Suppose your prediction is that the price of Bitcoin will rise from $ 2.9 to $ 2.9. So you decide to invest with this forecast. How do you think the price can be used without even having bitcoin? It is here that the concept of “Long position” comes up.

In the Cryptocurrency market, we can benefit from rising prices without assets. Long position is like betting on price growth. In this article, we explain the Long Position’s position and examine the difference between the Long and Short positions. We also explain how the strategies can benefit from this situation.

What is the Long position?

Long position (Long Position) In financial markets means buying an asset with Waiting for the rise in prices in the future Is. The trader bought the asset at a lower price and hopes to sell at a higher price. This strategy on the principle Cheap and expensive sale It is firm and suitable for bullish markets.

In Financial Markets, such as the digital currency market, when we say someone has taken a “position” means that the price of an asset is rising. Simply put, this person buys a digital currency like Bitcoin or Ethereum in the hope that it will be more expensive in the future and sell it at a higher price. This strategy is called ascending, because one expects price growth.

Long position can be opened for different assets; Such as stocks, investment funds, currencies and even derivative tools such as Futures and Options.

The interesting thing is that in the derivative market, even without direct purchasing assets, it is profitable. For example, if someone expects the price of Ethereum to rise, he can open a purchase contract. The contract gives him the right to buy Ethereum at a certain price in the future; If the price goes higher, it will benefit.

On the other hand, when a traider predicts the price falls and gets “Short Position”, it actually benefits from lowering the price. So the concept of Long’s position and the concept of the shortness of the shorts are exactly two opposing approaches.

Define the concept of Long position in digital currencies

When a trader opens the Long market in the Crypto market, it expects a digital currency to rise in the future. In the digital currency market, the Long Post is one of the most common trading strategies (TRADE); Especially when the market is upward. That is, when prices go up, many enter the Long position to benefit from the growth of more prices.

In fact, Long’s position in the digital currency market is no different from other markets, except that the Long position is taken on digital currencies instead of stocks or other assets.

How does the Long position work?

When the trader says, “I open the position of Long”, he means that I buy the asset right now because I’m sure his price will rise. Then, when the price goes up, I sell the asset and get a profit from the price difference. So login to the position of Long means:

- Predicting price growth

- Shopping at lower price

- Sale at higher price

- Earn profits from the difference between two prices

But in the modern markets of Ramsar, you do not always have to buy “really” assets. You often just bet on price growth. If the prediction is true, you will benefit and if you are wrong you will lose.

In fact, the location of the Long is a digital currency purchase signal and has a simple process that you can easily do in a Cryptocurrency Exchange:

- Purchase of assets: The trader first buys his desired currency at the current market price.

- The maintenance of the asset: After the purchase, he waits. During this time, it should examine market news, price trends, as well as the state of the global economy, and at the same time as technical analysis to make sure its prediction is correct. Sometimes it takes a few hours and sometimes even a few months.

- Sale of assets: If everything goes up and down the currency price, the trader sells the asset at a higher price and benefits from the difference between buying and selling. For example, if the Long position in Bitcoin opened for $ 4.9 and sells for $ 6,000, it will have a net profit of $ 6,000.

The importance of Long strategies in the digital currency oscillating market

The crypto market is a vibrant market and prices change tens of percent in minutes. In such a market, it is more necessary to have a strategy to enter the Long position than the night bread! Because without a program, small profits become major losses.

If you only get into the position with emotions or under the influence of rumors, you will lose. For example, you may enter the market at the peak of price, but lose all your capital because of the lack of loss.

The difference between the position of the Long and the shorts

Another important trading position in the financial markets is Short Position. The position of the shorts and Long are actually two different views of the future of the price. The person who enters the Long position believes that the price goes up and that the price rise is profitable. The one who enters the position of the shorts, the opposite, thinks; That means he hopes the price drop will fall.

As we said in the Long position, the trader buys the asset and waits for the price to rise and then sell it at a higher price. In the position of the shorts, the trader first borrows and sells the asset; Then when the price drops, it buys it cheaper and returns to the main owner and benefits from the price difference.

