In the dynamic world of digital currencies, Ripple and Ethereum represent not only two leading digital assets, but also two completely different views on the future of technology and finance. The two crypto giants have always been in a close competition to gain more market share, attract developers and gain investors’ trust. This battle raises a fundamental question for any investment: “Which one is better?” The answer that can determine your investment portfolio in the coming years.

This article is aimed at providing a comprehensive, data -based answer to this key question. In the following, with a deep and impartial analysis, we compare Ripple and Ethereum of all angles; From existential philosophy and technical architecture to economic model and legal challenges. By reading this report, you will gain a clear understanding of the strengths, weaknesses and potentials of each project and you can make an informed and consistent decision to your goals and levels of risk.

Ripple (XRP) and Ethereum (ETH) at a glance

To begin with, a quick and general comparison of the fundamental features of Ripple and Ethereum can provide a clear initial view of understanding the main differences between the two projects. The following table puts the most important parameters of these two networks together so that you can quickly get a general image of them. This table acts as a fast guide and the details of each section will be elaborated in detail.

| Feature | Ripple | Ethereum |

| The year of launch | 1 (XRPL) | ۲۰۱۵ (Mainnet) |

| Main founders | Chris Larsen, Jed McCaleb, Arthur Britto | Vitalik Butrin, Gavin Wood, Joseph Lubin, ETC. |

| The main purpose | International fast and cheap payments for banks | World platform for smart contracts and DAPPS |

| Native token | XRP | Ether (ETH) |

| The consensus algorithm | RIPPLE Protocol CONSENSUSU ALGORITHM (RPCA) | Stock proof (Proof-Oph-STAKE-POS) |

| Transaction Speed (TPS) | ~ ۱۰۰۰ Transaction per second | ~ 1-4 Transaction per second (L1), much higher in L۲S |

| Transaction finalization time | 1-5 seconds | ~ 1 minute (Finalized), ~ 2 seconds (Block Time) |

| Average transaction fee | Very minor (less than $ 0.9) | Variable, but after the updates are greatly reduced (less than $ 1) |

| Token supply model | Limited and pre -extracted supply (1 billion) | Unlimited supply with burning mechanism (EIP-1559) |

Ripple and Ethereum’s philosophy and goals

To deeply understand the differences between Ripple and Ethereum, one must return to their existential roots and philosophy. The two projects were designed from the beginning with completely different goals and perspectives that have shaped all their technical and economic aspects. Ripple was created to optimize the existing financial system, while Ethereum intended to build a completely new system.

Ripple: Revolution in the International Payment System

Ripple was born with the aim of solving one of the biggest problems of the traditional financial system, international payments. The main target audience of this project is not ordinary users, but banks, financial institutions and payment service providers. Ripple’s goal was to create a faster, cheaper and more efficient replacement for older systems such as Swift, which has been dominating the world’s financial infrastructure for decades.

The traditional banking system relies on a network of intermediary banks and pre -secured accounts (Nostro/Vostro). This process can take days and cost high costs. Ripple reduces the process to a few seconds at a low cost by providing its payment network called RippleNet and using the XRP digital asset as a “interface currency”.

It is necessary to understand that Ripple is the name of the Technology Company, Rippleten is its payment network, and XRP is an independent digital asset that can be used in this network to provide immediate liquidity. This distinction shows that Ripple’s philosophy is working with the existing financial system and improving it from within, not its complete replacement. Read what is the Ripple article for more information.

Ethereum: World PC to build a decentralized future

Ethereum’s landscape stemmed from bitcoin constraints. Vitalic Borin, the creator of Ethereum, believed that China’s blockchain technology had potential beyond a simple monetary system. He suggested a platform to have a complete Turing-Complete programming language and allow developers to build any DAPP (DAPP) program. The idea introduced Ethereum not as a payment system, but as a “global computer” to build a new generation of Internet (Web3).

This ambitious landscape is based on the three main columns. The first column is smart contracts (Smart Contracts); Codes that automatically execute the provisions of a contract without the need for intermediaries. The second column is decentralized programs (DAPPS) run on a peer -to -peer network and resistant to censorship.

The third and most important column is the Ethereum virtual machine (EVM); An isolated and global environment that processs all smart contracts on the Ethereum network. The philosophy of Ethereum is the creation of an open infrastructure, without the need for permission and completely decentralized that allows anyone anywhere in the world to innovate. This approach is in full contradiction with the model focused on the Ripple financial institutions. Read what is the Ethereum article for more reading.

