Digital currencies made in the US are actually related to American Chinese block projects, either the developer team in the United States or their parent company founded in the United States and operating under the law. There are many currencies, such as Solana, Ripple and Cardano. In this post, we will introduce the American digital currency list.

Of course, besides introducing these currencies, it is not bad to take a look at the impact of digital currency policies and laws on digital currencies.

Digital currencies made in America

There are many Chinese block projects such as Light Quinn (LTC), Uni, Kevin File (FIL) and Dodge Kevin (DOGE) that many people consider American. You can see an almost similar list of American block projects by visiting the Kevin Market (CMC) and Kevin Gco (CG) site, but not all currencies in this list are not necessarily American, and perhaps having a list to compare American and non -American currencies and attribute some of them to a specific geographical area.

However, in the currency team, we have found the basis of our selection to be criteria such as US development teams, headquarters, and the headquarters of the establishment of the currency company introduced in the United States, and among them, we have chosen the best market value and popularity options. It is noteworthy that the attribution of a digital currency to a particular geographical area contradicts the decentralized nature of China’s block, and this categorization is based solely on the above criteria and should not be considered a definite dependence.

For example, Cardano was created by Charles Hoskinson, one of the founders of Ethereum, in year 2. Cardano’s main developer company, called Output Hong Kong or IOHK, is not registered in the United States and is the headquarters of Singapore. However, the currency is on the list because of the bold role of Charles Haskin’s as an American entrepreneur and his influence on the development of the project, as well as the strategic importance of Cardano in the China Block space.

Ripple (XRP)

Ripple with the XRP symbol is one of the popular digital currencies in the United States, which founded Chris Larsen and Jed McCaleb, Ripple Labs, in the San Francesco County, Capital, Capital. In addition to the main office, the company has five other offices worldwide. Ripple’s main goal is to facilitate international transactions for banks and financial institutions.

One of the most important features that has made Ripple popularity among the world’s investors include:

- High speed and low cost of transactions

- Focusing on cooperation with banks and financial institutions

- High liquidity, popularity and public acceptance in the financial industry

- High scalability

Solana (XRP)

Solana is another popular American blockbuster project that Anatoly Yakoveko introduced in year 6. Mr Yakonko founded Solana Labs in San Francisqui, California, in year 6. The company, as one of the US companies in the digital currency field, is the developer of the China Block of Salana and its capabilities.

One of the most important reasons that encourages traders to buy Solana is:

- High processing speed (more than 0.5 transactions per second)

- Low transaction costs

- Widespread acceptance in the field of Difa, NFT and Mim Quinn

Cardano (ADA)

Cardano was created by Charles Hoskinson, one of the founders of Ethereum, in year 2. The Cardano Development Company, called Output Hong Kong or IOHK, is not registered in the United States and is Singapore’s headquarters, but we have listed it on the list for Donald Trump’s decision to put it on the US strategic reserves list. In addition, Charles Haskinson is an American entrepreneur, so Cardano can partly be considered an American project.

One of the benefits of investing and buying Cardano includes:

- Low costs

- Support for decentralized applications and smart contracts

- High speed and scalable China block

- Expansion of activities in the Difa and Mim Quinn space

China Link (Link)

China Link is one of the American blockchain projects whose native digital currency is traded with the Link symbol among users around the world. Steve Ellis, Arri Jules and Sergey Nazarov were introduced in year 6 and were launched in Year 2.

Mr Nazarov, of course, had established SmartContract ChainLink LTD in year 6, which was later renamed ChainLink Labs. The company’s headquarters is located in the city of San Francisqui, California.

One of the most important benefits and applications of China Link is the following:

- Providing detailed data for smart contracts

- Extensive partnerships with large companies

- Providing security and trust and decentralized Oracle

- Integration with a variety of projects in China Block

- High security

Stellar (XLM)

Stellar (XLM), beyond a digital currency, a solution for fast, cheap and global transactions. With low fees and high speeds, Stellar is a serious competitor in the world of digital payments.

Learn more about this innovative platform. Stellar with the XLM symbol is one of the potential options for investing in American digital currencies, founded by McCleck, the founder of MT.Gox and one of Ripple founders in year 6. Stellar Development Foundation, whose headquarters is in San Franceskiv, California, is responsible for the development of the China block. Stellar is designed to create a global payment system that enables quick and cheap money transfer.

One of the reasons for the popularity of Stellar’s buying among traders includes:

- Facilitate low -cost transboundary payments

- Cooperation with large financial companies including banks

- Support to token

- High speed in transactions processing

Avalanch (AVAX)

Avalanche is one of the fastest and most scaling blocks available by Ava Labs in year 6. The company was founded in the city of Itaca, New York, and is led by Amin Gün Sierer, a computer science professor at the University of Kernell. Avalanche is designed to provide a fast, low -cost and high -operative blockchain block.

