In the dynamic world of digital currencies, where opportunities and challenges are always ambushed, how do professional traders get market pulse and maximize their profits? The answer lies in the work of the car and the use of algorithmic transactions.

This article is a comprehensive guide to entering the world of trading algorithm Is. Here we start with the basic concepts and how computers are trading for us, examine key strategies in the crypto market, and explain how to build the first trader robot. Join us.

Algorithmic transactions in simple language

Algorithmic transactions (Algorithmic Trading) Also known as automatic transactions, in simple language, using a computer program to automatically run transactions based on a set of predefined rules. In this way, you teach your computer trading strategy to the computer, and the computer observes the market without human interference and executes purchase or sales orders at the right time.

A trader robot is like an automated pilot for your investment basket that guides your strategy without fatigue and error.

A simple example for better understanding of algorithmic transactions

To better understand this concept, consider a classic technical analysis strategy: Moving Avege Crossover. The rules of this strategy are very simple :

- Purchase condition: Whenever the 2 -day moving average of an asset price cuts the 2 -day moving average, buy 2 shares (or unit of digital currency).

- Selling condition: Whenever the 5 -day moving average goes below the 4 -day moving average, sell your shares.

A human trader must constantly monitor the charts to hunt this moment, but a computer program can observe prices for 4 hours and without interruption and execute the transaction in a fraction of seconds as soon as these conditions are implemented. This is the main power of the trading algorithm: converting strategy into an automatic, accurate and tireless process.

Key difference of algorithmic transactions with manual transactions

The main difference between algorithm and manual transactions can be summarized in three key areas that illustrates the absolute superiority of the automatic approach:

- Speed: Algorithms can execute transactions in microthlets (one millionth seconds), while the fastest human traders take several seconds. This speed difference in the vicious markets means the difference between profit and loss.

- Accuracy: Cars do not make human error. There is no longer news of the wrong number of shares or clicking the wrong shopping button instead of selling. The algorithms execute exactly the same command that is defined for them.

- Discipline and eliminate emotions: The greatest enemy of a trader is his feelings. Fear, greed, and excitement lead to irrational decisions and withdrawal from strategy. Algorithms do not feel feel; They act solely on the basis of defined logic and rules and maintain complete discipline in the implementation of strategy.

Advantages and disadvantages of trading algorithm

The use of algorithms in financial markets, especially in the Digital currency, has significant benefits that make it a powerful tool for traders. However, this technology is not a challenge and risk, and awareness of both aspects is essential for success.

Key benefits of trading algorithm

- Implementation of transactions at the best possible price: Algorithms at their high speed can register orders before severe price changes and get the best possible price for entry or exit from the transaction.

- Reduce Trading Costs: Rapid and optimized transactions can lead to reduced SLIPPAGE and thereby reducing hidden trading costs.

- 2 -hour transaction without interruption: The digital currency market will never be closed. Algorithms are not tired, unlike humans, and can observe the market around the clock and to exploit trading opportunities at all hours.

- Backtesting Ability: One of the biggest benefits of algorithmic transactions is the possibility of backing and testing strategy on historical market data. It can be optimized and optimized before risking the real capital.

- Simultaneous review of multiple markets and assets: A human being can hardly analyze multiple diagles at the same time, but an algorithm is able to monitor hundreds of digital currencies at several currency exchange and look for trading opportunities.

Challenges and risks of algorithmic transactions

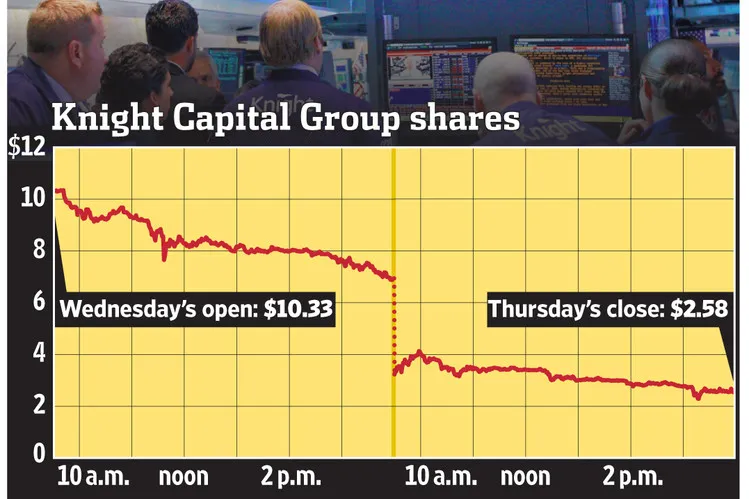

The power of trading algorithm in speed and automation is also the source of its greatest risks. A small mistake in manual transactions leads to a loss transaction, but a small bug in an algorithm code can make thousands of catastrophic transactions in a matter of seconds and destroy the whole capital, as it happened in Knight Capital in year 6 and lost $ 5 million in 5 minutes.