Technical comparison and performance: speed, cost and decentralization

The philosophical differences between Ripple and Ethereum have led to completely different technical choices in their architecture. This section examines the technical engines of these two networks, namely the consensus algorithm, speed, commission and decentralization, and shows how each has accepted different reconciliation to achieve its unique goals.

Consensus algorithm: battle between efficiency and decentralization

The heart of each China block is the consensus algorithm that determines the way the network participants agree on the status of the general office. Ethereum and Ripple use two completely different models. Ethereum uses the Proof-OF-Stake-POS algorithm, in which the validation gains the right to participate in transaction validation by locking at least 2 ETH units.

This system is completely without the need for permission, and anyone with the necessary funding can become a valid meter, which helps to decentralize the network. Network security is also provided through economic penalties; Any validation that has a destructive behavior loses part of its stepped capital.

In contrast, Ripple uses the Ripple’s consensus algorithm (RPCA) that is not based on extraction or sticker. In this model, a set of trusted servers called the validation are agreed on the arrangement of transactions in several rapid voting rounds.

Each server has a unique node list (Unique Node List – Unl), which contains other credentials that they trust. To finalize a bunch of transactions, you need to agree at least 1 % of the credentials in the UNL. This model is very fast and low, but because of its trust -based nature and requires permission, it has less decentralization level than Ethereum.

| Parameter | Ethereum Pos (Ethereum POS). | Ripple consensus algorithm (RPCA) |

| Participants | Validators (Validators) | Validators (Validators) |

| Partnership condition | Stick at least 1 ether (ETH) | Place on UNL List Other Credit Meters |

| Security | Slashing (Slashing) for malicious behavior | Need to agree to 1 % UNL Credit Meters |

| Decentralization level | Top (Network No Need to Permit) | Lower (network requires permission and trust -based) |

| Energy consumption | Very down | Very down |

| Byzantine error tolerance | Up to 1/4 of the network | Up to 1 % of the network (for strong accuracy) |

Speed and Transaction Practitioner: Which network is faster and cheaper?

For years, Ripple’s absolute advantage in speed and cost was its main strength compared to Ethereum. The Ripple Network (XRP LEDGER) is capable of processing about 2.5 transactions per second (TPS), and each transaction reaches certainly within 1 to 2 seconds. The cost of each transaction is also constantly about 0.5 xrp, which is virtually a small amount (a fraction of one tradition). This fee is burned after payment and reduces the total supply of XRP over time.

On the other hand, Ethereum is slower in its base layer (Layer 1) and processes about 1 to 2 transactions per second with a 2 -second block time. However, the fact that “Ethereum is expensive and expensive” is no longer true. Thanks to important updates such as Dencun and Pectra, and in particular the growth of layer two (Layer 2) ecosystem, such as arbitrum, Optimism, the user experience has evolved in the Ethereum. To learn about the top two layered projects of Ethereum, let the article be prevailed.

These updates have reduced the cost of transactions in layers of two to two to two % by introducing a space for data storage called “BLBS” and have average fees below $ 2. Layer two solutions have also significantly reduced the Ripple performance gap by processing thousands of transactions per second and at very low costs, while using the security of the Ethereum base layer. Therefore, the field of competition from the raw performance of layer one is changing towards the value and general use of ecosystems.

Decentralization Riddle: Is Ripple decently decentralized?

One of the oldest and most serious criticism of Ripple is its focus. Critics point to a few key points: First, the nature of the validity network is the authorization of the validation network in which no one can simply set up a ninety credit meter. Second, ownership of a large portion of XRP’s total supply by Ripple and its founders and supply control through monthly liberation from ESCROW. Third, Ripple’s active role in developing the main protocol and presenting a default UNL list to validation.

In contrast, Ripple supporters argue that XRP LEDGER is an open source and public software, and that Ripple has been constantly increasing the number of independent credit meters and reducing its network control. Technically, if Ripple disappears tomorrow, the XRP LEDGER will continue to operate. This “federal” or “semi -focused” model is an advantage for Ripple’s main audience, financial institutions, which are seeking efficiency and stability.

This approach is in full contradiction with Ethereum, which decentralization and censorship resistance constitutes the core of its proposed value. The Ethereum Network is designed to control or stop any single entity, which is essential for building a “world computer”. This fundamental difference in decentralization, the risks and investment opportunities in these two projects, completely distinguishes.

