In the dynamic world of financial markets, where the complexity of the charts sometimes seems confusing, various analytical tools are used to better understand price movements. One of these fascinating and efficient tools is a fractal pattern that, inspired by repeated nature structures in nature, offers traders a new view of market analysis and helps them discover the hidden order in the heart of appearance.

In this article, we intend to introduce the concept of fractal and examine the importance of using fractal patterns in technical analysis for detecting trends and recurring points. We will also explain the role of fractal analysis in improving the accuracy of traders’ decision -making so that you can better enjoy this powerful tool in your transactions.

What is a fractal pattern?

Fractals There are patterns that repeat themselves on different scales. This feature of repetition makes them very useful in analyzing patterns. For example, in analyzing financial markets, fractal patterns can be used to identify duplicate trends at different time intervals. These patterns help analysts anticipate possible entry and exit points and adjust their trading strategies.

In Technical Analysis, the fractal pattern is one of the subdivisions of the Price Action System, in which chart patterns is used as a key element of trading strategy. Bill Williams brought the idea to financial markets in Trading Chaos, believing that complex market movements were made up of self -sufficient duplicate patterns.

Read more: What is Price Action?

Simple definition of fractal pattern

Fractal can simply be considered a fundamental pattern that is repeated on a small and large scale. Just as it is possible to find Fibonacci Ratios ratios in nature, fractals are often found in nature, such as plants, crystals and snowflakes. This concept helps us to break down complex structures into simpler and more understandable elements.

Or, if you look at the branches of a tree, you will find that smaller branches are separated from the trunk similarly to the main branches, and each smaller branch has similar divisions.

In nature, there are many examples of these self-similar patterns, including the structure of clouds, mountains, and even coastal lines. This repetition of the pattern on different scales helps us to break down the complexities into simpler and more understandable structures.

The main features of fractal patterns in price charts

In price charts, fractal patterns appear as duplicate and geometric structures. These patterns help traders identify potential return market points, whether on the floor and on the ceiling, which can lead to better decisions in entering or exit transactions. In addition, fractal theory also develops and includes recurrent fractals and continuing fractals.

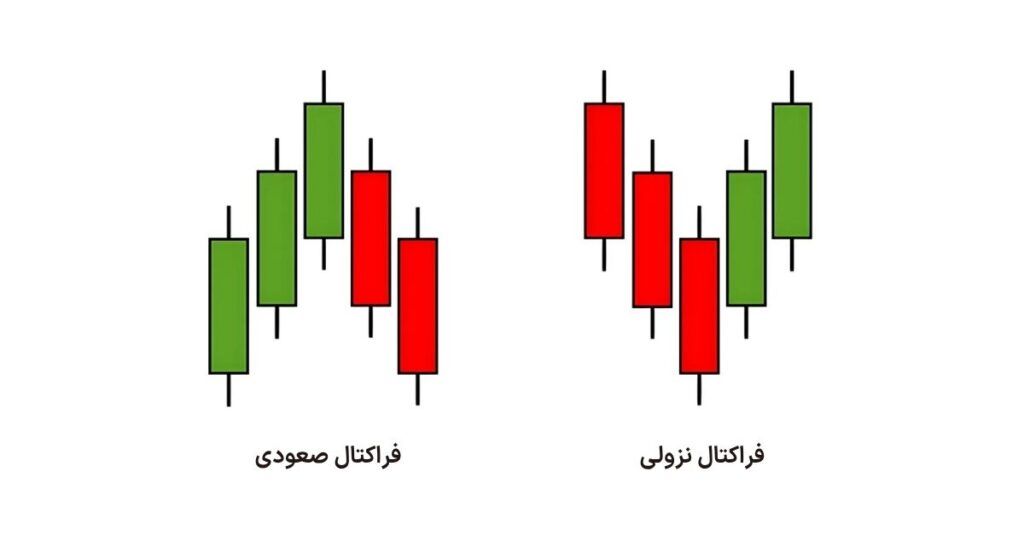

To accurately identify the fractal patterns in the Price Chart, you should look for a middle candle that records the highest or lowest point compared to the two candlesticks before and two. Although fractal theory in technical analysis is sometimes discussed because of the difference in the interpretation of the Kandel Steic patterns, understanding how to filter signals and build levels based on fractals can help traders use these patterns effectively.

Fractal pattern history

The roots of fractals go back to the world of mathematics and Benoit Mandelbrot. Mendelbro, known as the father of fractal geometry, invented the term in year 6 and examined irregular and self -sufficient patterns in nature. His work on the concept of self -sacrifice and measurement of fractal dimensions opened a new window to understand the complexities of the world.

Fractals from mere mathematics opened their way to the world of technical analysis. Discovering that many natural phenomena, including cloud structure or coastal lines, show fractal patterns, the idea was that financial markets may follow such patterns. This insight has led to the complexity and disorder of the price charts, in fact, a hidden and repetitive structure.

