Many of us come into the exciting world by seeing green charts and listening to success stories, dreaming of gaining and fast profits. The notion that it can multiply your capital with a few clicks is very tempting, but the market reality has another face; A face that shows itself to the newcomers with the first heavy loss.

This article is a roadmap and the bitter and sweet experiences of a trader that has taken this high -end and up -to -date route and published in a medium article. The goal is to provide four key lessons that can make the difference between sustainable success and rapid failure. Understanding these tips, you can take this challenging but potentially profitable path with open -minded, ready -made eyes and realistic expectations.

The first point: Trading is a business, not a lottery ticket

One of the biggest and most costly mistakes of newcomers is to look at the traid as a quick way to get rich. While wealth is possible in this way, this is a “slow” process and requires time, not a one -overnight plan. The notion that it can quickly reach financial independence with low capital is the root of many catastrophic decisions.

Success in the trading, just like setting up any other business, requires a business plan, discipline, seriousness and intelligent cost management (or losses). A successful traider considers himself a business manager in which losses, operational costs, and profits are income. This change of attitude makes you an exciting gambler into an accountant strategist.

To get started, you need to understand the fundamental difference between trading and investing to choose your path consciously. The trading focuses on short -term price fluctuations, while investing has a long -term view of the fundamental growth of an asset. The following table shows these differences clearly.

| Feature | Trading (TRADING) | Investing (Investing) |

| Time horizon | Short -term (daily up to a few months) | Long -term (years) |

| The main purpose | Earn profits from price fluctuations | Growth of assets over time |

| The dominant analysis | Technical Analysis | Fundamental Analysis (Foundtable) |

| Risk level | Higher | Relatively less |

| The rate of conflict | Requires continuous monitoring and activity | Need less supervision (purchase and maintenance) |

| Potential of return | Faster but more risky | Slower but more stable |

Tip 2: Risk Management is your only task

You can’t predict the direction of moving the market with certainty, but you can completely control the amount of money you lose if you are wrong. Therefore, your first and last task as a trader is “capital protection”. Without capital, there will be no more opportunity to compensate for mistakes and make a profit; You have been removed from the game.

To survive in the market, you need to use vital risk management tools. The most important instrument is the loss limit (stop-loss); Entering any transaction is not permitted without determining the exit point in the event of loss. As well,

Law of 1 to 2 percent Never forget: In any transaction, you should not endanger more than 2 to 5 percent of your total capital. This law protects you from destroying an account in a chain of harmful transactions.

In addition, learn the concept of Risk/Reward Ratio. Just enter into transactions whose potential profits are at least twice as much as your possible risk (eg 1 to 1 ratio). This mathematical principle allows you to remain profitable even if your trading percentage is less than 1 %, as your profits will be greater than your losses.

Tip 3: There is no perfect trading strategy

Many newcomers spend a lot of time and money searching for a perfect trading strategy that is always profitable. This search is a mirage. There are no strategies, indicators or trades at a success rate of 1 %, and each system, even the best, will have a loss.

Blind copying of others’ strategy is also a dangerous way. A strategy that works great for a trader with a quiet personality and high risk tolerance may be catastrophic for you who have an emotional personality. The success of a strategy depends heavily on the psychology and lifestyle of the individual he uses. Jumping from this branch to that branch and the constant change of strategy only lead to contradictory and confusion results.

Instead of focusing on the exact parameters of a indicator (eg the best number for RSI), focus on understanding the concept of the back of the strategy. For example, the concept of “following the process” is to move in strong trends with the market. If you understand this concept deeply, small details, such as the exact period of a moving average, become less important and your strategy will be stronger and more flexible.

Tip Four: Psychology is your main battlefield

The market is a battlefield in which your biggest enemy, not other traders, but your own mind. Two devastating feelings, fear and greed are the root of many failures. Fear causes you to get out of a profitable transaction earlier and forcing your greed to ignore your loss or over -risk.

In addition, you need to be aware of the cognitive bias that disrupt your decisions. The tendency to take revenge after a loss leads you to emotional transactions without analysis.

The hopeful hope will cause you to be in a harmful deal in the hope that the market will return and that false self -esteem will lead you to irrational risks after a few consecutive wins.

There are practical solutions to win this inner battle. Before each transaction, have a trading check and only enter if all the conditions are fulfilled. Avoid the market during stress, fatigue or excitement. And most importantly, accept the loss as an integral and natural part of the trading business, not a personal failure.