For example, if bitcoin is $ 4,000 and the trader predicts the price will fall, it will enter the shorts. If Bitcoin reaches $ 6,000, he would benefit from $ 6,000. If the price goes up, it will lose and may even receive a Cal Marjin warning.

Explaining the difference between the position of the Long and the shorts with the example

The position of the shorts means selling an asset that you still don’t have. These conditions seem strange at first glance, but it is common in the digital currency market. When a trader enters the shorts, it actually bets the price down.

To better understand the difference between the Long and the shorts, let’s check the two scenarios together.

- Long position scenario:

Trader predicts that the price of Ethereum will be priced at $ 2 to $ 2. So it buys at the price of Ethereum at $ 2. A few days later, its prediction comes right and priced at $ 5. The traider sells his asset and earns $ 2. In this situation, he really bought Ethereum and then sold, a simple, low -risk deal.

- Scenario Position Position:

Suppose the current Ethereum price is $ 5 and you expect it to fall and reach $ 2. In this case, you can open a short position. Simply put, you borrow the asset in your short position and sell it at a current price (ie $ 2), expecting and returning the same asset at a lower price (eg $ 2).

The most important difference between these two situations is in the direction of transaction and risk. Long’s position is easier and safer. The position of the shorts is more sophisticated and more risky, as its loss can be very high.

Step -by -step tutorial on Long position

Now that you are fully acquainted with the concept of Long’s position and know the difference between the position of the Long and the shorts, it’s time to examine the Long Position Training:

An introduction to the creation of the Long

The strategy of entry into the Long position is suitable when the market is upward or there are signs of growth. In fact, you invest in price growth by opening a purchase position.

Entering the Long position is suitable for newcomers because it has a simpler structure. To get started, you need to enter a trading platform or trading platform, you can analyze the market with charts such as Candlestick. Such ecilators such as McDe and RSI are very effective in analyzing entry and exit points.

The important thing is that profit in the Long position is not certain, and if the price acts against your prediction, you may lose. So don’t go into this position without analysis.

Select the appropriate trading platform

To enter the Long position you need to enter a good currency exchange that has high professional and security facilities. Iranians should be very careful or use Iranian currency exchanges due to sanctions when choosing a currency exchange.

When selecting a currency exchange rate, consider the trading fees, support for the desired Ramsar, the user interface, the volume of transactions and its security. Also make sure the platform is able to deal with Marjin or Fuchors, as you need this ability to enter this lever. If you are a beginner, start with the Spot section to get to know the market mechanism without the risk of leverage. You can then enter the Futures market.

Select the right digital currency for Long position

Not all digital currencies are suitable for Long position. You have to choose Ramarzi with a strong backing and high volume of transactions and positive news. In the first step, see if this digital currency has active developers? Is its network functional? Is there positive news about that?

Then, check if Ramsar has had an upward trend in the last few days or weeks. Tools such as CoinmarketCap and TradingView are very useful for reviewing market status. Always choose a “growth acceleration” in the current market. Do not deal with anonymous tokens or rumors whose volume is low.

Market analysis and ascending process identification

To successfully enter the Long position, you first need to make sure the market is upward and you need to use technical analysis tools. In the Viva Trading platform, use indicators such as the Moving average (MA), McD, RSI Indicator and Bollinger Bands. If the short -term moving average (like MA20) is higher than MA50 or MA100, the market is upward.

If the RSI is above 1, the purchasing power is high. Also, patterns such as twin floor, uptrend or resistance failure are good signs to enter the Long position. However, be careful not just technical analysis is not enough; Also consider the Fannattal news.

Determine the market entry point

When you make sure the market trend is up, you need to find the exact point to enter. This is when the price of a resistance has broken or returned from price correction. For example, if the resistance level is stabilized with its broken power and its high price is stabilized, it will be an appropriate entry point. To determine these points, use tools such as corrective fibonacchay, support and resistance levels and volume indicator in Tripting View.

Another way to determine the entry point is to use the candlestick; For example, a high -volume -up Kendel is a high volume after a modification of a excellent entry. Always define a loss limit after entering the market so that if the market has a different trend, prevent further loss.

