Grid trading is a relatively new strategy for traders in the dynamic field of digital currencies, which was created to protect traders from sudden price fluctuations. This strategy enables traders to systematically make buy and sell trades within pre-defined price parameters at their discretion.

The underlying belief here is that asset prices will inevitably fluctuate within a certain range. By placing orders at different price levels within this predetermined range, traders can benefit from price fluctuations in both the up and down directions. Next, we will explain what grid trading is and how it can be used for trading.

What is the grid trading strategy?

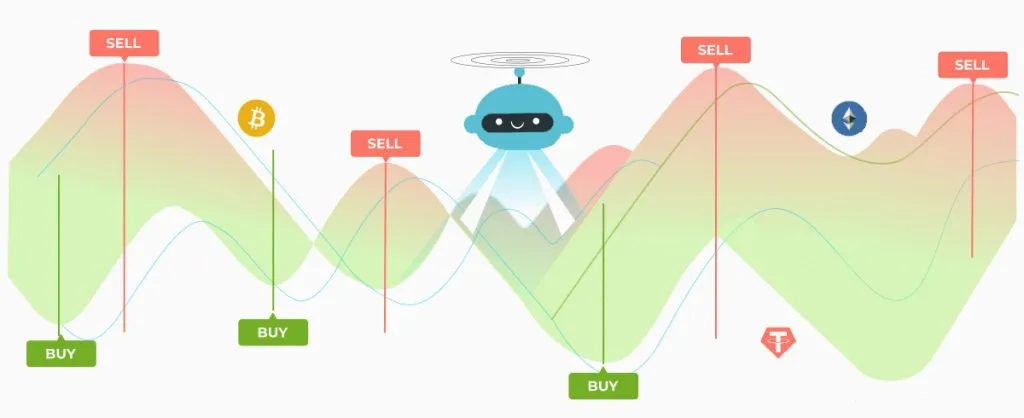

Grid Trading is a trading strategy that automates your trading using robots. This strategy allows you to pre-select the area where buy and sell orders will be executed. When the price falls to the low, buy orders are executed and when the price rises to the high, the asset is sold.

It creates a trading grid of orders that cover various market movements. In fact, traders set ranges based on the idea that the price of the asset will fluctuate within that range and then profit from the price movement up and down.

Types of grid trading

Grid trading in the digital currency market can be divided into two categories:

- Grid trading spot

- Grid trading futures

Each of these types has its own characteristics and risks. In the following, we will examine both types separately.

Grid trading spot

Grid trading spot strategy is considered relatively safer in the field of cryptocurrency trading. This strategy uses the balance of the trader’s wallet, as a result of which his trades are limited to the amount of available capital. The main advantage of the grid trading spot strategy is that it generates profits proportional to the invested capital.

Read more: What is spot trading?

In addition, this method has an inherent safety mechanism. If there are insufficient funds in the spot wallet, transactions will be automatically stopped. This method is especially popular among cryptocurrency traders who prefer to manage their risk conservatively.

Grid trading futures

A more complex and risky type of grid trading strategy involves its use in futures and leveraged trading. This approach allows traders to participate in larger trades than their available capital would normally allow.

Read more: What are futures?

While grid trading futures can potentially lead to higher profits, it can also increase the risk of illiquidity. Traders using this method should exercise caution and have a clear understanding of price movements in the cryptocurrency environment.

