The story of the Euro is a symbol of the confrontation of two economic worldviews. On the one hand, the euro is used by more than 5 million people across Europe and is the world’s second -largest reserve currency, a symbol of unity and economic power. On the other hand, Iran’s rial is telling the story of continuous devaluation, continuous crises, and softening of sanctions and structural inefficiency.

This deep contradiction is not merely a numerical difference in the rate of equality, but rather in the existential philosophy, the structure of sovereignty, the political will, and the institutional design behind each of these currencies.

Post -War Dream: The necessity of a single currency to ensure peace

The formation of the euro was not a mere financial or economic decision, but it was the culmination of a semi -final political project to permanently engage in European nations to ensure peace through economic integrity. After the destruction of World War II and the tragedy that the continent of Europe had experienced over the centuries, European leaders sought a way to make the upcoming war between France and Germany not only impossible but practically impossible.

French Foreign Minister Robert Schuman presented a revolutionary plan on May 9, suggesting that the production of coal and steel of the two countries – the basic raw materials of the war – be subjected to a common authority. The idea led to the establishment of the European Coal and Steel Society at 7, which was the first time in modern history when European nations voluntarily delegated part of their national sovereignty to a transnational institution.

The success of this experience paved the way for Rome’s treaties that established the European economic community. The main purpose was to create a joint market that guaranteed the free movement of goods, services, capital and labor. This path increased the interdependence of countries so that the idea of a single currency seemed to be inevitable as the next logical step.

Early ambition and exposure to monetary turbulence

The idea of the Monetary Union was first introduced in the Werner Plan of Year 2, which provided a roadmap to reach the Complete Economic and Monetary Union by up to 1. But this ambition came out with the collapse of the Bretton-Woods system and the oil crises of the 1980s. Subsequent efforts were not successful, showing that the achievement of monetary stability requires stronger political commitment and deeper coordination.

In 1, Europe has taken a more successful step by launching the European monetary system (EMS). It required the currency of the member states to move in a limited range of fluctuations and opened the German brand. This mechanism showed an unprecedented level of coordination of monetary policy and has been successful for more than a decade.

EMS provided valuable experience for European central banks and proved that joint exchange rate management is possible. The system was, in fact, a real laboratory for the euro and provided the mental, technical and political background for the final acceptance of the idea of a completely single currency.

Maastrich’s treaty

The EU Treaty, signed in Maastrich in February, officially created the union of modern Europe. The treaty went beyond economic cooperation and made the economic community a political union by creating a joint foreign policy and the concept of European citizenship. The most important achievement of the treaty was the provision of a detailed three -step program for the economic and monetary union.

To ensure the power of the new currency, the Maastrich Treaty set rigid criteria that became known as convergence criteria. This included inflation control (maximum 3.5 percent above average of the top three countries), government financial health (budget deficit below 2 % and debt below 5 % GDP), exchange rate stability (two years in ERM II) and low interest rates. These criteria were in fact the price of German participation, which, in order to give up the powerful Mark, asked its partners to commit to Germany’s financial discipline.

These criteria institutionalized German economic philosophy throughout the euro zone. The strong focus on the conditions of entry and relative weakness in ensuring constant adherence to the seeds of future debt crisis has planted. Later, the “Stability and Growth Treaty” (SGP) was created to eliminate this weakness, but the political will to enforce laws for large countries was often shaken.

The Euro Launch Process

Converting a political idea into wealth for millions needed careful planning and advanced technology. On January 1, the euro was introduced as a non -formal currency and the exchange rate of the national currencies of the primary member states was fixed with the euro. For three years, the euro was used only for financial calculations and transactions so that banks and companies could adapt their systems.

On January 1, the banknotes and coins of the euro entered nine countries. It was the biggest cash change in history, which included a pre -distribution of € 5 billion. Success was incredible: Just three days after the start, 5 % of the ATMs were distributing the euro, and a week later, more than half of the cash transactions were done with the euro.

The establishment of the European Central Bank in Frankfurt was a symbol of the transfer of monetary sovereignty from national capitals to transnational institution. The ECB is responsible for monetary policy for the entire euro area and has a clear mission to maintain price stability and inflation targeting 5 %. The National Central Banks have become part of the “Eurosystem” and their task is to make Frankfurt’s decisions.