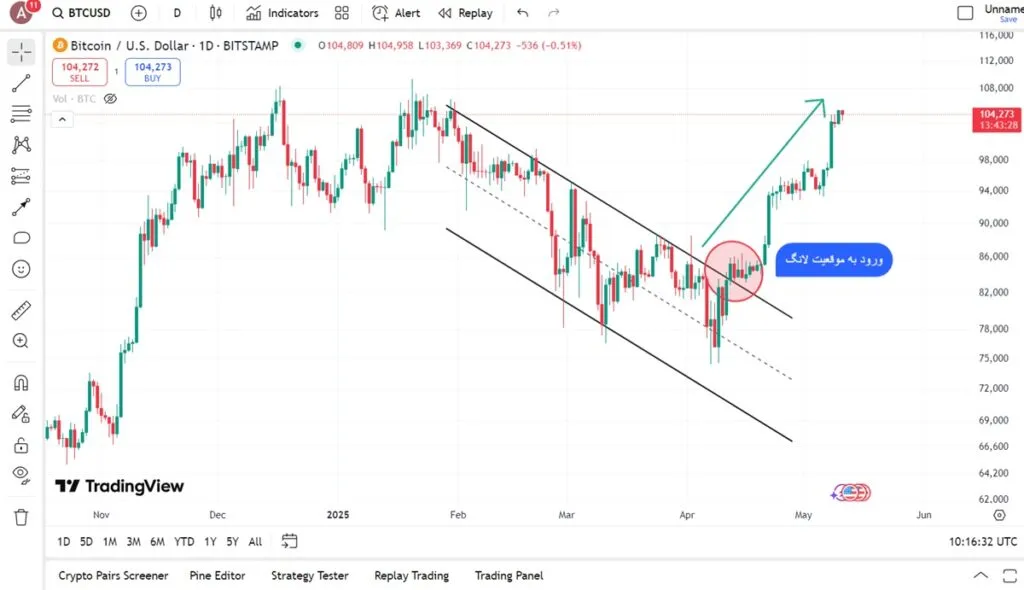

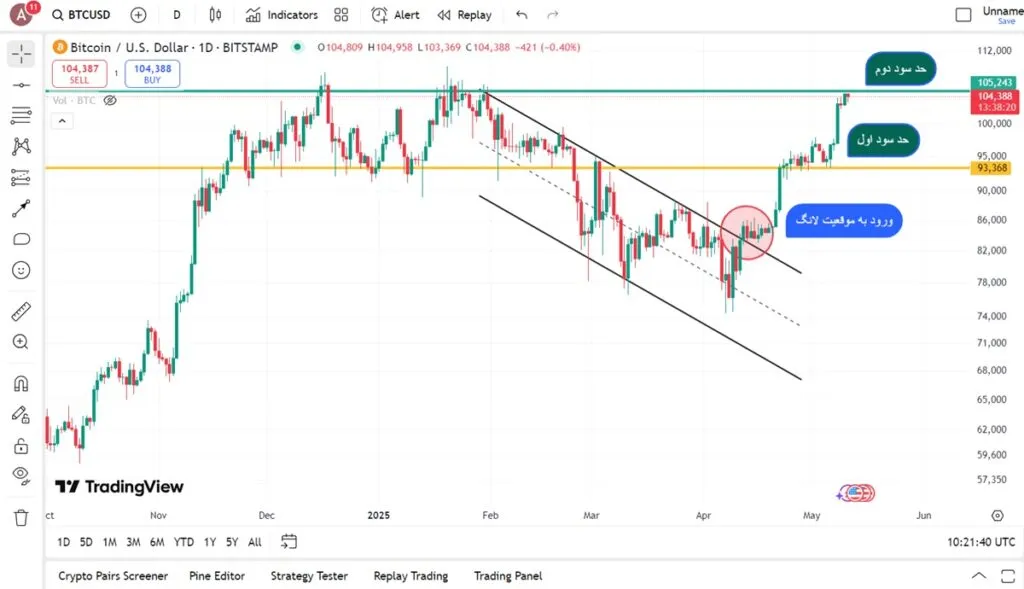

In the example below in the Bitcoin chart you can see that the descending channel is broken with two powerful ascending candles. This is the perfect entry point for the Long position.