- Technical risks: Any system may develop technical defects. Internet definitive, server problems, software bugs, or APIs disruption can cause the strategy and severe implementation of heavy strategy and losses.

- Over-Optimization Risk: This phenomenon occurs when a strategy is so optimized on historical data that it actually learns the “noise” of the market instead of the real “signal”. Such strategies in the background show great results, but fail in the real market.

- Need to monitor and maintain continuous: Algorithmic transactions are not a “set up and forget” a solution. Markets are constantly changing, and algorithms require continuous monitoring, review and update to maintain their efficiency.

Transportation of an Algorithm Trader: Starting Prerequisites

Entering the world of trading algorithm requires a combination of financial knowledge, technical skills and infrastructure. These four components form the main columns to build a successful automatic trading system.

- Market Knowledge and Strategy Design: Before writing even a single line, you need to have a clear, rules -based trading strategy. This strategy should include the exact points of entry and exit, the volume of the transaction, and the risk management rules such as the Stop-Loss.

- Programming Skills: You need programming knowledge to turn a strategy into a computer program. Python has become the first choice for algorithmic traders because of its simplicity and powerful libraries for data analysis (such as Pandas and Numpy) and technical analysis (such as TA-LIB).

- Access to Market Data (API): Your robot must be connected to the currency exchange for instant price information and sending orders. This connection is done via the Application Programming Interface (API) currency exchange. Choosing a currency exchange with a sustainable API is crucial and complete documentation.

- Technical and backsting infrastructure: Your robot should run on 1/4, so you need an always -clear system. Many traders use private virtual servers (VPS) for this purpose. Also, your infrastructure should provide the ability to backstage the strategy on historical data so that you can measure its performance before live performance.

Popular algorithm trading strategies in the digital currency market

There are a variety of trading strategies that can be implemented algorithm. Choosing the right strategy depends on the market conditions, the amount of risk tolerance and the trader’s goals. Here are some of the most popular strategies in the crypto market.

Trend-Following strategies

These strategies are based on the principle that “your friend’s process”. The algorithm is designed to identify and enter a strong ascending or downward trends. These methods usually use technical indicators such as moving averages, MacD or RSI to detect the process and are a good starting point for beginners because of their relative simplicity.

Return strategies (Mean Reversion)

This strategy is precisely the opposite of pursuing the trend, assuming that prices, after a severe move, tend to return to their long -term average. In this way, the algorithm seeks to identify the conditions of “Overbood” for the sale and conditions of “Oversold” for shopping. Indicators such as Bollinger Bands are a popular tool in this strategy.

Arbitage Opportunities (Arbitrage)

Arbitrage is one of the least risky strategies and means earning a profit from the price difference of an asset in different markets. For example, the price of bitcoin may be $ 4.9 at the binoconor and $ 4.9 at the Crinkle. An arbitrarical robot can detect this dispute at the moment, buy it at Binnes, and sell at Krakon at the same time, and make a risk without risk. This can be done almost only by algorithms because of the need for very high speed.

Executive Strategies (VWAP and TWAP)

These algorithms are not designed for direct profit, but their goal is to execute large orders with the least impact on market price. These strategies are mostly used by institutional investors and funds.

- VWAP (average volumetric price): The algorithm divides the large order into smaller sections and executes them based on the profile of the volume of historical share transactions throughout the day to close the final price of the transaction to the average volumetric price.

- TWAP (average weight price): This algorithm divides and executes the order in equal times during the day so that it does not have a great impact on the market.

| Strategy name | Main logic | The best market conditions | The level of complexity | Example Indicator |

| Follow the process | Ride on the wave of ascending or descending trends | Trendy markets (ascending or strong descending) | Down | Animated averages intersection, MACD |

| Return to average | Buy on the floor and sell on temporary price ceilings | Neutral and Ranger Markets (Range-Bound) | Medium | Bolinger bands, RSI |

| Arbitrage | Earn profits from the price difference of an asset in different markets | Any market (on condition of price differences) | Top (requires strong speed and infrastructure) | – |

| Executable (vwap/twap) | Execute large orders with minimal impact on price | Markets with high liquidity | Medium | Volume -based and time -based |

How to build our first trading robot? (Step -by -step guide)

Making a trader robot may initially look complex, but it can be managed by dividing the process into specific steps. This guide is a practical roadmap to build your first robot.

