The price of Bitcoin fell to $ 4.9 in November last year, after the FTX currency exchange bankruptcy. Now that the trial of Sam Bankman Farid, the founder of the currency exchange and he can be sentenced to more than 5 years in prison, we are witnessing that the digital currency has returned to the $ 1.2 billion. But can an increase in the likelihood of ETF approval, improving the United States economy, and future hooks make Bitcoin ready for a climb?

The deep and dark winter of the digital currency market began with the fall of the FTX currency exchange last November, along with the possibility of billions of dollars in customer capital and the suppression of the industry by lawmakers. One year after the accident, there is a place for 5 % of customer funds to return to FTX assets.

Increasing Usability and ETFs stimulus bitcoin price growth

It didn’t take long for Bitcoin to overcome the widespread fear in the digital currency market and was able to return to its position before the fall. This digital currency on January 2 was able to offset the whole decline in the price of the FTX crash.

Certainly the macroeconomic conditions have been involved in accelerating the improvement of Bitcoin prices, but the important role of the growing trend of China’s block -based applications cannot be overlooked. Jason Fang, a manager of Sora Ventures, said:

Surely speculation transactions will not make bitcoin prices reach $ 1.5 or $ 4.9, but its growth is due to the value of bitcoin in its applicability.

Fang, whose company is investing in the development of Bitcoin -based applications, believes that the rise in the price of the digital currency in the future will initially be due to technology. He noted that decentralization is part of Bitcoin’s advantages.

As long as Ethereum or other prominent layer solutions, such as Solana, rely on cloud service providers such as Amazon Web Service, there is a question of how decentralized they can be. Fang also points out that Ethereum and other projects rely on their foundations to develop their technology, which will be a big challenge if they have a problem.

He added.

These projects are focused on their technology and financing, so if one of the two has problems, they will be in trouble. But Bitcoin is funded by miners, who receives the reward, their incentive to support the network. This mechanism leads to a more profitable business for them. The Bitcoin path is unique and does not require adaptation to Ethereum, and this makes the narrative more powerful.

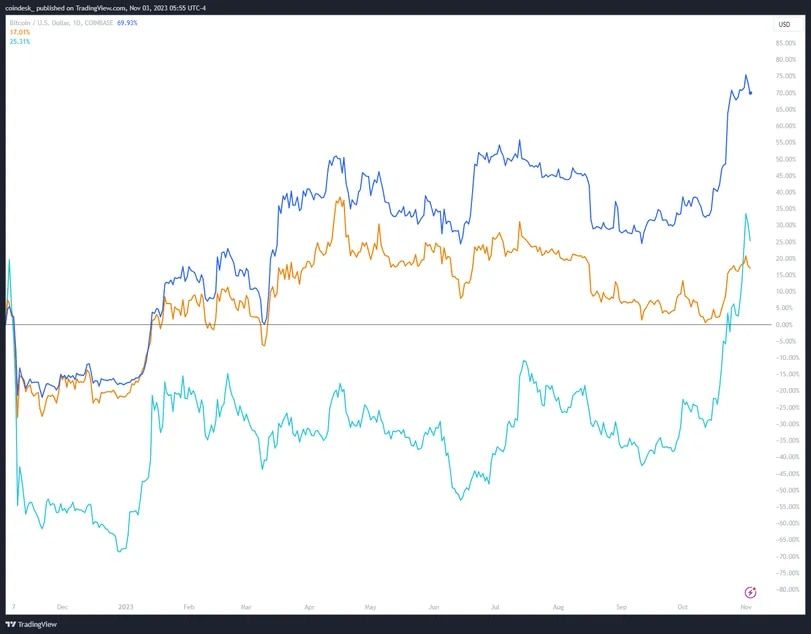

Of course, it cannot be said that Ethereum or Solana has done badly over the past year.

Ethereum prices rose by about 2 percent compared to last year and solena prices rose by about 2 percent. However, Bitcoin has seen a 5 % increase in its value. Lucy Hu, a senior metalpha (Metalpha) analyst (Metalpha), as a result of market expectations to confirm the request of Spath ETFs and the Federal Reserve Reduction.

He explained

Bitcoin prices will be determined in the short and medium term, with the approval of ETFs, a possible decline in interest rates by the Federal Reserve, increasing the upward emotions of institutional investors such as Micrustergia, as well as the Hawning event in the first half of next year.

Currently, the market expects that the Bitcoin ETFs licenses in the US market are likely to be approved in January (January), and many large names, including Blacklek and Fidellet, are preparing for this.

High volume of market transactions at the end of the year

An ETF, which seems to be a month away from its approval, and the increase in the interest of financial institutions in digital currencies has attracted the attention of traders.

The volume of transactions in the digital currency market was low most of the year, and Quinbis showed the issue by publishing its revenue report throughout the year. The volume of activity in the digital currency markets in September reached its lowest level in 2.5 years.

But then, in late October, we saw that the volume of transactions increased with the likelihood of ETF approval and the market ice melt. According to Kevinshir, digital currency investment funds registered the highest volume of weekly input capital in the past six months with $ 5 million by the end of October.

Fang said.

Bitcoin proved its flexibility, especially after the FTX currency exchange collapsed, priced at zero and showed that the Chinese block was not for fraud. Bitcoin has come to stay. On the contrary, many of the top 5 market token are still in their early stages of growth and have not faced a real downward market. However, Bitcoin is expected to survive the multiple recession and last for the long run.

RCO NEWS