Determine leverage

Leverage or Lorij allows you to deal with more money than your capital. For example, with $ 1 and a 2x leverage, you can open a $ 4 position. However, the lever will multiply the loss, while multiplying the profit. In our example, it is enough to drop the currency price by 5 % to eliminate all your capital.

If you are a newcomer, enter the market with low leverage and adjust the amount of lever when opening the position. You also need to properly manage the initial margin and make sure you have enough inventory to prevent lycid.

How to close the Long position

When the price reaches your specified Target, you must close the position to save the profit. You can easily do this on the same trading platform. If you do not want to check the market permanently, use orders like Limit Order or Take Profit to automatically get out of the transaction when the price reaches a certain limit.

Do not forget that you must always have the loss limit; For example, if you enter a $ 2 position, set the profit limit to 2 and the loss limit to 1.

In the previous example, the first profit limit can be as high as the height of the channel (yellow horizontal line) and the second profit is twice as high as the channel height or in accordance with previous ceilings (green horizontal line). The profit limit and the percentage of exit depend on your strategy.

Practical tools for Long position

To be able to get a profit by choosing a Long position, it is good to use the tools for this position. These tools are as follows:

Candlestick or candlestick

Kendell Steic Charts are the basis of technical analysis. Each candle shows important information on the price of opening, closing, the highest (high) and the lowest price (Low) over a specified timeframe. For example, a 4 -hour candle shows the price behavior during one hour.

The color of the candlesticks helps you a lot; Green candle indicates the upward trend and the red candlestick indicates a decline in prices. Patterns such as Hammer, Morning Star or Doji help the trader identify the right entry and exit points.

Technical indicators

To enter the Long position, technical indicators help you a lot. Indicators alone are not enough, but they multiply the accuracy of the analysis when you use them with support and support lines.

Exchange demo accounts

If you are still on the way to the road or want to be risky and learn, traded with the currency exchange demo account. In these accounts, you can open the Long and Short positions and your capital is not compromised and most currency exchanges have this ability.

In the demo account, you are trading exactly the same charts and tools used in real trading, but not with real money. This way you will be introduced to the market structure, test strategies, and you will find more confidence to enter the real market.

Use of Fannattal Analysis and Market News

Don’t just get into the charts to enter a secure lang position. Foundtable analysis means project review, development team, news, and events that affect Ramsar’s price. There are good sources for tracking the news, including Cointelegraph, the news section of the Vali -e -Digital site and Twitter projects.

The use of fundamental analysis with technical analysis gives you a more complete view at the same time. Always check out whether there is some positive news or not before entering the Long position. With this information you enter the market at the right time.

Common mistakes in Long position

There is no trader that doesn’t make a mistake in the market. There are also errors in choosing a Long position that will issue a digital currency purchase signal. If you know these mistakes, you will be less impressed:

- Inappropriate entry

- Non -use of technical analysis tools

- Maintaining over -position and ignoring market signals

Inappropriate entry

If you enter the market at the Long position when the asset reaches or is being modified, you will be losses. Many newcomers are excited and enter the market without careful analysis when they see the upward trend; While that may be the end point of price growth. To avoid this mistake, we need to rely on technical analysis and wait for the process.

If you use tools like RSI to detect saturation and return patterns like Daji, you will find the exact time to enter the market. Always check out whether the price is really at the start of the uptrend before entering the market.

Non -use of technical analysis tools

Unlocking the Long position without technical analysis is one of the mistakes the traders make. Some traders are traded solely on the basis of inner sense or rumors, but you need to have logic to trademarked in this market. Technical analysis helps you identify points of entry and exit, market trend, purchase or sales power, and support and resistance points.

Along with the indicators, the volume of transactions and the structure of the candlesticks have reliable signs to enter the Long position. If you use these tools, your decisions are blind and emotional. Even if you just start with a few simple indicators, you will increase your decision -making precision.

