With Bitcoin crossing the $ 4,000 border, the penis market has entered a new season. In this vibrant atmosphere, investors are looking for projects with explosive growth potential. This confrontation is not merely a technical comparison, but the confrontation of two different philosophies: the Ripple, which seeks to integrate with the traditional financial system, focuses on the SEI network that focuses on optimizing decentralized finance.

The main question is: Which of these projects is a better option for investment in the current uptrend and provides greater growth potential to increase the return on assets? This article is taken from the article article. Join us.

The current state of the penis market

The penis market is currently in a critical and early stage of the uptrend. Although the widespread growth of the penis is still not fully felt, the early signs and metrics have gradually started moving in the positive direction. This situation reflects the beginning of a new period for the digital currency subsidiary.

The main reason for not feeling this growth is currently the full mastery of digital currencies with high market capital. In recent weeks, large and consolidated projects have made all profits and have abandoned other penis in their dust. This phenomenon is evident in the unequal performance of the market.

However, analysts believe that there is a good time to identify and select penis with enormous growth potential. In these circumstances, comparing projects such as XRP and SEI, each with widespread potential, is of particular importance.

This article is written solely for market information and analysis and is not considered any investment recommendation. Investing in digital currencies contains high risks and please research before any financial decisions.

Ripple (XRP): Consolidated International Payments Giant

Ripple is a payment and digital currency network aimed at replacing slow systems such as SWIFT for international transactions. The project, for more than a decade, is known as one of the pillars of the crypto market.

With the $ 2 billion market value, Ripple ranks third in the largest digital currency. This position is the result of its widespread use of technology by banks and financial institutions.

Key strengths

The most important advantage of Ripple is the focus on institutional acceptance and legitimacy within the framework of global financial laws. The company’s request to obtain a National Banking Authorization and the Federal Reserve’s main account will give it a complete bank privilege if approved.

Win against the SEC complaint has removed one of the biggest barriers to the growth of this digital currency and has created significant regulatory transparency for the XRP. This has made it a low -risk choice among the penis.

