Diffi atmosphere has grown dramatically in recent years, and one of the names gradually shining on this path is Base. The network, with Coinbase support and relying on the technology of the second layer of Ethereum, has become a platform for launching innovative projects. In the following, we will take a look at what are the best base network projects and what role each play in expanding this ecosystem.

In this article, we will introduce the top token token of the Base network and examine the performance of their projects. We also discuss how to get assets on the base network and what tools there are. Finally, we will evaluate the future prospects of the base network and review the route on this network. Join us.

What is Base Network?

Base Network is a second layer of Ethereum Layer, which was launched by Kevin Base. The network was officially introduced on August 7 (August 1) and is the first Chinese block to be developed by a public corporation. The main purpose of Base is to provide a quick, scalable and simple platform for the development of decentralized applications (DAPPS).

For more information on the base network, we suggest that you read the base of the base network. Base utilizes Kevin Base’s extensive ecosystem, which comprises more than 2 million approved users and more than $ 5 billion in assets.

By eliminating native token and direct use of ether for payments, the network increases users’ trust and reduces the risk of counterfeit tokens. Simplicity has made Base a safe and efficient option for developers and users.

Base infrastructure technology

BASE Network developed on OP Stack Technology platform; The open source frame created by optimism and designed to build second -layered ethereum networks. This technology allows the base to process the transactions rapidly and low -cost in the form of Optimistic Rollups.

Using roll -up, transactions are first executed outside the main network and then sent to Ethereum as a category. This method reduces costs and increases scalability, while maintaining the main network of ethereum is maintained. Due to this structure, Base is part of the Superchain landscape, which aims to connect the various networks of the second layer.

Also, the base is fully compatible with the Ethereum ecosystem and enables easy transfer of assets and data between networks. This feature allows developers to build apps that move the platforms without hindrance. Therefore, China Base Block, while taking advantage of the security and decentralization of Ethereum, brings more efficiency and access to China’s block space.

The best bass network projects

The base network is quickly becoming one of the most important poles of decentralized apps. Subsequently We introduce 5 of the best base network projects:

- Morpho (Morpho)

- Aerodrome Finance)

- Spark (Spark)

- Monwell (moonwell)

- Soo Valio (Sosovalue)

- Gantlet (Gauntlet)

- Anzen Finance (Anzen Finance)

- Simmels Protocol (Seamless Protocol)

- Block Analytica (Block Analitica)

- Curious Current (B.protocol)

- Extra Finance (Extra Finance)

Here are some of these projects and their role in the Base ecosystem.

Morpho (Morpho)

Morpho is a decentralized loan protocol that operates on the Ethereum and the Base Network. This protocol allows users to create isolated and custom loan markets and has a non -governmental structure without the need for permission. With capabilities such as Morpho Vaults, DAO Governance and High Security, Morpho has become one of the most important infrastructure in the Base Dipy Ecosystem. The proprietary token of this protocol, MORPHO, is one of the new bass tokens.

The role of Murphu in the Base ecosystem is not limited to lending; Rather, it has also provided a platform for the development of innovative tools such as bitcoin -based Anchin. For example, Kevin Base’s collaboration with Morpho has made it possible for users to borrow up to $ 4.9 USDC on Bitcoin Bitcoin.

Such applications put Morpho in the category of successful bases projects and show that the protocol is not only technically, but also at the real -time use level, connecting to the traditional financial world.

Aerodrome Finance)

Aodram Finnus is an automatic marketer (AMM) designed to become the main center of liquidity. This platform provides users with a fast and cost -effective experience by modeling Velodrome V. Its duality structure with Aero token to provide liquidity and Veaero for the sovereignty contributes to the balance between participation and reward.

The role of Arrodram in Different Projects in Base is very key; Because the role of a bridge plays efficient liquidity. Users can participate in the governance by locking Aero and benefiting from fees and incentives. This sovereignty has made Arrodram one of the best baseball projects for traders and investors in the field.

Spark (Spark)

Spark is one of the key Dipai infrastructure in the new Sky ecosystem that focuses on optimizing liquidity and capital productivity. This protocol, through Sparklend, enables lending and borrowing with transparent rates for assets such as DAI, ETH, Wsteth and CBBTC. Spark is currently active on Ethereum and Base, and its data can be intercepted for a moment through Spark Data Hub.