The most important benefits of buying Avalanche for traders and developers are:

- Using Avalanche Consensus Innovative Mechanism

- High operational ability and rapid finalization of transactions

- Ability to create independent subcategories for various projects

- High processing speed and significant scalability

- High security and decentralized

- Lower fee than ethereum

Sea (SUI)

SUI is one of the relatively new and scalable American blockbank projects developed by Mysten Labs in Year 2. According to some sources, the company was founded in Palo Alto, California, and others said in San Franceskoy.

A group of former Meta (Facebook) engineers working on the Facebook DIEM project launched the project. One of the special consensus mechanisms called Narwhal & Tusk enjoys high operational capability and low costs.

One of the most important benefits of buying a block for China’s block space is:

- Scalability and high speed

- Lower fees

- High activity in the space, game, web and web

- Host today’s popular projects

Hedra (HBAR)

Hedra Hashgraph with the HBAR icon is a distributed network of the US company Hedra Hashgraph LLC. There are various data about the company’s headquarters; Some have cited Dallas in Texas and some City of Nevada in Las Vegas. The project uses Non -Oriental Graph Technology (DAG) instead of the traditional China block, which makes it very fast and scalable.

One of the most important benefits of buying Hedra Hashgrah is the following:

- Open text and its common rule by organizations around the world

- High speed and with 2 seconds

- High security along with a dedicated consensus mechanism

- Ethereum Virtual Machine Compatible

- Low costs

Aptus (APT)

APTOS with APT view is a layer -like blockbuster founded by a team of former Meta developers (Facebook). For this reason, Aptus can be considered as a sister sister project. Aptos Labs is the creator of the China block, whose main office is located in the city of Palo Alto, California, in the United States. This project, of course, has expanded its offices to other US cities. Aptus uses the Move programming language designed for the dry project and aims to provide a safe and scalable China block for smart contracts.

Benefits of Aptus for investors and developers:

- High operational ability and scalability

- High security and user -friendly

- Using exquisite technologies such as Block-StM

What are American Strategic Reserve Currencies?

Donald Trump cited five digital currencies on January 1, with a post on his social media, Truth Social, and said he was expecting to see them on the US strategic reserve list.

In his post, Bitcoin and Ethereum are in the heart of strategic (strategic). Among the digital currencies we introduced in this post, Ripple, Solana and Cardano are among the US strategic reserve currency list that Trump has mentioned. In other words, these two currencies are among the US government -backed digital currencies.

After that, Bitcoin recorded a 5 percent increase and Ethereum increased by 5 %. Subsequently, Cardano was a 5 % market for the market, followed by Ripple with 2 % and Salana with a 5 % growth, making good profitability.

Read more: Which US politicians agree or disagree with digital currencies?

What is the impact of American policies on digital currencies?

In general, the United States can have a direct impact on China’s blocking and technology, investing and receiving digital currencies, not only domestically, but also on the whole global market. For example, during his presidency, Joe Biden issued a comprehensive strategy for digital assets by issuing an executive decree, indicating the US government’s willingness to regulate and oversee the digital currency market.

In contrast, Donald Trump has taken a different stance during his presidency in years 1 and 2. He had called Bitcoin “fraud” during his former presidency, but in 2007, focusing on competing with international projects in other countries, he promised to turn the United States into the Crypto Capital of the World.

On the other hand, Trump’s new orders to import goods from China, Canada and EU member states have also affected the digital currency market. For example, tariffs on China during the Trump era have raised concerns about semiconductor imports that could affect the bitcoin mining industry.

Read more: The impact of Trump’s tariff policies on digital currencies and bitcoin in year 2

What is the US digital currency regulations?

Digital currency laws in the US are still unclear and no precise framework has been defined. Of course, in year 4, Fit21 was summarized and approved by the House of Representatives, but has not yet been implemented. The purpose of this law is to emphasize the role of the CFTC as one of the most important lawmakers in the United States.

However, there are various rules on the use of the country’s resources for various activities, including digital currency extraction. For example, digital currency extraction in New York is prohibited. To learn more about other digital currency rules in the US, click on the relevant article.

How to buy American digital currencies

If you are interested in buying American digital currencies, you can use concentrated and decentralized domestic and foreign currency exchanges. Due to the high popularity of currencies such as Ripple, Solana, Cardano and more, almost all of them are listed in all centralized Iranian and foreign currency exchanges.

Foreign currency exchanges

Although it is almost impossible for Iranians to work with most foreign currency exchanges due to sanctions and the inability to authenticate them, there are still currency exchanges in which authentication is not mandatory and has not banned Iranian activity. You can see the full list of these platforms by referring to the best foreign exchange for Iranians.

