Arjun Dougal, Executive Vice President and CIO of Card Technology at Capital One, told the audience at the VB Transform conference: “We always start by focusing on the end customer and then think about how we can use AI to solve their problems. to do This approach is a common starting point. Dougall explained that the company’s strategic plans begin with customer and stakeholder values and then detail how to achieve those goals.

Attention to the customer

Capital One’s special focus on customers defines how each AI use case is evaluated and prioritized as part of the financial giant’s comprehensive strategic plan. In the most recent fiscal year, the company reported $36.8 billion in revenue, a 7.4 percent increase over the previous year.

It is necessary to focus on this vision while ensuring that the latest AI and machine learning technologies help improve the adaptation, successful integration of generative artificial intelligence (genAI) with traditional AI models and human methods in the AI circle.

Data driven approach

A data-driven approach is in Capital One’s DNA. In 1987, Richard Fairbank and Nigel Morris, the company’s founders, came up with the idea of using statistical analysis to provide customized credit card offers to different customer segments. Capital One relied on this data-driven approach to differentiate itself in the growing credit card services market. The company was the first credit card provider to fully focus on advanced data and statistical analysis.

By launching the company based on a data-driven approach, Capital One’s accuracy and speed in analyzing large volumes of customer and market data has enabled them to manage risk, define new services, and gain deep customer insights that cannot be obtained in any other way. excel

Dugal’s many insights into how Capital One is making the most of AI and machine learning in a firework conversation at VB Transform demonstrate the company’s maturity in choosing ways to integrate new technologies into its business operations.

To increase speed and scale, Capital One has focused on building a modern data ecosystem and started by overhauling its technology stack. Further, the company has built an in-house technology team of 14,000 people and democratically implements AI and machine learning across all parts of its business with managed processes and human participation.

Dugal emphasized the critical role of humans in the loop process and introduced it as one of the main pillars of his approach to all forms of modeling, from machine learning to the generative AI pilots currently in development. Here are five key takeaways from Dugal’s speech at the VB Transform event.

Dugal’s five key takeaways on how to accelerate Capital One’s AI capabilities and stay ahead of the enterprise competition:

Balance between rapid development and adaptation:

Compliance with regulatory requirements in each region and country is one of the biggest challenges in managing a large financial services business. By leveraging compliance reporting, analytics and predictive analytics along with its AI initiatives, Capital One has taken on this challenge to ensure that both sides work together. Overall, Capital One is trying to learn ways to accelerate compliance and turn it into a competitive advantage using AI. Dugal emphasized the importance of having regulatory-compliant AI frameworks that are globally scalable and able to provide the necessary insights in real-time to avoid any delays.

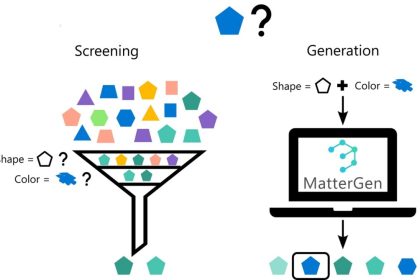

Integration of generative artificial intelligence and traditional artificial intelligence models:

It’s clear from Dugal’s comments that Capital One is actively investing in genAI and machine learning models, with the primary goal of democratizing AI-based decision-making at the enterprise level. By combining genAI with existing machine learning models, Capital One seeks to uncover new insights from the ever-increasing amount of data it generates in its daily operations. This integration must adhere to the high regulatory standards of quality and security required in a highly regulated industry such as banking.

Emphasis on artificial intelligence applications with human presence:

Dugal noted the importance of prioritizing AI programs with human presence at Capital One, which aims to reduce risk, ensure accuracy and the ability of models to learn in real-time from human intelligence. This approach ensures that while AI can reliably scale to perform routine tasks, human oversight of critical decision-making processes is still maintained.

Creating an advanced technology ecosystem:

Capital One continues to make significant investments in its modular technology infrastructure, which enables the integration of artificial intelligence without requiring extensive restructuring or overhaul of the technology stack. This includes leveraging public cloud infrastructure to train scalable AI models and focusing on data management practices to maintain data quality. Capital One was the first US bank to focus all of its efforts on the cloud, demonstrating the bank’s commitment to continuously building and improving its technology ecosystem. The move to the cloud allowed the company to create a unified enterprise platform for software delivery and provide an environment conducive to rapid innovation and experimentation, while maintaining the necessary governance and stability.

Continuous investment in talent development:

During his speech at VB Transform, Dugal emphasized the critical importance of talent development in any AI project. To build and strengthen a capable AI workforce, Capital One focuses on developing internal talent and recruiting externally. With the goal of expanding AI across its global operations, Capital One sees talent development as a key enabler to scale operations using the latest AI applications being designed. Dugal also noted that Capital One has been recognized as one of the best banks to attract AI talent, a testament to the success of its strategies in attracting, retaining and developing the best professionals in the field.

conclusion

As a model for other large financial institutions, Capital One’s holistic approach to integrating artificial intelligence into its operations responds to the challenges of balancing growth, compliance with regulatory requirements and increased global competition. Dugal’s comments and insights reflect Capital One’s maturity in evaluating next-generation artificial intelligence and its potential for its customers, employees and business.

RCO NEWS