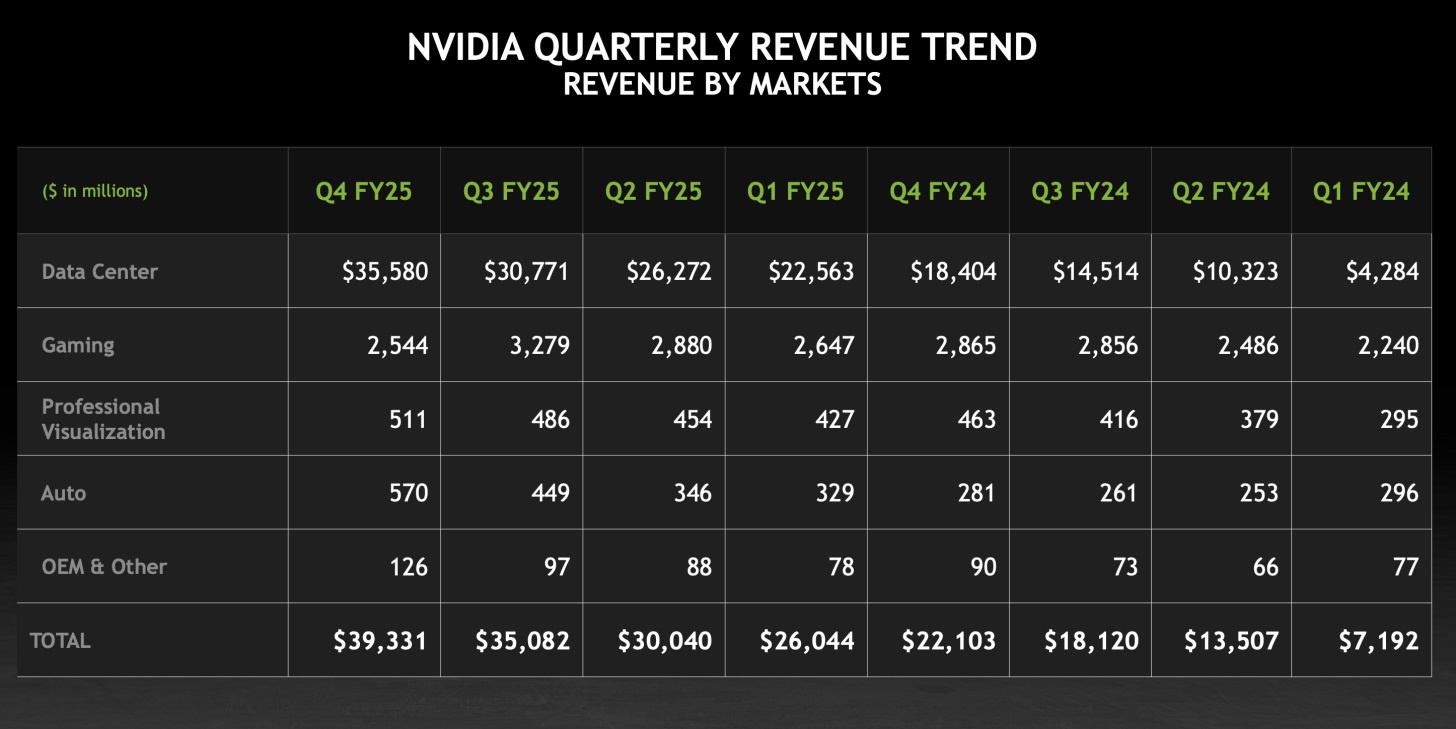

Nvidia released its fourth quarter report and once again showed significant results. The company was able to easily exceed the forecasts of analysts who estimated $ 1.2 billion in revenue and $ 1.2 billion in revenue.

It is noteworthy that Nvidia has predicted more than $ 5 billion for the current quarter, which is more than $ 1 billion above estimates of $ 1.2 billion. However, despite these brilliant results, investors did not respond very exciting, and the company’s shares in post -market trading remained almost constant immediately after the release of the profit report, but continued to increase by 4.9 percent.

As Nvidia’s analysts and investors approach the announcement of a three -month profit, there is a severe anxiety among analysts and investors. The reason for this concern was the fall of the company’s stock value in January, which led to the loss of about $ 5 billion of its market value. However, Nvidia’s ascending trend continued in strength in the fourth quarter of the year. The company’s revenue increased by 5 percent to $ 1.5 billion annually, and its net profit reached $ 5 billion with a 5 percent increase. Both of these indicators went beyond the forecasts of analysts, and Nvidia’s $ 2 billion forecast for the first quarter of the year also indicates the continuation of this positive trend.

According to Jensen Huang, the company’s CEO, the market’s enthusiasm for Blackol Nvidia’s GPUs remains strong. This new series of Nvidia’s artificial intelligence processors, called Blackwell, has been shifted to the second half of this year due to the complexities of the manufacturing process and inventory limitations. “The demand for Blackwell is beyond expectation, because the artificial intelligence defines the rules of new scale,” Huang said. “By increasing the computational power in the training phase, the models are much smarter and with the increased computational power in the processing phase, the responses are more accurate and intelligent.”

Another key indicator that affects the stock price is profitability. Production of advanced Nvidia chips is costly, and investors have previously faced a devaluation due to their inability to increase profit margins. But after investigating the results by investors, the value of stocks increased by 4.9 percent.

However, Nvidia’s promising prediction eliminates all doubts about the possible reduction of demand for its artificial intelligence graphics processors. Dip -Sick’s disappointing sale last month was based on the assumption that teaching artificial intelligence models could be done using less graphics processor and, consequently, lower costs. However, given the multi -billion dollar investment commitments of large technology companies, it seems that Nvidia’s optimistic prediction will fully address these concerns.

RCO NEWS