Step One: Select a specified trading strategy

Everything starts with an idea. Before doing anything, bring your trading strategy in full detail on paper. Determine the laws of the transaction, exit (both profit and loss) and the amount of capital you risk in each transaction. To get started, an ideal strategy such as the moving average intersection mentioned earlier is ideal.

Step Two: Select the platform (use ready or coding platforms)

The two main paths are in front of you. If you do not have the knowledge of programming, you can use ready -made platforms such as 3commas or Cryptohopper robot that provide visual tools for making robots without the need for coding. But if you are looking for complete control and flexibility, the best way, robot coding using Python language and libraries like ccxt There are different exchanges to connect to the API.

Step Three: Backstage and Strategy Performance Evaluation

This is the most important step to prevent losses. Test your strategy on market historical data to see how it was practicing in the past. Tools like the library backtrader In Python, they can facilitate this process. At this point, carefully examine criteria such as total efficiency, Sharpe Ratio and maximum Drawdown capital loss.

Step 4: Paper Trading)

Once the background results were satisfactory, test your robot in the real market environment but with virtual money. Many exchanges offer Demo Trading accounts. This step helps you to measure the robot’s performance with live data and possible delays of the network without financial risk.

Step Five: Live Performance with Risk Management

After ensuring the robot’s performance in the experimental transactions, it comes with real capital. Start with a little amount that you are ready to lose. Risk management is vital at this stage; Make sure the damage to your code is properly implemented and carefully monitor the performance of the robot, especially in the early days.

Take a look at the future: Artificial intelligence and transformation of the trademark algorithm

The trading algorithm is evolving rapidly and emerging technologies are redefining its borders. The future of this area is not only in the automation of fixed rules, but also in the construction of systems that are capable of learning, adaptation and a deeper understanding of market dynamics.

The role of machine learning in improving strategies

Machine learning (ML) allows algorithms to learn complex patterns from massive market data that are not recognizable to humans. Deep Reinforcement Learning Models go further and allow robots to optimize their strategies in response to variable market conditions by trial and error. This means building algorithms that not only enforce the rules, but also discover new strategies.

Analysis of Emotions and Alternative Data (Alternative Data)

The most successful future algorithms are those that have access to unique data. Emotional analysis by processing social network data (such as Twitter and Reddit) and the news, measures the market’s pulse, and transforms it into a measurable input for strategies.

Alternative data also includes non-financial information such as on -chain, large wallet activity (whales), and even satellite data that can provide leading signals to predict market movements.

Future Vision: Quantum Calculations and Decentral Finance (Defi)

In the farther horizon, two other revolutionary technologies are looking forward to changing the face of the trading algorithm. Quantum computing, with its unique processing power, will be able to solve the problems of optimization and risk management on a scale that is unimaginable today. On the other hand, decentralized finance (Defi) has provided a new playground for automatic strategies such as Dex and Yield Farming by creating open, transparent and 4 -hour block markets on China’s blockchain platform.

Frequently asked questions

Yes, algorithmic transactions in most countries are completely legal. However, traders are required to comply with market laws and regulations to prevent measures such as market manipulation.

There is no specified amount. You can start using Paper Trading without any capital. To enter the real market, it is advisable to start with a small amount you have the ability to lose it to measure your robot’s performance in real conditions.

Yes. There are many user -friendly platforms such as 3Commas and Cryptohopper that allow you to design your own strategies and execute pre -made robots using graphical interfaces without the need for coding.

Python is widely recognized as the best language for the trading algorithm.

The biggest risk is the technical failure. A small bug in the code, a definitive connection, or a system error can lead to the execution of thousands of losses in seconds.

Conclusion

Algorithmic transactions are not just a new tool, but a paradigm change in how to interact with financial markets. Using the speed, precision and machine discipline, this technology allows traders to go beyond human emotional and physical constraints and gain a real competitive advantage in high -speed markets such as digital currencies. From simple trend strategies to complex machine learning algorithms, this area provides numerous opportunities for innovation and profit.

However, entering this world requires caution and commitment to learning. Trading algorithm is not a magical money -making device; Success is the result of watches of research, precise strategy design, numerous tests, and most importantly, smart risk management. This route is an exciting journey to the boundary of financial knowledge and technology. Start your journey with caution, curiosity and commitment to learn.

RCO NEWS