The role of fractals in modeling the complexity of financial markets is very important. By identifying these repetitive patterns at different time scales, analysts have been able to develop tools for predicting potential recursive points and better understanding of the market dynamics. Bill Williams was one of the most prominent people to use fractals in particular in the field of technical analysis and introduced the fractal indicator to identify these patterns in the price charts.

Application of fractal pattern in technical analysis

Fractal patterns are a powerful tool in technical analysis that help traders understand the hidden structure of financial markets. These are the like, key applications in identifying trading opportunities and understanding price behavior.

Identifying Reversal Points using fractals

One of the most important uses of fractals is their ability to identify market returns. By identifying the upward and downward fractals in the price chart, traders can predict points where the trend is likely to change. An upright fractal on the ceiling indicates the likelihood of returning down and a descending fracture on the floor makes it possible to return upwards.

These patterns allow traders to better identify the entry and exit points. For example, the emergence of a downtrend at the end of a downtrend can be a sign of buying and starting a rising trend, while a fractal at the height of the uptrend can be a signal for sale and the possibility of price descending.

Fractal comparison with Eliot waves

There are similarities and differences between fractal and Elliott Waves. Both theories are based on the idea that financial markets have duplicate patterns and both use the concept of self -sufficiency; This means that patterns are larger than similar smaller patterns. However, Eliot’s waves are based on a five -wave structure in the process and three waves in correction, while fractals define specified five candlestick patterns.

The advantage of fractals is the simplicity of their diagnosis, as they are easily identifiable by the Bill Williams Indicator and can show clear references. In contrast, Eliot waves need more complex interpretation and the waves count can be subjective. Fractal constraints may be false signals in the markets of suffering, while in Eliot waves the main challenge is the correct interpretation and avoidance of misconduct.

Complete Fractal Analysis Training

In this section, we will discuss the comprehensive and practical training of the fractal pattern to learn how to accurately identify these patterns in the price charts, to learn how to use the fractal indicator in technical analysis software, and finally see how to combine fractals with other analytical tools.

How to detect fractal patterns in price charts

The fractal pattern in the price charts is identified as a set of five consecutive candlesticks. In a descending fractal, the central candlestick has the highest point with two candlesticks before and two have lower ceilings. On the contrary, a uptrend has the lowest point in the middle candle, with two candlesticks before and two candlesticks record higher floors. These precise rules help traders clearly identify these key patterns.

Use of Fractal Indicator in Technical Analysis Software

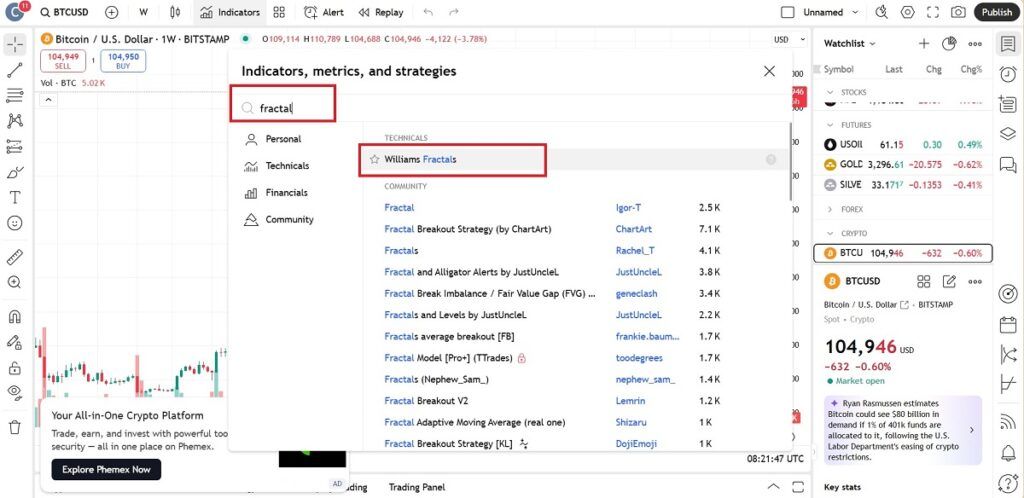

Fractal indicator is one of the standard tools in many technical analysis software. You can easily find this indicator on platforms such as Metatrader 1 and 2, TradingView and Crader. In these software, it is usually enough to go to Indicators or Insert.

Read more: TradingView Complete Training

Then select Bill Williams and add the FRACTALS Indicator to your chart.

This simple process allows you to see fractal points immediately on the chart. After adding the indicator, small arrows over the ceilings or lower price floors appear that represent fractal patterns.

For example, a candlestick flash may indicate a descending fractal and a potential resistance, while the candlestick shows an upright fractal and a possible support.

There is usually no need to change the default settings of this indicator, but some platforms may provide options to customize its appearance. Keep in mind that these arrows help you identify and use duplicate price structures in your analysis.

Fractal composition with other technical analysis tools to improve accuracy

To increase the accuracy of trading signals, fractals can be integrated with other technical analysis tools. One of the most common compounds is the use of fractals with support and resistance levels. When a uptrend appears near an important level of support, the likelihood of prices returns upwards; Similarly, a downtrend near a resistance level can be a strong sign of price reduction.

