The value of artificial intelligence -related companies fell on Tuesday, as investors are waiting for Nvidia’s financial report, which can provide a vision of market demand and justify the high value of the sector.

Technology stocks around the world declined this week after a report from TD Cowen analysts. The report showed that Microsoft has canceled some of the rental contracts in the United States, including at least two contracts with private data centers.

The value of Nvidia’s shares, known as one of the top artificial intelligence companies, declined by 4.9 % before the expected financial report on Wednesday. Investors are waiting to see if the demand for the company’s expensive artificial intelligence chips will still be strong after the cheaper Chinese company Deepseek’s cheaper models.

“These drops in the market are not unusual, especially before the release of the financial report, but US stock supporters are looking to Nvidia to reassure,” wrote in a note.

The shares of chip -producing companies have also been pressured, as reports that the United States intends to impose more restrictions on Nvidia chips to China and is negotiating with its allies to intensify chip export controls to the country.

The value of other chip -produce companies such as Broadcom and Micron Technology (Micron Technology) each decreased by about 4.9 %, while the semiconductor index (SOX) fell 4.9 %.

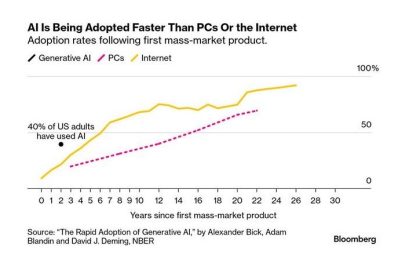

Increasing investors’ doubts over the billions of dollars that US technology companies have spent on artificial intelligence infrastructure have intensified due to slow efficiency and significant improvements at Deepseek Chinese Startup.

The value of the Digital Realty Digital Data Operator declined by 4.9 %, while the value of the VertiV Holdings, which is involved in the design and construction of data center infrastructure, dropped by about 4.9 %.

Electricity manufacturing companies, which are expected to benefit from the increased energy demand by the data centers needed to develop artificial intelligence technology, have also been pressured. The value of the Vistra stock (VISTRA) was reduced by 4.9 % and the value of the Energy Constitution (Energy Congary) was reduced by 4.9 %.

The value of artificial intelligence servers, Super Micro Computer, which had one of the weakest functions in the S&P 500 index, dropped by 4.9 %. The decline occurred earlier to submit the annual financial report of the company.

The value of the Palantir Data Analysis Company, one of the most popular shares among micro -investors for artificial intelligence trading, declined by 4.9 %.

RCO NEWS