5 important components of grid trading

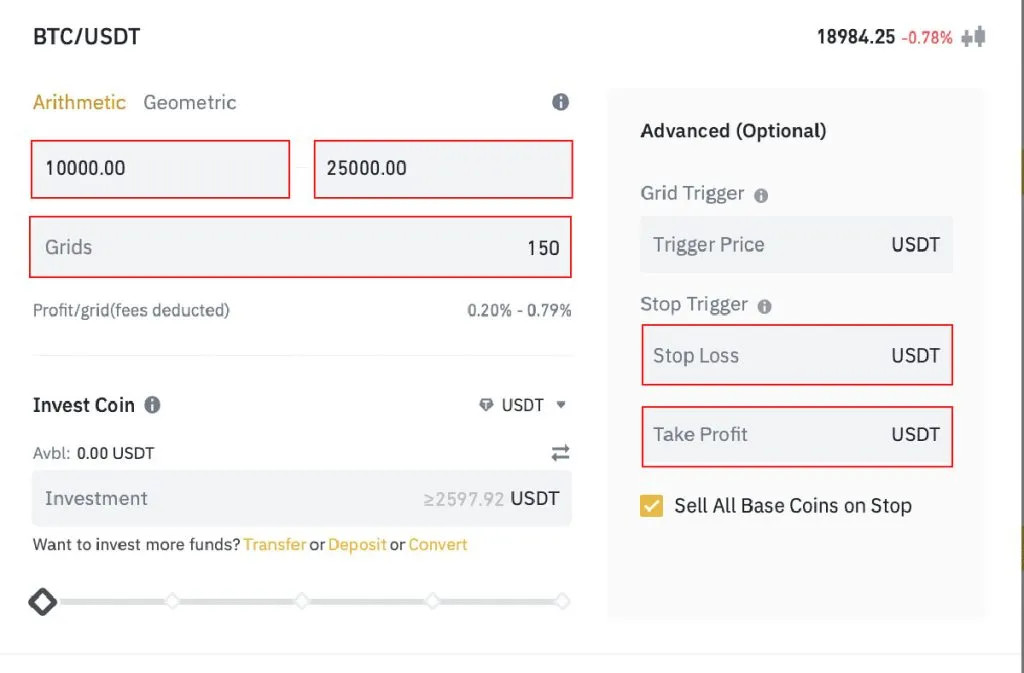

When using grid trading robots, it is very important to understand and adjust the key parameters. These parameters are largely the same across platforms, and the ability to adjust them is essential for greater success and profitability. Five important parameters for a grid trading strategy in digital currencies are:

- upper limit

- lower limit

- Number of orders

- profit withdrawal

- loss limit

upper limit

The upper limit determines the price ceiling for your strategy. No sell orders above this price will be sent by the robot. Obviously, the bigger the upper limit you have, the more profit potential you have in your trades.

lower limit

On the other hand, the lower limit shows the floor price of your strategy. The bot will not place a buy order below this level and is often set slightly above the stop loss as a risk management tactic.

Number of orders

The number of orders (Grid Number) indicates the total number of buy and sell orders in your strategy. You should know that the orders are evenly distributed. For example, with grade number 10, 5 buy orders and 5 sell orders are executed equally.

profit withdrawal

Take Profit determines the highest price at which you intend to sell your assets. Once the price of the cryptocurrency reaches this target, the bot will automatically execute sell orders and the profit will usually be converted into USDT or other stablecoins in your account.

Read more: What is a stablecoin?

loss limit

This parameter is the minimum price you are ready to accept for your transaction. If the price of the digital currency falls below this level, the stop or loss limit (Stop Loss) is implemented and causes the exit of the position to reduce the loss further. Consequently, stop loss applies to futures trading.

Read more: What is the limit of loss or stop loss

If you use futures and margin trading, it is necessary to use stop loss; Whether you trade with a grid trading strategy or trade yourself.

Read more: What is margin?

How does grid trading work?

