Most analysts see Merge’s approaching time of Merge on September 9 as the reason for the 5 % rise in the price of Ethereum after reaching the $ 2 range in June. However, there are indicators that show that even the upgrades can prevent the fall in the future.

According to Kevin Telegraph, Ethereum is still trading at 2 percent lower than its highest price in November (October 1), according to Kevin Telegraph. A review of the downtrend of the Ethereum market will show why Ethereum value is likely to continue the downtrend.

Buy with a rumor, sell it!

According to data collected by the Glassnode analytical platform, the options traders predict that the price of the digital currency will rise from $ 4.9 to $ 4.9 before the current integration. Even some traders think that the price of Ethereum will reach $ 4.9, though there is not much passion for the post -transfer era.

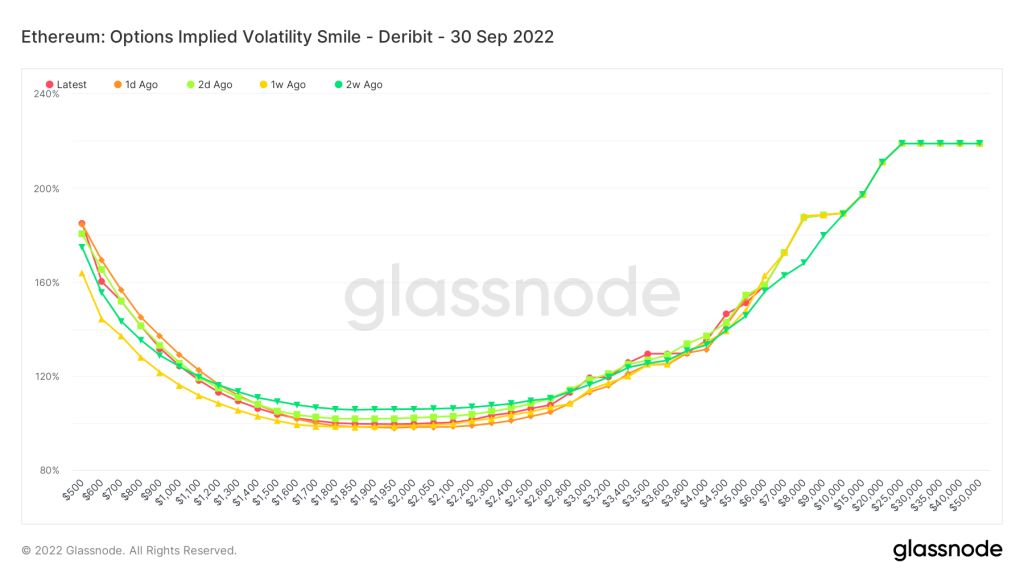

Review of the “Smile Smile of Optional Elit Fluctuations” or “OIVS” shows that for the post -merger era, there is a demand for use of protective contracts against the downward trend. This index depicts the implicit fluctuations of the option transactions for the Strike Price prices on specified maturity dates. Optional contracts with more profit cause more implicit fluctuations.

Implications of the Implication of Volatilation reflect the market expectation of future fluctuations. When investors believe that asset prices will fall over time and the market will be reduced, implicit fluctuations will increase.

For example, the slope and shape of the smile chart of Options Expiry on September 9 helps traders evaluate the cost of transactions and check the type of risks that the market considers.

The face -to -top slope of the fluctuations of fluctuations shows a large demand on the Ethereum Call Option transactions that expire in September. This means that traders are willing to pay a premium to maintain their own trading positions.

Golsonud analysts have written on the following OIVS chart or PUT Open Interest at different agreed prices:

After the merger, the left trail of the chart is priced significantly in implicit fluctuations. This shows that traders pay a guarantee to protect their sales contracts under the influence of “sales with news” after merger.

Simply put, Ethereum traders are ready to cover their transactions if the news of the sale of Ethereum sales is influenced by news.

Federal Reserve Policy Policies

Metropolitan events, especially the Federal Reserve contractionary policies, could be the second reason for the fall in the price of Ethereum after merger.

Jerome Powell, the head of the US Central Bank, emphasized the Federal Reserve’s commitment to contain inflation last week, saying they would continue to implement contractionary policies until inflation control. In other words, Paul and his colleagues are likely to increase interest rates by 0.5 to 4.9 percent at their subsequent policy meeting in September.

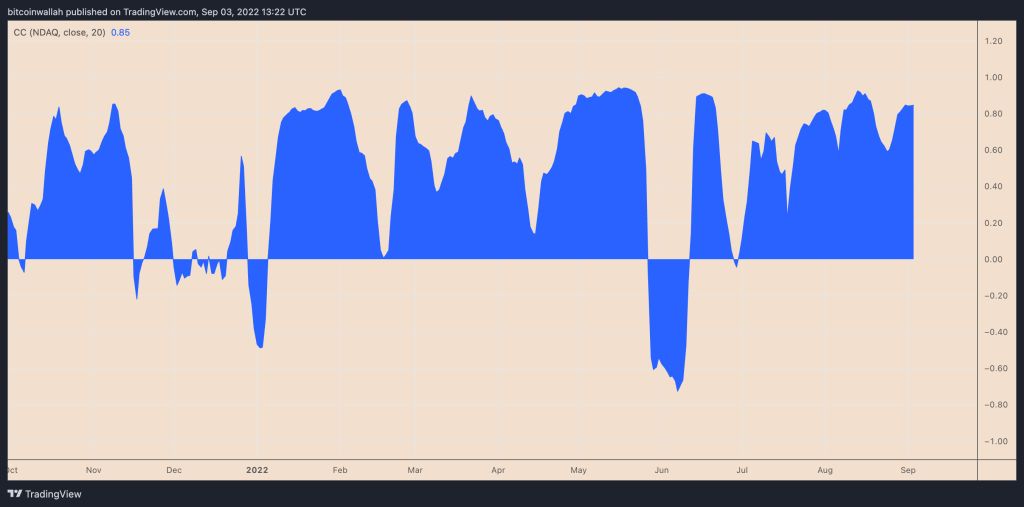

Positive and growing correlations of the digital currency markets and traditional financial markets in risk -taking indicators against the prospect of liquidity reduction in the economy have led to recent news of interest rates on the price of Ethereum. For example, the daily correlation coefficient of Ethereum Price and Nasdaq Stock Exchange (NASDAQ) on September 9 (September 1) was 2 %.

Therefore, the possibility of lowering the price of the Ethereum along with other risky assets is high; Especially if the Federal Reserve increases interest rates this month by 6.5 percent.

Ethereum’s big descending flag

From a technical analysis point of view, Ethereum is forming a descending flag pattern in its weekly chart.

The descending flag pattern is formed when the price fluctuates within a rising channel (with parallel ceiling and floor) after a rapid and significant drop. According to the rules of technical analysis, the price will be reduced to the extent of the previous descending trend (flag rod) after leaving the canal.

This week, Ethereum tested the lower flag’s line as support. The price of this digital currency in this range can try again to cross the flag’s upper line (about $ 1.5), or to be subjected to a lower trend line as its downtrend continues.

Given the factors we have examined earlier and as shown in the chart below, there is a possibility of falling the price of Ethereum to the goal of the descending flag ($ 1) in September; A level that is about 2 percent lower than today’s Ethereum.

RCO NEWS