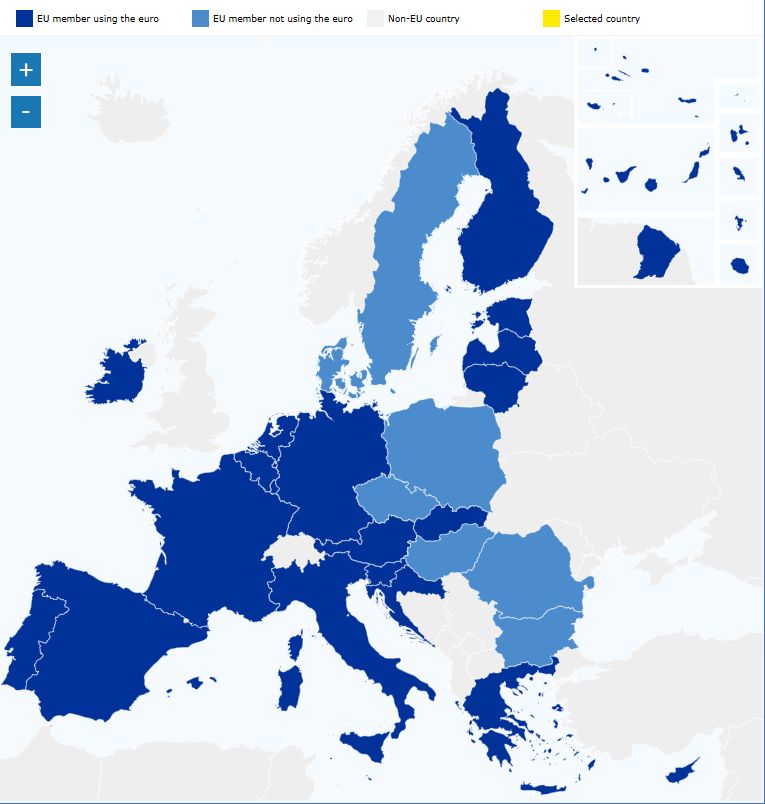

EU member states

The European Union, a unique political and economic block, consists of many countries that work together to cooperate in common goals. Membership in the union has many benefits, including free trade, easy commuting between borders and economic solidarity. The union plays an important role in the international arena by trying to create peace, stability and prosperity in the European continent.

EU member states whose formal currency is euro

The euro, a single European currency, is a symbol of economic and monetary convergence on the European continent. The currency is currently used by twenty EU member states as official currency. These countries, known as the Euro Zone, coordinate their monetary policy under the supervision of the European Central Bank.

| Country | The capital | Year of joining the EU | Year |

|---|---|---|---|

| Germany | Berlin | 1 (Founder Member) | 1 |

| France | Paris | 1 (Founder Member) | 1 |

| Italy | Rome | 1 (Founder Member) | 1 |

| Spain | Madrid | 1 | 1 |

| Holland | Amsterdam | 1 (Founder Member) | 1 |

| Belgium | Brussels | 1 (Founder Member) | 1 |

| Austria | Vienna | 1 | 1 |

| Portugal | Lisbon | 1 | 1 |

| Finland | Helsinki | 1 | 1 |

| Ireland | Dublin | 1 | 1 |

| Luxembourg | Luxembourg | 1 (Founder Member) | 1 |

| Greece | Athens | 1 | 1 |

| Slovenia | Liobeliana | 1 | 1 |

| Cyprus | Nicosia | 1 | 1 |

| Malta | Walta | 1 | 1 |

| Slovakia | Bratislava | 1 | 1 |

| Estonia | Taline | 1 | 1 |

| Latvia | Riga | 1 | 1 |

| Lithuania | Vilnius | 1 | 1 |

| Croatia | Zagreb | 1 | 1 |

EU member states whose formal currency is not euro

Currently, the European Union consists of 5 member states, but not all of them use the euro as their official currency. Some member states have decided to maintain their national currency or have not yet met the conditions to join the euro area. These differences in monetary and economic policies have created an interesting diversity among EU member states.

| Country | The capital | Year of joining the EU | Official currency |

|---|---|---|---|

| Poland | Warsaw | 1 | Polish zlotti (pln) |

| Romania | Bucharest | 1 | Leo Romanian (RON) |

| Check | Prague | 1 | Croh Czech (CZK) |

| Hungary | Budapest | 1 | Hungarian Forcet (HUF) |

| Bulgaria | Sofia | 1 | Lu Bulgarian (BGN) |

| Sweden | Stockholm | 1 | Swedish Coron (SEK) |

| Denmark | Copenhagen | 1 | Danish Croon (DKK) |

Important Tips:

- A total of 5 EU member states are

- 2 countries use the euro as a formal currency

- ۱۰ Still maintaining their national currency

- In order to use the euro, countries must meet specific economic criteria (Maireshttar criteria)

The following image shows that the EU member states are pale blue -colored countries that do not use the euro currency, and the countries with the colorful blue color are members using the euro currency.

The advantages and disadvantages of the euro

The biggest advantage of the euro was the complete elimination of the exchange rate risk and the cost of converting money in the region, making it easier, cheaper and safer to trade and transboundary investment. Companies could easily compare prices that led to increased competition and benefit of consumers. For investor countries such as Germany, investment was made without concern for currency fluctuations.

For countries with a history of high inflation (Italy, Spain, Greece), joining the euro meant achieving unprecedented price stability. Inflation control restored trust and enabled future planning. The euro, as the world’s second -largest reserve currency, gave a significant influence on the region and created more resistance to foreign shocks.