Comparison of Ethereum and Ripple tokenomics

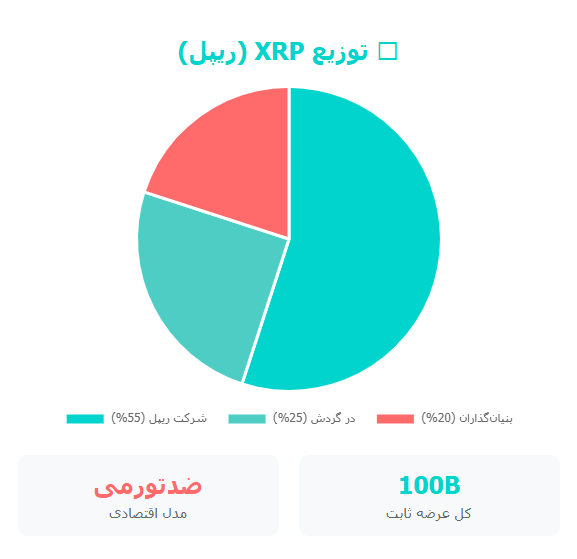

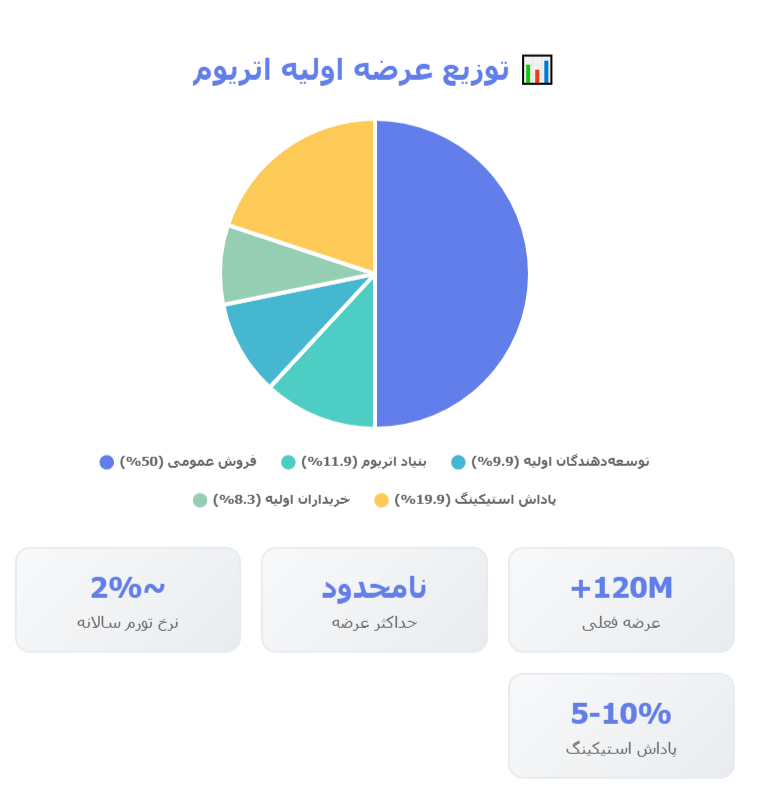

Tokenomics, or the economy, examines how to supply, distribute and manage a digital asset and is one of the most important factors in determining its long -term value. The economic models of XRP and ETH have fundamental differences that reflect their different goals. The XRP with a fixed and predetermined supply designed for stability, while ETH has a dynamic model to secure an ecosystem.

Supply and Distribution: Limited supply against unlimited supply

One of the most notable differences in the supply model is the two token. All 2 billion XRP units were pre-extracted at the time of the launch of the network. Of this amount, $ 5 billion was transferred to Ripple, the bulk of which was locked in an ESCROW account.

This account releases up to $ 5 billion per month to use the company’s operations and ecosystem development. This limited and predictable supply is often referred to as a positive factor in preventing inflation and long -term scarcity.

In contrast, Ethereum has no specific ceiling for its whole supply. New ETH units are issued as a reward to credit meters to provide network security. This inflation model is essential to encouraging participants and maintaining the security of a decentralized network. However, this does not mean inflation controlled, as other mechanisms are designed to manage its supply.

Mechanism of inflation and anti -swelling: burning token against sticker

Both networks have mechanisms to control their token supply, but with different approaches. In the Ripple network, the low cost of each transaction is completely burned and exits the supply cycle. This process of removing tokens is called token burning. The process puts a permanent but very gentle anti -inflationary process on the total XRP supply.

Ethereum, however, introduced a more dynamic and more complex economical model after the London Grand Update (EIP-1559). According to this update, each transaction in the Ethereum network contains a “base fee” that is completely burned. In periods where network activity is very high, the burned ETH level can be higher than the new ETH amount issued as sticker rewards.