Maintaining over -position and ignoring market signals

Occasionally, after successful entry into the Long, the traders keep the position too open from greed or self -esteem and ignore the signs of exit. For example, if the price reaches the Target but there are signs of the return of the trend (such as a return candle or negative divergence in RSI), it is best to close the position. But in these circumstances, some people think the market is still up and waiting for more profit, while the market is corrected and their profits are eliminated.

In this situation, the profit and loss limit will help you a lot. Also take negative news or market feelings seriously. The market does not always go as you will, and professionals know when they have to get out and make a profit, so always have a departure strategy.

Important recommendations and tips in Traid Long

Follow the following principles to get in the position of Long:

- The first and most important point, Choosing the right asset Is. Long position always begins with the purchase of an asset; Now this asset can be bitcoin, ethereum or any other penis. But you need to make sure that that asset has a strong growth potential for raising prices.

- Investment time horizon Specify. Entering the Long position means investing with medium -term or long -term vision. So don’t expect to get a Long position today and get money tomorrow! You have to wait and follow the price growth in a few weeks to several months.

- Another important point of review Market conditions Is. If the economic indicators are positive, the overall market trend is upward and demand for the asset in question will be rational. Always ascending markets are the best time to enter Long.

- The mental atmosphere of the market and the emotions of investors Check out. When the market space is positive and users are good at an asset, the likelihood of rising prices increases. Tools such as the index of fear and greed or the volume of transactions help you a lot.

The best digital currencies for the Long Trading

The best digital currencies for Traded Long include the king of the digital currency market, Bitcoin, the most prestigious penis of the market, Ethereum and some other penis, as we look at:

Bitcoin

Bitcoin is one of the safest options to enter the Long position. This digital currency is the world’s first and most popular Ramaz and has attracted the largest organizational investment. Bitcoin is one of the first to grow assets when the market is in the uptrend.

Analysts see bitcoin like gold; That is, they look at it as a long -term save. For mid -term or long -term traders, the Long position in Bitcoin is a logical and risky choice. To get started, it is best to find the entry point with technical analysis and enter the market in the reform phase.

Ethereum

Ethereum is the second largest digital currency in the market, which has the highest liquidity and volume after bitcoin. Unlike bitcoin, Ethereum is not just a currency; Rather, it is a powerful platform for the implementation of smart contracts, NFT building and decentralized applications. For this reason, Ethereum plays an important role in the growth of the China block industry. In the uptrend market, Ethereum experiences more growth than bitcoin and has a high potential for the Long position.

Other valid penis for Long position

Some penis are also good options for the Long position due to the strong development team, practical uses and active community. These include BNB (Binnes Currency Exchange), SOLNA, Avax (Avanch) and Matic (Paligan). These projects have a good price growth and have played an important role in decentralized financial infrastructure, blockchain games and network scaling.

You need further research to invest in the penis than bitcoin and ethereum; Because their price fluctuations are greater. So, if you want to open the Long position with the penis with the penis, set the loss limit so you don’t lose if the market is returned. The variety of investment baskets with a few strong penis increases your profit.

Frequently asked questions

Long’s position means buying a digital currency with a prediction that will rise in the future.

By purchasing low -priced assets and selling it at a higher price, this will be your profit price difference.

Yes, because the digital currency market has a lot of fluctuations and there is always the possibility of a decline in prices.

When the price reaches the specified Target (the target) or the signs of the return return appear, you should close the Long position and get the profit.

At the Long position, pricing benefits, but in the shorts, price reduction will benefit you.

Collection

Long position means buying a digital currency with forecasting price growth. Entering this position is simple, you buy assets at a low price, sell at high prices and profit. But to make a profit, you have to analyze, schedule and manage risk. You also have to choose the right asset, know how to work with technical tools, and not allow your decisions.

Bitcoin, Ethereum and Penis Quinn are the best digital currencies to enter the Long position, especially in the uptrend markets. Lang’s entry into the digital currency market is like surfing; If you recognize the wave correctly, you can get a good profit.

RCO NEWS