The most serious defective euro is the existence of a single monetary policy for different economies. The right interest rate for Germany may be devastating for Greece. Member States have lost key policy tools, namely change of interest rates and devaluation of money. The system is often in favor of the northern economies and has fueled the divergence between north and southern Europe rather than convergence.

| Benefits | Disadvantages |

| Remove the costs and risks of currency conversion. | The loss of independent monetary policy. |

| Increase price transparency and competition. | The policy of “one copy for everyone” hurts weaker economies. |

| Lower inflation for many members. | The inability to devalue money to recover competitiveness. |

| Facilitating transboundary trade and investment. | Losing national sovereignty over a key economic tool. |

| More global infiltration. | It can lead to economic divergence (north and south gaps). |

Comparison of Euro and US dollar

The US dollar and the euro are the two main currencies in the world, each with a special place in the international economy. The US dollar is known as the global reserve currency and is used in most international transactions, including oil and gold sales. The price of the dollar is influenced by the US Central Bank’s policies, its economic situation, and global geopolitical developments. This currency is usually considered a safe haven during economic crises and demand for it is increased.

On the other hand, the euro, the joint currency of the EU member states, is the world’s second most important currency. The price of the euro is mainly influenced by the decisions of the European Central Bank, the economic status of the eurozone member states and the EU trade relations with other countries. EUR/USD is one of the most important foreign exchange rates in the world that has a huge impact on international trade. While the dollar has more power in world markets, the euro has maintained an important role in the international financial system due to the EU’s economic power and the high volume of trade.

Compare the euro with the Iranian Rial

The comparison of the euro with the Iranian rial reveals the difference between two opposing economic worldviews. The euro is run by a fully independent central bank, which only has the mission to maintain price stability, and decisions are based on scientific data and far from political pressures. On the other hand, the central bank of Iran lacks real independence and its policies serve the government’s financial needs, counter sanctions and the management of political crises.

During the 4-5 period when Europe launched the euro, Iran’s rial was on a devaluation path. In 1, Iran was dealing with the multipurpose currency system; The official rate was 1.5 rials, while the free market rate had reached more than 2.5 rials. This huge gap created widespread corruption and rent.

This comparison shows that while Europe had a complex framework for long -term stability, the Iranian currency system was identified with short -term solutions, multiple rates and constant erosion of money. The euro stabilizes countries into financial discipline and creates a stable cycle, while the instability of the rial feeds a defective cycle of devaluation, inflation, capital escape and more value devaluation.

| Index | Euro | Rial of Iran |

| Governance | Transnational, Independent Central Bank (ECB). | Dependent on government and political needs. |

| The main stimulus of politics | Price stability for the whole region. | Management of sanctions, budget deficits, political crises. |

| System structure | Unified currency. | Multiple and non -transparent rates (official, free market, etc.). |

| The path of movement | Planned launch for stability. | The path to chronic devaluation and crisis -oriented. |

Future: euro in the age of digital currencies

The euro’s stability and credibility have also reached the world of digital currencies. Stebels such as Euro Tether have been created to combine Fiat currency stability with China’s blockchain technology. These tokens are supported by a 1: 1 ratio to the euro and allow the euro stability in the crypto ecosystem. The prices of Euro -based digital currencies are usually less influenced by the sharp fluctuations in the crypto market, and are a good option for investors seeking to reduce risk in digital space.

The European Central Bank itself is also investigating the creation of a digital euro, which will be an electronic version of cash and is directly issued and guaranteed by ECB. The project is the next step in the euro evolution and directly enters the digital age. The price of official digital currencies, such as the digital euro, is expected to be more stable than conventional cryptocurrencies because they are supported directly by the central bank.

This move shows that even the world’s most stable currencies must adapt to technological innovations to stay related in the future. Digital Euro raises important questions about privacy, the role of commercial banks and future money, but it reflects Europe’s commitment to maintain a leading position in the global financial system.

Conclusion

The story of the formation of the euro is a story of political will, economic discipline and complex reconciliation. The euro began as a bold political project to ensure peace and came true through a strict framework influenced by German philosophy. It brings undeniable benefits such as eliminating currency risk and pricing stability, but at the expense of losing monetary sovereignty and accepting the policy of “one way for all” that is challenging for weaker economies.

The story of the Euro is a major and continuous experiment that shows that the currency goes beyond the means of exchange, a mirror of political will, institutional design and national priorities. This is a powerful lesson for the challenges and choices facing economies with currencies such as the Iranian Rial.

The deep link between economic stability, the effective sovereignty, and the public confidence in the euro story clearly show that the creation and preservation of a powerful currency requires long -term commitment to economic principles, institutional independence and financial discipline. These lessons are critical and informative for any country seeking monetary stability and sustainable economic growth.

RCO NEWS