Under such circumstances, Ethereum is temporarily converted into an anti -inflation asset. This mechanism creates a powerful positive feedback loop: ecosystem growth and increased use of the network directly lead to decreased supply and increased ethereum prices.

| Parameter | Ripple (XRP) | Ethereum (ETH) |

| Maximum supply | 2 billion (fixed) | Unlimited |

| Method of creation | Pre-extracted (pre-mined) | New issuance through sticker bonus |

| The main mechanism | Anti -Treatment (Transaction Burning) | Dynamic (New Issuing + Burning Basic Carry) |

| Supply control | Monthly Publishing from Amani Account (Escrow) Ripple | Controlled by the protocol and network activity |

| Token’s main application | Intermediate currency to pay, pay papers | Payment, sticker, bail on Defi |

Ecosystem and Applications: Traditional finances against the modern digital economy

Beyond technical and economic theories, the real value of a blockchain lies in the ecosystem and its practical applications. In this regard, Ripple and Ethereum represent two completely different worlds. Ripple has developed a deep but limited ecosystem focusing on B۲B (business to business), while Ethereum has cultivated a wide and diverse digital economy based on B۲C (customer -to -customer) and C۲C (customer -customer).

Ripple Ecosystem: Transboundary Payments

The main application and strength of the Ripple ecosystem is its flagship product, on-Demand LiaQUIDity-ODL. The service allows financial institutions to use XRP as an interface currency for instantaneous settlement of international payments instead of keeping cash in various accounts around the world.

For example, a bank in Australia can convert Australia to XRP, send it immediately to Mexico, and convert it to Mexico’s peso. This process reduces the costs and releases the locked capital in international accounts.

The success of the Ripple ecosystem depends directly on its acceptance by financial institutions. Collaboration with big names such as Santander and Bank of America reflects progress in this regard. Although Ripple is developing other capabilities such as the decentralized currency exchange (DEX) and supporting assets, these applications are still in the early stages, and the main focus is still on the international pay market.

Ethereum ecosystem: King Defi, NFT and decentralized programs

Ethereum is undoubtedly the undisputed king of the digital economy decentralized. The network has created a dynamic and self -sufficient ecosystem by hosting thousands of decentralized programs. Ethereum leadership in the field of decentralized finance or Defi is undeniable.

The total value of the locked capital (TVL) in the Ethereum Defi protocols reaches tens of billions of dollars (for example, $ 2 billion for Ethereum against about $ 5 million for XRP LEDGER), which reflects deep confidence in the ecosystem. Protocols such as Uniswap allow exchanges, lending and borrowing without the need for any central entity.

In addition to Defi, Ethereum led the NFT Revolution by introducing tuned standards such as ERC-721 and ERC-1155. The network has become the main platform for creating, buying and selling digital artworks, game items and digital collections. Statistics show the scale of this ecosystem well: More than 2 million unique wallets and 2 million DAPP transactions are certificates of a live and growing digital economy.

Future and Investment Vision: Regulatory and Roadmap

The future of crypto projects depends on legal threats and technology roadmaps. This section examines the SEC file against Ripple and future programs of both projects, indicating moving towards convergence of contrasting routes.

SECTIONS SECONDS Against Ripple

Although the SEC’s case against Ripple had dropped the price of Ripple in previous years, the court in August ruled that XRP’s public sales were not securities (Ripple Victory), but institutional sales. Ripple fined $ 5 million and was banned from attracting capital in the United States for five years.

Future Road Map

Pactra Ethereum update will introduce the concept of account abstraction with the aim of simplifying the use and improving the user experience. Ripple moves towards institutional Defi and competes directly with Ethereum by making Dex, lending protocols and Sidecinics EVM. Both projects cover their weaknesses: Ethereum targets simplicity and the Ripple ecosystem develops.

Frequently asked questions

No, these two are not direct rivals; Ripple focuses on institutional and Ethereum payments on the general platform of decentralized programs and can both be successful in their field of expertise.

Ethereum is more liquidity because of the active Defi and ETF active ecosystem, while Ripple’s price depends heavily on bank cooperation news and legal developments.

The XRP is designed to be stable with 2 billion units, but Ethereum needs to be continued to issue a credit for rewarding validation, which is controlled by the burning mechanism.

No, the court found the institutional sales as securities and created restrictions in the United States, though uncertainty has declined.

No, with Dencun and Pectra updates and the use of two layers, fees have been severely reduced and have been affordable for ordinary users.

Summary: Ripple or Ethereum?

The choice between Ripple and Ethereum is the choice between the two philosophies and there is no final winner. Ripple Betting on the success of Fintech is a specialist in improving international payments (B2B market with legal barriers), while Ethereum Betting is a fundamental platform for the entire future digital economy (strong network effects but fierce competition).

The final decision depends on this: Do you believe in improving the existing financial system or building a completely new system?

RCO NEWS