitcoin. Basically, even if the price of Bitcoin goes back to the $19,000 range, nothing will change because it has been 50 days since Bitcoin last traded above $22,000.

RCO NEWS