Samsung’s semiconductor unit has reported Sudi, much lower than predictions, indicating the intensity of the crisis in the world’s largest memory chip producer. This key section announced operating profit of 2 billion won (equivalent to $ 5 million) in the second quarter of the year, while analysts expected an average profit of about 1.5 trillion won ($ 1.5 billion); Decreased performance of the unit is affected by US export constraints on high bandwidth memory chips as well as its casting losses.

South Korea’s largest company, which had previously released unpleasant figures for operational profits and revenue in early July, announced Thursday that its net profit reached 1.2 trillion won ($ 1.5 billion), lower than analysts estimates $ 1.2 billion. The decline in profits occurred when the Samsung casting unit, which set part of its sales on China’s demand, recorded a one -time cost for its warehouse inventory; Because export restrictions were not sold, artificial intelligence chips were not sold. The exploitation rate also declined. Samsung saw a profitability drop despite the good demand for high -level memory use.

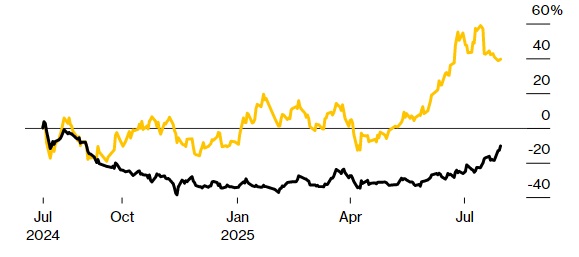

According to the company, the operational loss of the casting unit is expected to be reduced in the second half of the year due to gradual improvement of demand. Samsung’s three -month disappointing report comes as the company has a $ 1.5 billion contract with Tesla to produce artificial intelligence chips at a factory under construction in Taylor Texas. The value of the company’s stock has grown by 5 % since Monday, following the announcement of Samsung’s growth in July to more than 2 % and has put its shares on the way to the best monthly performance in more than four years.

Samsung trying to reduce its distance with SK Hynix Inc. And Micron Technology Inc. In the field of artificial intelligence memory chips, it has increased investment in research and development and initial production capacity. At the same time, it is trying to bring a new life to its affected viability, which is a sharp drop in exploitation rates by attracting large customers such as Tesla.

In the competition with the SK Hynix, Samsung remains lagging behind in terms of stock performance in the field of artificial intelligence, and the smaller company has succeeded in dominating the high bandwidth memory market. Successful implementation of Tesla’s multi -year contract can further enhance Samsung’s position in attracting customers and prove its ability to mass -produce 2 -nanometer technology.

Investors are also looking for signs of whether Samsung will benefit from NVIDIA’s H20 chips to China. The Samsung HBM3 chip, which is not the most advanced, has been used before the H20 chips. Samsung slows down the process of completing the Taylor Factory and is now planned for Year 2. The company has had little success in attracting large customers from the leading market company, TSMC; A company that has already started its production in Arizona and is increasing capacity in the United States.

Investors are still concerned about Samsung’s ability to enter the HBM advanced memory market, a market currently dominated by SK Hynix. Samsung has faced challenges in the approval of its new products from NVIDIA, which has given SK Hynix unprecedented opportunity to create a dominant market in the growing market for artificial intelligence memory.

RCO NEWS