Numerous factors such as rising interest rates, widespread sales of ethereal by miners, and the withdrawal of smart money from investment funds have put a lot of pressure on the price of ethereum due to concerns caused by concentration. However, the Foundation and Technical Market Examination shows that in the worst scenario, the value of Ethereum against the dollar may be reduced by up to 5 %.

The value of Ethereum has declined significantly after the merger against the US dollar and bitcoin, according to Kevin Telegraph. From the day of Ethereum transfer to stocks to September 9, the value of the Ethereum/USD trading pair (ETH/USD) has declined by more than 2 % and Ethereum/Bitcoin (ETH/BTC) has fallen by about 2 %.

Why is the pressure of ethereum cows decreasing?

Numerous factors have been involved in the formation of the downward trend of Ethereum during this period. First, the decline in Ethereum prices against the same dollar was the federation of other digital currencies, resulting from a 5.5 percent increase in inflation rate by the Federal Reserve.

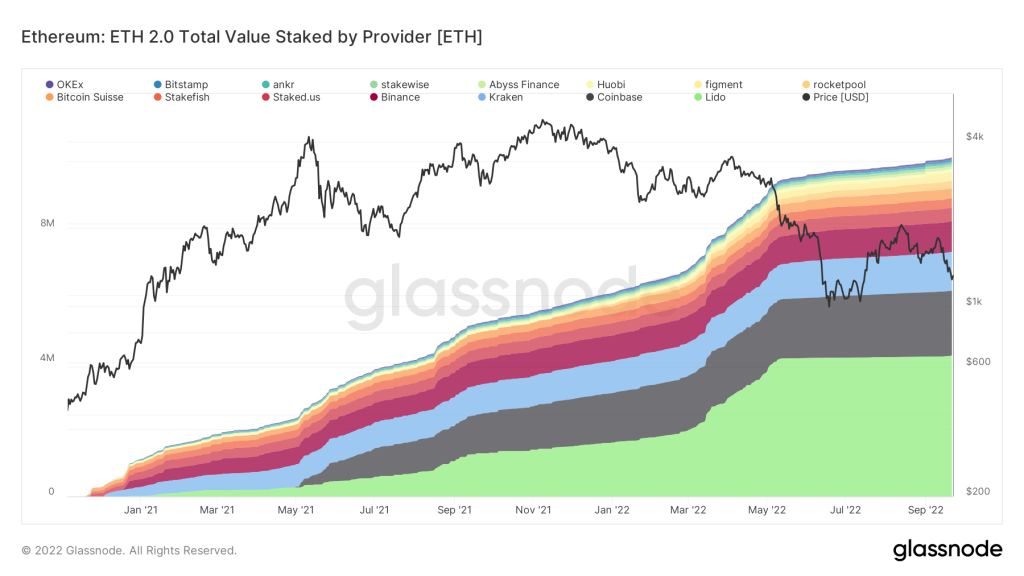

Second, Ethereum faced many problems because of the over -concentration after the merger.

Currently, 5 institutions produce 5 % blocks. Lido Dao’s largest share is an Ethereum share protocol that has deposited 3.5 million Ethereums, which is more than 2 % of the total ethereums of the stake in the Smart Contract of China.

Third, institutional investors removed their funds from the Ethereum Investment Funds in the days leading up to the merger.

According to Kevin Shirz’s weekly report, Ethereum investment funds saw $ 1.5 million from their treasury in the week ending September 9. In contrast, Bitcoin’s investment funds attracted $ 1.5 million a week, indicating a smart money withdrawal from Ethereum after merger.

Finally, the sale of $ 5 million of Ethereum by minor minor mining on the days leading up to the integration update imposed severe sales pressure on Ethereum.

As you can see in the chart below; Tuur Dmester, an independent market analyst, pointed to the behavior of Ethereum/ Bitcoin in important market events, pointing out that Ethereum may continue to devalue its value against bitcoin in the coming days.

This chart shows the performance of Ethereum traders to raise its price against bitcoin in admission related narratives, including enhancing the enthusiasm of NFTs and Dipy programs in year 2 or the boom in coin (ICO) in year 2.

All of these price increases disappeared after the emotions were subsided. Dimester considers the change of Ethereum to prove stocks as a bubble that increased the price of the Ethereum/ Bitcoin pair in year 2 and expects the pair to experience severe reform in the coming weeks.

She said.

I expect the value of the Ethereum/ Bitcoin pair to fall sharply. Currently, Ethereum is like an hourly bomb.

Technical analysis of Ethereum/ Bitcoin points to a 5 % decrease in

Investigating these fundamental analysis, along with the technical analysis of the Ethereum/ Bitcoin placenta, also shows a similar downtrend.

As you can see in the three -day chart, the price of Ethereum/ Bitcoin declined by about 2 percent after reaching 1.2 bits. This range corresponds to the long -term resistance level of this pair, 1.2 bitcoin. Now, this pair is looking to further reduce the level of support for the process of its process.

The trend line support range will be equal to 1.2 bitcoin; The range that has acted as a price return area in year 2. In other words, there is another 5 percent decline (up to 1.2 bitcoin).

The likelihood of a 5 % reduction in the price of the Ethereum against the dollar

Ethereum prices against the dollar can be reduced by up to 5 %; Because it seems that a paradigm pattern is formed in the downward trend.

As a rule, the formation of the descending triangle pattern is decided after the price fails below its lower process and then the price is reduced to the maximum height of the triangle. Therefore, the target price of Ethereum will be around $ 2 by the end of this year, which is about 2 percent lower than its current price.

In contrast, the price of price from the lower trend of the triangle could raise the price above the high trend line, which means price rise to $ 1.2 or a 5 percent increase in the current price.

RCO NEWS