Tip 5: Start with low capital, very little!

One of the best tips for any new trader is to start with a capital capable of losing it completely. In months and even the first year, you are learning and it is part of the process. Consider these losses as the “tuition” entry into the market. Paying this tuition fee is much more reasonable than endangering your all -savior.

Your goal at the beginning of the road is not to make a dollar profit, but to achieve stability in performance. Try to adhere to your risk management strategy and rules for a specified period (for example, three months), even if the end result is little profit or loss. This will institutionalize the right trading habits in your mind; The habits you can scaled later by raising capital.

Trading with low money dramatically reduces psychological stress. When you’re not worried about losing a huge amount, you can calmly focus on the learning process, the correct analysis, and the proper implementation of the strategy. This approach allows you to acquire the necessary skills without fear and stress.

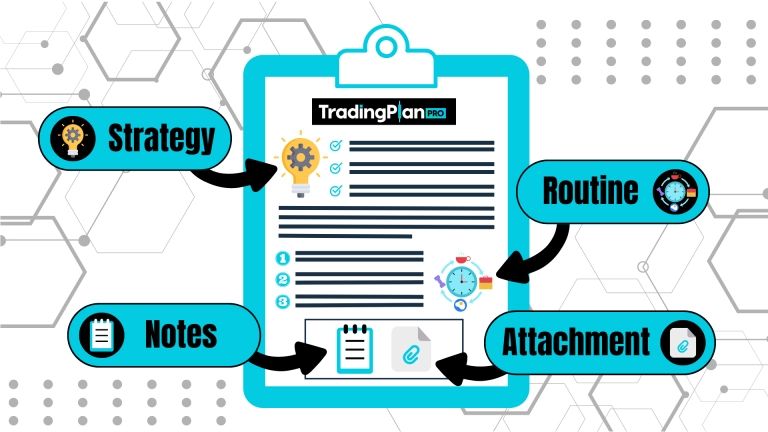

Tip Sixth: Your Roadmap is the Trading Plan

Trading without a written plan, such as driving in an unfamiliar city without a map or GPS; You will be lost sooner or later. The Trading Plan is your spine of discipline and removes decision -making from the moment of emotion and turns it into a rational and predetermined process.

A comprehensive trading plan must answer the following questions:

- What market do you trade? (For example, the main forex pairs or the top 3 digital currency)

- What is your entry and exit strategy? (Which price patterns or signals do you enter and where do you go out?)

- What are your risk management rules? (Where is your loss limit? How much is the volume of each transaction?)

- When are you trading? (In which market sessions are you active and in what circumstances do you avoid the market?)

Place the famous slogan “Trading your schedule and plan your transactions”. Your program should guide all your actions in the market. Adhere to it, even when you are tempted to violate your rules based on an inner sense or a rumor.

