03 April 1404 23:30

The Islamic Republic of Iran Customs announced the new customs tariff for mobile phone imports for 1404 by announcing a new directive.

At the same time as 1404 AD, the Iranian Customs Import Office announced the import rights of foreign phones to importers and buyers. Given the customs directive, the new year’s tariffs will rise, and as a result, the price of foreign mobile phones will rise. Here’s a look at the text of the customs directive and the amount of new year tariffs.

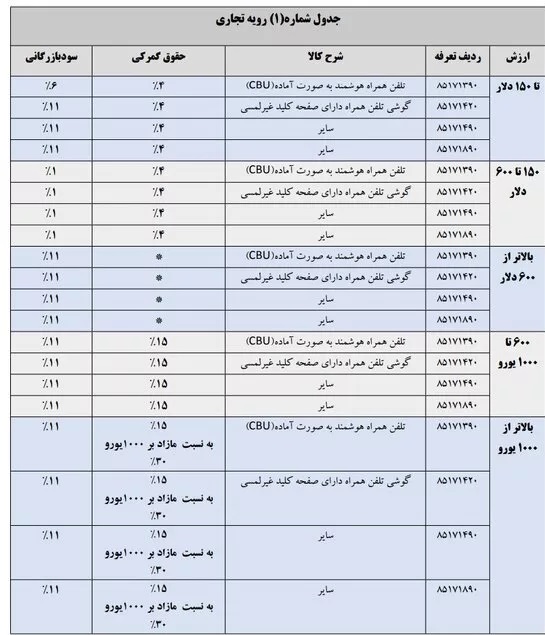

New Customs Tariff for Mobile Import for 1404

Customs, in line with the announcement of the budget law of 1404, which reached the President of the Medical President on February 15 last year, has issued an executive instruction to calculate the import rights of foreign smartphone imports. According to paragraph (1) of Note (1) of the Budget Act, the value -added tax subject to Article 7 (7) increased to one percentage as a share of the government to equal the total value added tax rate (10).

In addition, the exchange rate is based on the calculation of input rights except the goods subject to paragraph (2) of this law, which is calculated based on a single preferential rate, will be based on the average exchange rate of the gold and currency exchange center in March last year. In paragraph (Z) note (1) states:

Customs salaries for foreign mobile phones will be priced at between € 600 and € 1,000, 15 %, and a surplus price of a thousand euros and more than 30 %. The customs are obliged to deposit the resources from the execution of the sentence into the 110410 income line. Imports of these goods are also subject to free trade and industrial zones.

In the Decree of the Cabinet, published in June 1403, the type of currency basis for the calculation of customs value to determine the customs rate of foreign mobile phone imports is determined by the euro, and the customs are required to review the value of the imported phone if viewed by a different currency.

If the cellphone is valued at more than 1,000 euros, up to 1,000 euros at a customs tariff of 15 % and the rest will be calculated at a rate of 30 %. Finally, the sum of the figures obtained as customs rights will be the criterion for calculating the entry rights. On the other hand, in accordance with the country’s total budget law in 1404, from the beginning of April, the exchange rate is based on the calculation of the input rights of the handsets based on the average exchange rate of the gold and currency exchange center in March 1403.

Given the process of registering the passenger and postal mobile phone information process dated July 19, 1403, the exchange rate for calculating the customs value of the imported mobile phone in the passenger and postal procedure is the central bank’s announcement rate. In addition to the customs duties and commercial interest rates received, the value -added tax rate is 10 %, the Red Crescent duties will receive one percent of the input salaries and the waste duties of half a thousand.

Note (2) Article (5) of the Customs Act explicitly states that the owner of the goods is responsible for the payment of input rights and other funds and that the customs officers must ensure the accuracy of the calculations. In the above tables, the customs duties of imports of a phone value above $ 600 to 600 euros are 4 %. The validity of the above directive is by the end of this year.

(tagstotranslate) Mobile Phone (T) Importing Mobile Phone

RCO NEWS