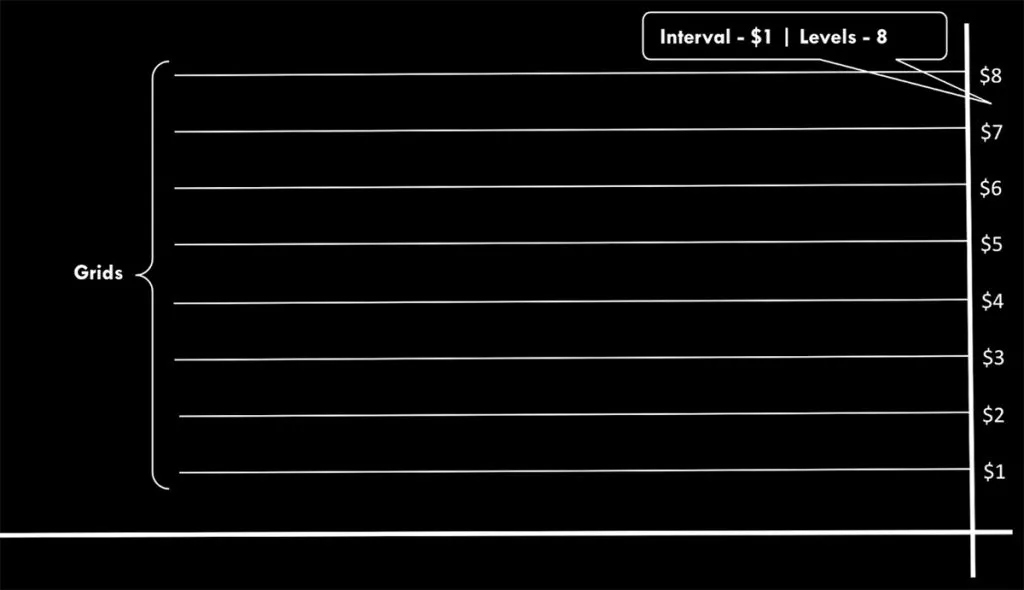

Grid trading is a process in which buy and sell orders are arranged at regular intervals. These regular and automatic orders can be set by creating a grid with different levels on the price chart.

For example, the chart below shows a price chart with different grids/levels with a $1 price gap between each level.

A grid is an area in which transactions are arranged. Note that the distance between each grid line is usually the same. Also, the smaller the intervals, the more levels there will be, and due to the increase in the number of networks, more transactions will be made, and vice versa.

Advantages of grid trading

The grid trading strategy in the cryptocurrency sector has several distinct advantages that make it a valuable tool for traders looking for a solution to the complexities and needs of the crypto market today. Below are some of the key advantages of this strategy.

Bottom entry point

Robots allow traders to enter positions at levels they would not normally be able to enter. This is because they have to constantly monitor prices to catch those lows. Similarly, bots can help them sell at the best possible price as well.

High level of automation

The underlying trading strategy for this type of trading makes sense. Robots can easily perform their tasks without being influenced by market sentiment or trends. This leads to efficient operation, as bots can operate independently of human emotions or market changes.

Advanced risk management

When using the bot, you can directly configure the settings to greatly affect your rewards and profitability. This in turn gives you more control and reduces the possibility of losing high risk trades.

Remove emotion from trading

Emotions such as anger, fear and greed are driving factors in investing, especially in the field of digital currencies. Using the grid trading strategy through trading robots minimizes emotional dependence; Because this process is done automatically and through logic and rules.

Disadvantages of grid trading

While grid trading in the crypto market has various advantages, it also has certain disadvantages that traders should be aware of.

Long waits for larger time slots

Large time frames require you to keep your position open for weeks or even longer. This will reduce profits in a volatile market. Patience is key in this scenario, but this strategy is generally more for smaller time frames.

The possibility of strategy failure if the trend is strong

For this strategy to be successful, there must be consistent pullbacks in the market. If the direction of the market is always the same, this type of market direction will only work against you and not only cause losses, but you will not benefit from the market trend and you will lose many opportunities.

Read more: What is Poolback?

Is grid trading profitable?

A grid trading strategy can be profitable, especially in markets with relatively small daily price fluctuations, such as those often seen in trendless movements common in the forex markets. This strategy revolves around evaluating the collective performance of multiple trades rather than focusing on individual trades. This strategy usually involves setting specific profitability targets for the entire network, such as achieving a return of 5% or 10%, ending trading once these targets are met.