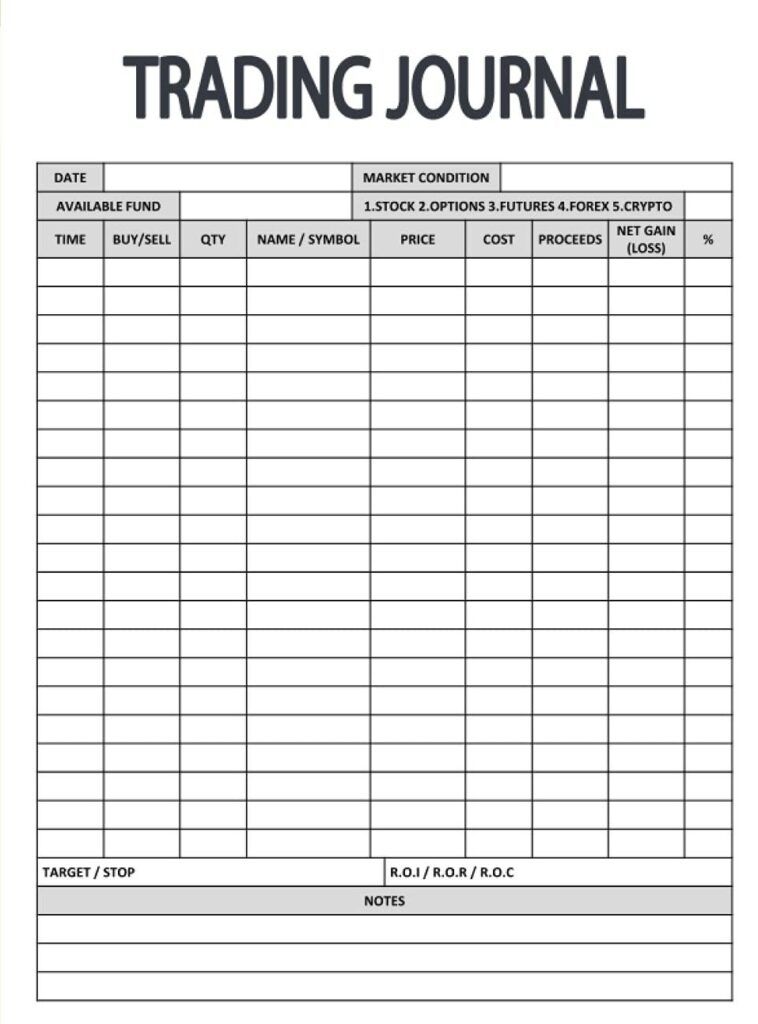

Tip 7: Trading Journal is your most powerful learning tool

You can’t improve what you do not measure. Human memory is very wrong and you need objective data for real growth. The Trading Journal is your business diary that allows you to analyze your performance impartially.

In your journal for each transaction, record the following: Date and Time, Transaction Property, Entry point, Loss Limit, Profit, Exit point, Final result (profit or loss), and most importantly, the reason for entering the transaction and your mental state and feelings at that moment. Did you enter out of fear? Or based on accurate analysis?

At the end of each week, review your journal. This will help you identify your behavioral patterns. You may find that most of your losses have been due to the loss or emotional transactions on the stressful days. The journal is a mirror that shows your true strengths and weaknesses and illuminates the path of recovery.

Tip Eight: Leverage, Dolly and Dangerous Sword

Lever or Lorij allow you to trade with much more than your real account. In fact, a broker or currency exchange will lend you to increase your purchasing power. This tool is fascinating for newcomers, as it promises to have great profits with low capital.

But the lever is a double -edged sword that, as much as it increases, multiply the loss. A small price move in the opposite direction can quickly eliminate all of your account inventory (leicoid). This tool is the main reason for the bankruptcy of many beginner traders.

It is strongly recommended to all newcomers: Unless you reach a profitable and stable strategy, do not use high leverage or preferably start your trading in the Spot (without leverage). Leverage is a tool for professionals to optimize their efficiency, not a means of compensating for beginners.

Ninth Tip: The quality of transactions is more important than quantity

Many beginners think they need to trade more to make more profit. This false belief leads to “overdose” or overdrading. This, which usually comes from boredom, greed, or effort to quickly compensate for a loss, is almost always endangered by more losses and paying for heavy fees.

A professional traider is like a patient sniper; He spends most of his time analyzing, preparing, and waiting for a trading situation with the possibility of success and only kills the trigger when all conditions are available. Remember, sometimes the best and most profitable deal is not to make any transaction.

Also, do not force yourself to break daily. Many successful traders work part -time and use medium -term strategies such as Swing Trading. These styles in which the transactions remain for several days to weeks are less stressed and provide you with more time to analyze and make decisions.

Tip Tenth: Look for a coach (Mentor), not the signal seller

At the beginning of the path, it is natural to look for guidance, but you have to distinguish between real learning and blinding. The signal channels that promise guaranteed profits make you an affiliate. Following the signals, you will never learn the “why” of a deal and you will ultimately get any skills.

In contrast, a good coach or migration does not give you fish, but it teaches you fishing. He helps you develop personal strategy, psychology management, market analysis, and deep understanding of concepts. Finding an experienced and reliable trainer can greatly accelerate your learning process.

Financial markets are constantly changing, and a successful trader always remains a student. Never stop learning. Use valid educational resources such as classic trading books, quality training courses, and analytical websites to keep your knowledge up to date.

Summary: Trading is a marathon, not a speed race

These 2 tips are not merely a set of recommendations; They are the rules that many traders have taught by paying heavy costs. Sustainable success in the trading is the result of the balance between three key elements: Mind or Correct psychology, method or efficient trading strategy, and money management or smart risk control.

The path to becoming a professional traider is a challenging path, but with the right roadmap, it is quite achievable. With patience, discipline, commitment to continuous learning and applying these lessons, you can also avoid common mistakes and maximize your chances of success in this fascinating marathon. Save this article and return to it many times during your trading trip.

RCO NEWS