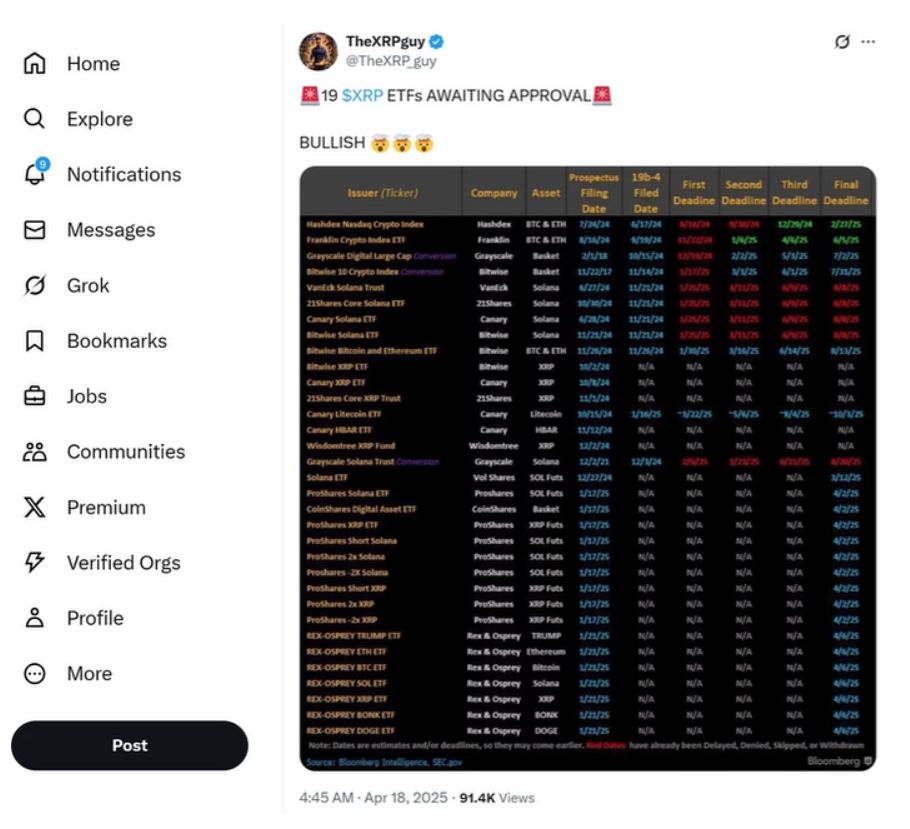

ETF potential and ecosystem expansion

With 2 registered requests for the ETF Spot XRP by the world’s financial giants, they are estimated to be approval in year 2. These ETFs can send a flood of new liquidity and institutional capital to XRP.

The Ripple ecosystem is no longer limited to international payments. The XRP Ledger is now compatible with the Ethereum Virtual Machine via Sidecin. This progress has made it possible to enter the Dipy, NFT tools and real -world assets into the Ripple ecosystem.

Challenges and limitations

The biggest criticism of Ripple is its centralized structure. Less than 2 % of the total supply of 2 billion units is in public circulation. Much of the token is still under the control of Ripple Labs, which allows price suppression through planned sales.

The very high market value of $ 5 billion makes the explosive growth potential almost impossible. Although it is possible to grow 2 to 5 times, the growth ceiling is much more limited than emerging projects.

Network (SEI): Crypto’s emerging phenomenon

SEI is a specialized layer block design designed for high -speed transactions. The project, which launched its main network in August, introduces itself as China’s first specialized blockchain.

The main purpose of the SEI is to solve the concentrated and decentralized currency exchanges through the provision of optimized and fast infrastructure. The network’s TVL growth to more than $ 5 million in the short term has attracted the attention of the Crypto community.

Revolutionary technical advantages

The SEI has one of the fastest transaction final times with only 2 milliseconds. This speed ensures that the transactions are confirmed and irreversible in less than half a second.

With the GIGA feature, the network will be able to process 1.2 transactions per second. This speed is not only more than the current EVM blockchain, but even than web giants like Google.

Transfer to evm ecosystem

The SEI is moving from the Cosmos ecosystem to a fully compatible Ethereum virtual machine chain. This clever move makes it one of the leading chains in the biggest intelligent contract ecosystem.

At the same time, SEI entry into the field of artificial intelligence varies its basket of applications and reduces the risk of dependence on a particular field. This diversity increases the potential of the project’s long -term growth.

Explosive potential

With a hypothetical market value of $ 1.5 billion, SEI has only about 2 % of Ripple market value. This huge gap provides a lot more space for its growth.

While a 2 -fold growth for Ripple is a great achievement, it looks 1 or 2 times available for SEI. This potential for a few tens of profits is the main reason for the excitement about this project.

Final comparison: Selection based on risk -taking

This analysis helps investors make more informed choices between Ripple and SEI, given their risk -taking.

Ripple: Conservative option

Ripple is an ideal option for conservative and institutional investors looking for stable, low -risk and approved assets. This project, with strong backing and solid position, is a safer investment with a reasonable growth potential.

Winning the SEC and ETF requests has drawn a brighter future for the XRP. However, high market value and centralized structure impose restrictions on its growth potential.

SEI: Risk

The SEI is made for risky and bold investors seeking exponential growth. This project with pioneering technology, ambitious team and low market value has a much higher profitability potential.

The risks associated with a startup project, including fierce competition and the need for widespread acceptance, should be taken into account. But for those who are willing to take these risks, SEI has the potential of transformation.

Conclusion: The final winner

Which one will grow more in response to the original question? Although the XRP is a more risky and stable investment, the SEI growth potential is far higher because of the much lower market value, the superior technology and the great ambitions of the developer team.

For investors looking for dramatic and transformative profits in this uptrend market, SEI is a more exciting and more efficient option. Of course, this choice requires more risks and a deeper understanding of the nature of emerging projects.

RCO NEWS