In the last phase of the whales’ accumulation over the past two months, we saw bitcoin prices above $ 1.5. Of course, instead of buying more, they seized the opportunity to get out of the market and get profits. Now, Anchin’s data shows that whales are again increasing their bitcoin and ethereum accumulation.

Although Bitcoin’s great investor reserves have reached its lowest level in three years, demand for this asset is increasing; We’ve seen a 5 percent decline in bitcoin prices since the beginning of the year.

According to Ki Young Ju, CEO of Cryptocon, the volume of bitcoin trading in currency exchange has doubled over the past six months. Since price growth has not been associated with an increase in trading volume, it can be concluded that bitcoin is likely to be in the stage of accumulation.

The volume of transactions reached the highest level of the year last month; But there has been little change in the price of closed (Kendell) daily. This shows that someone buys all liquidity on the sale side.

Baynens, leading in spotted bitcoin transactions

The atmospheric analysis also shows how the Binens has expanded its digital currency during the winter. He pointed out

Since Bitcoin’s price reached $ 4.9, Binens’s share of the marketplace has increased sharply and has now reached 2 percent.

Kevin Base, the largest US currency exchange, accounts for only 5 % of the total volume of transactions. The company recently witnessed a sharp decline in its revenue, leading to the fall of stock value and adjustment of its employees.

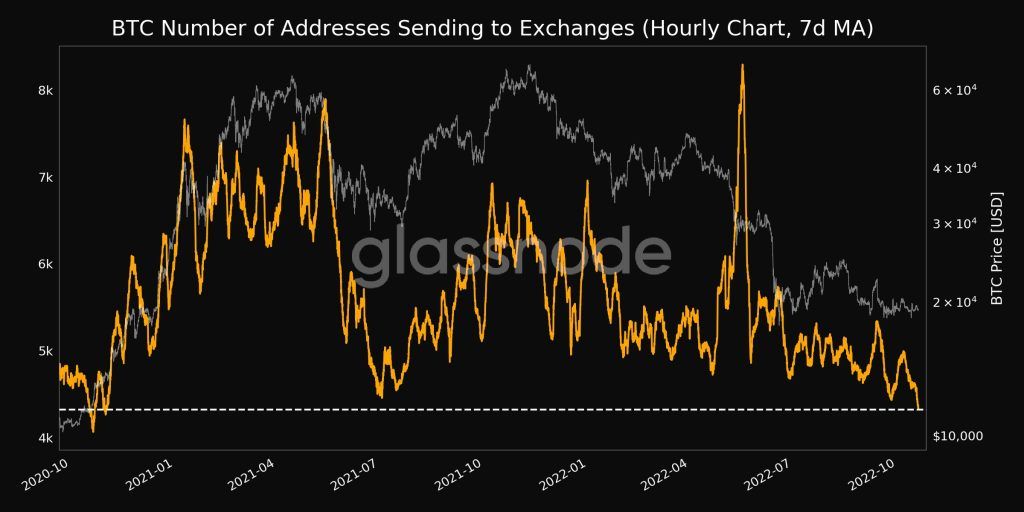

Despite the increasing volume of transactions, bitcoin inventory is declining. Glasnod has pointed out that the number of addresses that bitcoin send to the currency exchanges has reached its lowest amount in two years on Thursday. These data also confirm that bitcoin is in a severe accumulation.

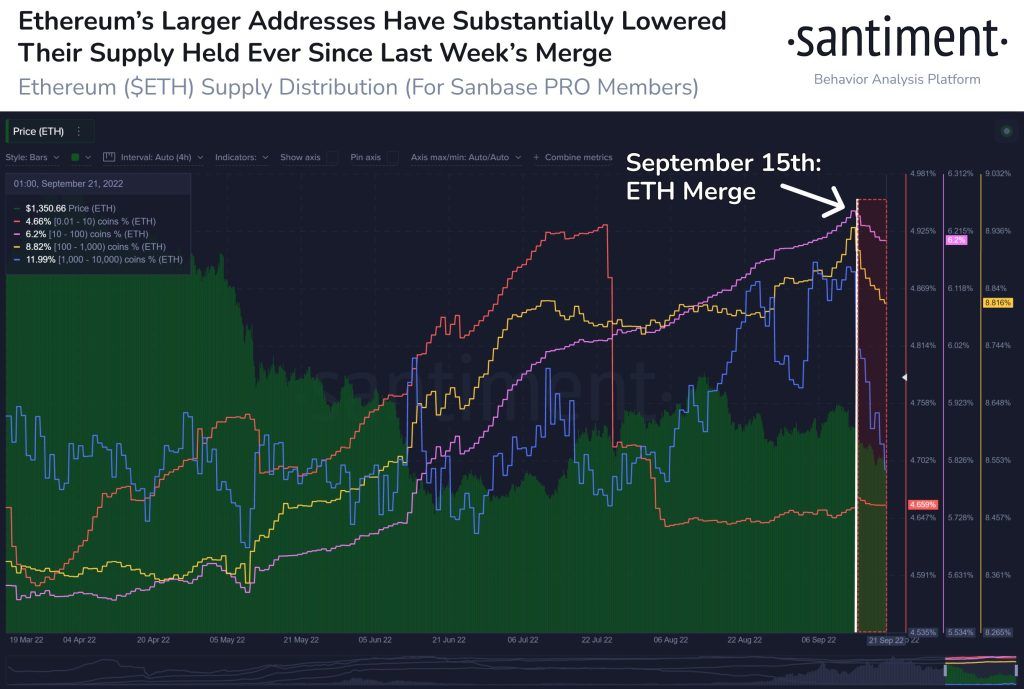

Great whales’ investment in Ethereum

Digital currency whales are also interested in Ethereum. Saintmont data shows that addresses that have at least one million dollars in inventory have bought more than 1.5 million units in recent months. These investors have invested $ 1.5 billion in Ethereum.

Ethereum inventory has declined in currency exchanges such as bitcoin. Increasing volume of token output from the exchanges against the input token to the currency exchange shows that the ethereum is also at the stage of accumulation.

However, how long the whales continue to accumulate both assets and whether the next rowing cycle begins after the end of this stage. At the time of writing this article, Bitcoin and Ethereum are trading at a price of about 2.5 percent in the past 7 hours, respectively, in the price range of $ 1.5 and $ 2.9.

RCO NEWS