Also, the combination of fractals with moving averages can help identify the overall process and optimal entry and exit points. For example, if the high price of the 4 -day moving average is and a uptrend is formed, this can be more confident. The moving averages act as a filter and help traders enter the transaction only in the prevailing process and avoid false signals.

In addition, simultaneous use of fractals with mildum oscillators, such as the relative power index (RSI) or MacD (MACD), can be a strong confirmation of the trend.

Read more: What is the RSI index?

For example, if an ascending fractal is formed in the RSI’s Oversold area, this can be a strong sign of upward return. Or if a descending fractal is associated with descending divergence in the MACD, the likelihood of a decrease in prices will be strengthened.

Read more: Tutorial on using the MacD Index

The benefits and limitations of using a fractal pattern

The fractal diagram pattern, despite the simplicity of identification, is a powerful tool in technical analysis that has both significant benefits and a constraint and challenges. Understanding these things is essential for their effective use.

The benefits of fractal analysis

The use of fractal analysis in financial markets can have many benefits for traders. These benefits are mainly related to the simplicity and efficiency of these patterns in identifying key market points:

- Easy identification of recursive points: Fractals clearly show points in the chart that are likely to change the price process, which helps traders decide to enter or exit transactions.

- Use in time frames (Timeframes): Because fractals are self -esteem, they can be identified and used in each frame of the chart (from short to long -term).

- Verify other signals: Fractals can act as a verification tool for signals received from other Indicators or technical analysis and increase the validity of trading decisions.

- Simplicity in use with indicator: Bill Williams’s fractal index automatically identifies these patterns on the chart, making it easy for beginner traders.

Restrictions and challenges

Despite the many benefits, the use of fractal patterns is not a challenge, and traders must be aware of their limitations so that they do not make a mistake:

- False signals: Fractals may produce a lot of false signals, especially in the markets of suffering or with low fluctuations, leading to the entry of losses.

- Signal delay: Since fractals need five candlestick to complete, their signal may appear slightly delay and the trader will lose the opportunity to enter the best point.

- Need to verify with other tools: Due to possible false signals, it is recommended that fractals always combine with other technical analysis tools such as Trend Lines, support and resistance levels, or other indicators.

- Failure to provide a price goal: Fractals only identify possible recursive points and do not provide information about the next price or purpose move.

Practical applications of fractal pattern in financial markets

The fractal diagram in practice is a flexible tool for traders in financial markets, especially in the field of digital currencies. Here are some applications of fractal patterns in financial markets.

Identify the levels of support and resistance

Fractal trend lines can help traders identify potential support and resistance in price charts. By seeing how these lines are formed and how the price reaches them, traders can make more informed decisions on entry and exit points.

For example, if in a bitcoin diagram, a fractal process line consisting of multiple fractal connectivity on price ceilings continuously acts as resistance, traders can consider selling near that level.

Returning patterns detection

Fractal process lines can also be useful in detecting Continuing and Reversal patterns in price movements. By observing the formation of fractal process lines, traders can evaluate whether the current trend will probably continue or return.

For example, if in a chart after a rising trend, a downward fracture is formed at the peak of the trend and the price begins to decline, this may indicate a possible return of the trend from upward to downward.

Determine the level of loss limit and profit limit

Traders can use fractal process lines to determine the effective levels of the Stop-Loss and the Take-Profit for their transactions. By putting orders, the loss limit is right below the support lines or above the resistance process, traders can limit possible losses if the price moves contrary to their position.

For example, in a purchase position, the loss limit can be slightly lower than a recent uptreen fractal to limit the loss in the event of a sudden price descending.

Frequently asked questions

The fractal pattern is repetitive with at least five candlesticks whose central candlestick has the highest or lowest point compared to two candlesticks before and after.

Fractals are simple five -candidates that focus on self -esteem, while other graphic patterns include more complex structures with different rules and goals.

Trading software and technical analysis such as meta -ender, trading View and CTRDER are among the best to offer a fractal indicator.

The fractal index automatically draws arrows above the ceiling or bottom of the central candlestick floor of the identified fractals that represent recursive points or levels of support and resistance.

No, it is not recommended to deal only with a fractal analysis; It is best to combine it with other technical analysis tools to increase accuracy and reduce false signals.

Conclusion

Fractal patterns are powerful tools in technical analysis that help traders identify repeated and market -like structures. These patterns, rooted in mathematics and entered the financial markets by Bill Williams, are easily recognizable and can identify possible recurrent points, support levels and resistance levels, and appropriate points to determine the loss limit. Correct understanding and combining them with other analytical tools is critical to increase the accuracy of signals.

However, like any other analytical tool, fractals also have their limitations. They may produce false signals in the markets of suffering and provide a little delayed signal due to the need to complete the five candlestals. Therefore, to maximize the efficiency of the fractals, it is recommended that traders do not use them alone and always combine them with more comprehensive analysis and other indicators to make more informed and successful trading decisions.

RCO NEWS