In the BASE ecosystem, Spark provides a tool for profit through storing assets and simple interaction with USDC, DAI or USDS by providing stubble SDAI. Also with SparkConduits, liquidity is transmitted directly from Sky to other dipy protocols in the Base network.

Moonwell (Moonwell)

Moon Wal is a decentralized and open source lending protocol built on the platform of baseball, optimism, Moonbeam and Moonriver. This platform allows users to lend or borrow their token without ownership, while also benefiting from the high security and transparency of the network. Non-Custodial architecture guarantees the security of users’ assets.

Moon Well is recognized as one of the best Dipai platforms on the base that has been able to attract the attention of new and professional users by providing a simple user experience.

The project is also one of the best token to the base of the base and earns money through the Liquidation loans and processes. Moon Wali plays a key role in attracting liquidity and upgrading the Dipai ecosystem and is a good option for investing in the bass ecosystem.

Soo Valio (Sosovalue)

Sue Valio is an artificial intelligence -based research and investment platform that offers tools for market analysis and portfolio management by combining decentralized financial capabilities (CEFI).

The platform includes a smart data analysis tool and a decentralized SSI protocol built on the Ethereum Virtual Machine platform and implemented on the base network. Its main purpose is to reduce the complexity of decision -making for investors among the mass of information and tokens.

Among the best base network projects, Soswolio plays an important role in the development of smart investment tools because of its focus on transparency, free access and elimination of traditional costs. The direct connection to the Base China block has enabled users to create and manage their decentralized portfolio without the need for intermediaries. This project is especially an efficient and flexible option for investing in the baseline ecosystem.

Gantlet (Gauntlet)

Gantlett is a risk analysis and performance optimization platform that helps projects with advanced and data -driven modeling to resist their financial mechanisms against user behavior and market fluctuations. The platform has so far been able to become one of the key actors in the back of projects such as Aveve.

Gantlett plays an important role in promoting the security and efficiency of the Dipy protocols in Base. Given the risky behavior of some users and fluid liquidity on the network, Gauuntlet analysis helps developers optimize interest rates and other financial incentives.

Anzen Finance (Anzen Finance)

Enszen Finance is a real asset -based platform (RWA) that sought to stabilize financial stability and reduce fluctuations in the digital currency market by providing token USDZ. This token, with a variety of portfolio, is supported by asset -based securities (ABS), which is mainly in the United States, which reduces macroeconomic risks.

In the base ecosystem, Enszen plays an important role in strengthening decentralized financial infrastructure by providing real asset -based stubbles. Users can buy and steak USDZ and get a reward automatically by receiving SUSDZ. The presence of Enszen in the base increases the network’s attractiveness for institutional users and enhances its RWA ecosystem.

Simmels Protocol (Seamless Protocol)

The Seamless Protocol is a native loan and borrowing platform that has been launched with a fully societal approach and without public or private SEAM public sales. Relying on a decentralized sovereignty model and fair launch, the protocol strives to provide a new financial structure for Dipy users.

In the base ecosystem, Simmel plays an important role in improving capital productivity by introducing an innovative structure called Integrated Liquidity Markets (ILMS). This structure allows liquidity suppliers to operate in a coordinated and transparent manner, making lending conditions without collateral or on limited collateral in the difa space.

Block Analytica (Block Analitica)

Block Analytica is a data analysis company and a Dipai -based risk consultant that focuses on analyzing Anchin data, helping various risk management protocols. This set of advanced tools for the financial health of lending platforms and tracking key market indicators and has a key role in designing risk control mechanisms.

In the base network, the Analytica Block plays the role of data consultant and data supplier for some loan protocols to ensure the balance between liquidity, collateral and interest rates. These collaborations increase transparency, reduce the risk of users’ lycoid, and optimize collateral policies on base platforms.

Curious Protocol (B.Protocol Cuator)

The Curler Protocol is an automated system for managing and improving the “cash” or “liquidation” process in lending protocols. With the help of users, the system performs licocoids faster and better to prevent more lenders and to provide more secure to assets. As such, the protocol causes the cash to be done regularly.

Extra Finance is a lever lever cultivation protocol, built on the Aptimism Network and allows users to use lever up to 5x.

Users can put their assets in different ponds and make more profit in a variety of ways, such as long -term or short -term investment. Extra Finance also allows users to earn fixed income and non -activity by lending assets.