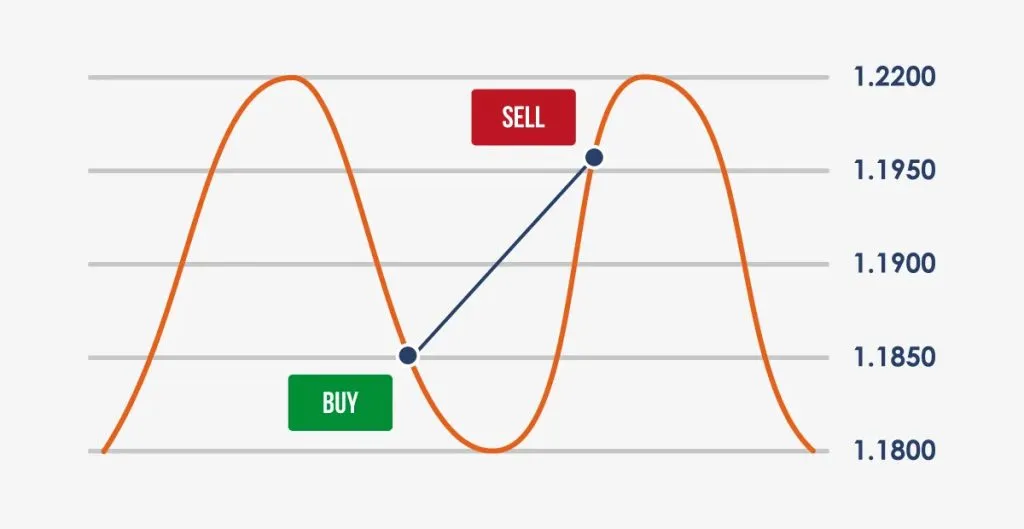

Grid trading bots can increase profitability by automating functions and reducing the chance of missing timely orders. However, profitability is conditional on price movement in a sustainable direction, as buy orders are set at low prices and sell orders are placed at higher prices.

As a result, the efficiency of grid trading is higher during periods of non-trending price movement, where rapid price increases may lead to early profits, while sharp price drops can activate stop-loss mechanisms and limit potential losses. In general, the profitability of grid trading depends on the market conditions and the effectiveness of strategy customization.

What is Grid Trading Robot and how does it work?

Grid Trading trading robots are designed to grow the account in the volatile digital currency market by trading quickly with price fluctuations. They do this by placing a range of buy and sell orders between two specific price points (high and low limit prices) set by the user.

Read more: What is a robot trader? Using a trading bot (Trading Bot) in digital currency trading

For example, let’s say you want the Grid Trading bot to trade the cryptocurrency Ethereum, which is currently priced at $3,000. Then, consider the ranges of $2,500 and $3,500 as the low and high limits and the $100 gap.

In this situation, the robot can buy or sell the asset at ten different price levels. When the price of Ethereum drops below $3,000, the bot buys the asset. If the price reaches $2,900, the robot will buy every time it touches this grid line and will continue to do so until the price drops to the $2,500 level. But if the Ethereum price falls below the lower limit of $2,500, the bot will stop buying.

Similarly, if the price rises above $3,000, the robot will sell the asset. Every time the price touches a grid line up to $3,500, it continues to sell and stops selling after the price rises above it. By doing this, the bot makes a profit; Because he has successfully bought the asset at a lower price and sold it at a higher price.

If the digital currency you want fluctuates a lot and its price moves within your desired price range, you can maximize your profit from this method.

Read more: What is the Ethereum currency?

summary

Grid trading strategy is a smart way to earn money while reducing risk; Like having a system that trades for you, which can help avoid mistakes and increase your profits. However, it is important to remember that this strategy also has its drawbacks.

Make sure your trading setup matches current market conditions, especially in non-trending markets. If your orders are set too far from the current price, you may be missing out on opportunities. But the good news is that as the market changes, you can readjust your strategy.

All in all, Grid Trading is an ideal option for beginners who want a structured way of trading.

RCO NEWS