The steps for buying an American digital currency such as Ripple are as follows:

- Buy Tetter from Iranian Currency Exchange

- Transfer Tetrone to Foreign Exchange

- Buy the desired digital currency (XRP in our example)

Iranian currency exchanges

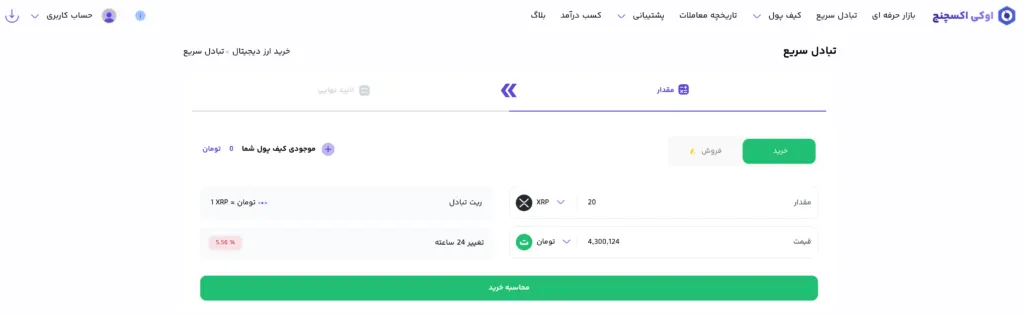

In Iranian currency exchanges, the process is almost the same. For example:

1. First log in to the currency exchange site and register and authenticate. Then charge your account with the amount of currency you want to buy, with a digital currency.

Enter the rapid exchange or professional currency market and search for the currency (eg XRP). Then enter the amount of digital currency or the value of the currency for the purchase and click on “Buy”.

Then specify the digital currency deposit address (to your own currency exchange or personal wallet) and wait for the purchase.

Decentralized currency exchanges

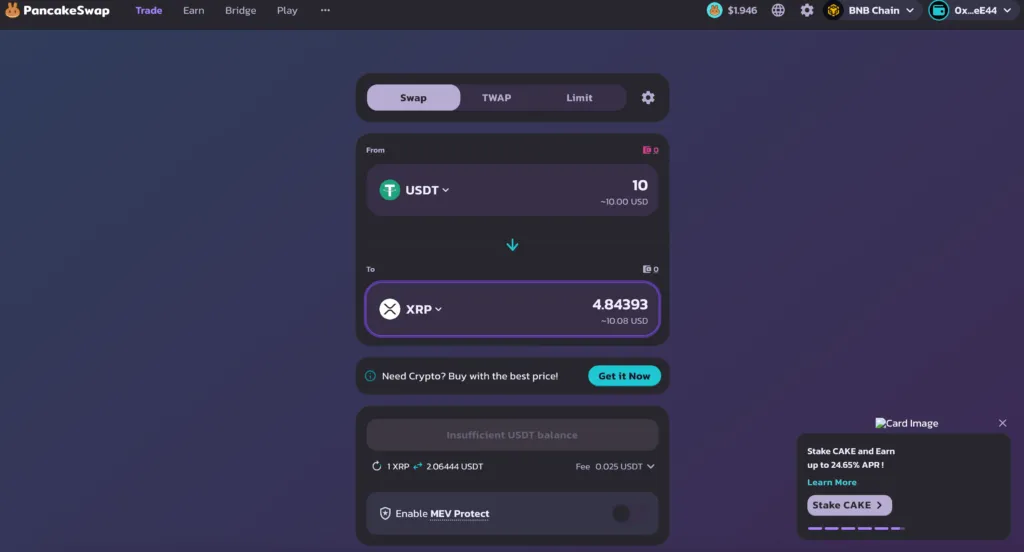

You can also find these popular digital currencies in the United States in non -convenient currency exchanges such as PancakeSwap and Uniswap. To do this should:

- Install a web wallet like the Chrome Metamsk plugin version.

- Post the pair of currency supported in the currency exchange (eg tattress in the pancakes currency exchange) into your wallet.

- In the from FROM, select the first currency (Tetter) and in the to to the second currency (eg XRP) and do the swap by specifying the amount of exchange.

Frequently asked questions

American digital currencies are usually influenced by rigorous laws such as SEC and CFTC and are often more transparent and institutional acceptance.

Investing in these currencies can be safer due to a more specific legal framework and potential government support, but regulatory restrictions also pose risks.

Ripple (XRP), Cardano (ADA), Solana (SOL), Link, Stellar (XLM) and Avalanc (AVAX) are Chinese block projects whose main office is deployed in the United States.

US laws can restrict or have to register with supervisory bodies, which has led to the migration of the headquarters of some projects, such as Ripple, to other countries.

Launching the national and digital version of the dollar may reduce the demand for stubbells for private queens and increase government control over financial transactions.

Conclusion

Projects such as Ripple, Cardano, Stellar, Avalanche, China Link, Soy and Aptus are among the digital currencies that their main developer or main developer team has been deployed in the United States. US oversight of digital currencies is one of the most sensitive points in the market that has created many problems for some projects such as Ripple. However, Donald Trump’s policies during his new presidency will probably have a great impact on the future of digital currencies in the United States.

RCO NEWS