On the base network, Extra Finance helps users improve their capital efficiency and reduce borrowing costs. This protocol, with the new interest rate model, makes it easier and more profitable with stubbles with stubbles and lickidite tokens. As such, Extra Finance plays an important role in attracting investors and the growth of dipy on the base network.

How to bridge the assets to the base network

Base.org’s official website has two main proposed bridges for asset transfer:

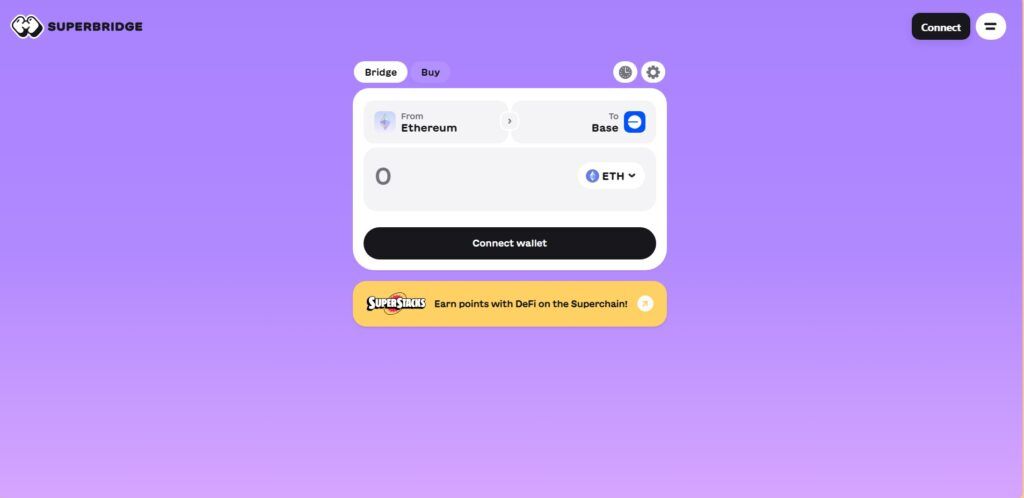

The first is Superbridge and allows you to move ether (ETH) and other supported assets directly from the main Ethereum (first layer) network to the base network. You first need to enter the ether value you want and press the Connect Wallet button. You should choose your volt below.

BRID.GG is another option that will help you move ether and supported assets between the core of the Ethereum (the first layer) and the base network. The bridging process in this option is like the Super Bridge.

These two bridges allow the quick and secure displacement of assets between the various networks and the base network. Each of these methods has its own features and interface that can vary depending on your needs. After the deposit is confirmed in the China Block, the asset will be displayed in your Base Network.

The future vision of the base network

The future prospects of the base network focuses on building a global economy in the chain that everyone can participate. The network intends to create a powerful and open ecosystem by investing in five key parts including “developers”, “apps”, “ownership”, “markets” and “public access”. The ultimate goal is to bring billions to the China block world.

To achieve these goals, the base intends to provide simple and powerful tools for decentralized apps so that anyone can work easily from beginner to professional. The base network focuses on increasing scalability, reducing fees and improving user experience to make it easier to enter this new economy and grow the number of users and transactions rapidly.

Base also pledges to build a decentralized, secure and transparent network that benefits from ethereum technology and improves continuously. With this approach, Base hopes to play an important role in the transformation of the global digital economy and create a good environment for innovation, cooperation and growth of all users.

Frequently asked questions

Base is an Ethereum -based China Block Network for the creation of the world’s world economy.

Morpho, Arrodram Finnus, Spark, Monol, Sue Valio and Gantlett are some of the best Base network projects.

The expansion of millions of users and developers in an open and decentralized economy can be considered the main prospect of the base network.

Conclusion

In this article, we introduce 5 of the best base network projects. These projects are in high position in terms of innovation, growth and acceptance of users and have a large share of Anchin Base’s activities. The diverse presence of these projects has increased the attractiveness of the base for users and developers.

With the base focus on scalability, the simplicity of use and open source tools, these projects are expected to grow further. Achieving large goals such as attracting one billion transactions and increasing the capacity of the Space block can provide a good space for their progress. The base seeks to become a global infrastructure for Anchin’s apps.

RCO NEWS