The price of Ethereum yesterday reached the highest level of the historical update of The Merge at $ 1.2. As it turns out, numerous positive factors have been involved in the formation of this ascending mutation in the Ethereum market.

Ethereum is currently selling more than 2 percent in the past 7 hours at a price of over $ 2.9, according to Crypto Brifing. Prior to this, Ethereum had been trapped for more than a month for between $ 1.2 and $ 2.9. Although it is early to confirm the exit of Ethereum from this oscillation interval, this is the first time since the update of the digital currency at the price of these levels.

Yesterday’s mutation of Ethereum was probably partially affected by other financial markets. The S & P500, Nasdaq and Dow Jones stock indexes are all in green for the third consecutive day and have experienced growth of 0.5 %, 4.9 percent and 0.5 percent, respectively. The digital currency market has been closely linked to the US stock market for most days of the year. In mid -October, however, although all three of the three main indicators of the US Stock Exchange fell to their lowest levels of the year, digital currencies have shown more flexibility, and bitcoin and ethereum did not exceed the fluctuations in recent months.

Most importantly, the dollar index, which compares the value of the US dollar with a basket of national currencies in the world, has been reformed over the past few days. The index is now located on a level of 4.3 units after reaching its peak of 1.5 units on September 9, and there are signs of its reversal of its motion process on the chart.

Increasing the dollar’s power in world markets throughout the year, put a lot of pressure on the stock market, digital currencies as well as other world -renowned national currencies such as Euro, British Pound and Japan. It may now be reduced to the universal pressure that the dollar has created in global markets; Because the US Central Bank seems to have been more willing to slow down bank interest rates than in the past.

However, big factors are not the only thing that has advanced at the Ethereum during this time. The volume of open trading positions in future ethereum markets has grown dramatically in recent hours. According to the Delphi Digital Analytical Platform, yesterday, within an hour of about $ 5 million permanently, the Ethereum Future Contract was purchased at the Kevin Bass currency exchange and immediately after this large purchase of Ethereum from $ 1.2 to $ 1. $ 5 rose.

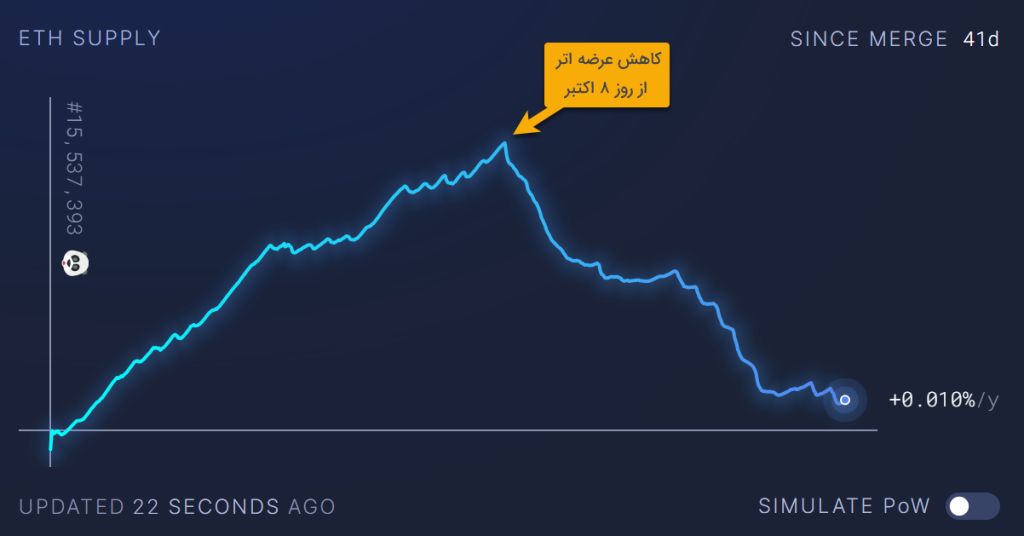

The next factor could be the reduction of the supply in Ethereum Tourism in recent days. According to the Ultrasound.money website data, even after changing the Ethereum network mechanism to prove stocks, the supply of this digital currency was increasing for some time; The new Ethereum Unit was added to the digital currency from the time of October 1 (October 1). However, from October 5, with the increase in the volume of intra -crop activities related to Ethereum, the Chinese monetary policy of the Chinese block has become an anti -inflicted form, and the supply of ether began to decline. It is worth noting that the supply of the Ethereum circulation has now been reduced to the same level that was recorded on the day of the presentation.

Also Read: An unknown project has made Ethereum an anti -inflation asset! What is the story of the token Xen?

RCO NEWS