To predict the future of Bitcoin price, different factors should be considered. Factors such as hawing, supply and demand, laws, the behavior of whales and large institutions, macroeconomic factors, etc. affect its price. There are various websites that have provided their predictions of the future of the king of digital currencies by using technical and fundamental indicators, exclusive algorithms and relying on the analysis of experts.

In this article from Aruzdigital, we first examine the opinion of websites and experts about the future of Bitcoin price. Then, by analyzing various criteria, we will examine the factors affecting the price of this digital currency and the profitability of buying BTC currency.

Bitcoin future price prediction from 2025 to 2050

With the victory of Donald Trump in the US presidential election race in 2024, the crypto market witnessed an increase in prices. Countries such as the United States, China, Great Britain, El Salvador and Ukraine have about 470,000 units of Bitcoin, which shows their belief in this financial market. In addition, countries such as Argentina, Singapore, Vietnam and the UAE have also shown their support for this technology. These factors can create a much brighter future for Bitcoin.

In the following section, we will examine the prediction of the Bitcoin price for 2025 to 2050 by CoinGape. These predictions are summarized in the following table:

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | 36/100,367 dollars | $47.216.109 | $85.383.114 |

| 2026 | 36/100,367 dollars | $12.703,129 | $04.934.138 |

| 2030 | $71.555,136 | $58.574,902 | $83.666,471 |

| 2040 | $29.123.2,303 | $58.2,410,693 | 2,651,174.63 dollars |

| 2050 | $38.107.38 | $13.3,307,788 | $58.3,454,010 |

Note that these predictions are related to the time of writing this article in December 1403 (late 2024). As market conditions change, the numbers reported on source websites may also change. To know the latest anticipated price changes, visit the respective websites.

Bitcoin price prediction in 2025

The analysis team of the Coingap site has considered a cautious scenario for 2025 by examining the history of the price of Bitcoin. According to them, the average price in 2025 will be in the range of $47.216. The minimum and maximum prices of this year have been predicted at the levels of 36.367 dollars and 114.383 dollars respectively.

Bitcoin price prediction in 2026

As Bitcoin continues to evolve, 2026 could be an important year for wider adoption and technological breakthroughs. As the ecosystem of cryptocurrencies matures, Coingap believes that the price of the king of digital currencies could reach $04.934 in that year. This year, the price floor is 36.367 dollars and the average price is 12.703 dollars.

Bitcoin price prediction in 2030

In 2030, which will be the end of a transformative decade, Bitcoin will prove itself as one of the important pillars in the crypto market economy. Relying on its infrastructure, which is the basis of its countless applications, this digital currency can reach a price ceiling of $83.666,471 and a price floor of $71.555,136.

CoinGap analysts have predicted an average price of $58.574,902 for the king of digital currencies in 2030.

Bitcoin price prediction in 2040

Although it is difficult to accurately predict the future price of digital currencies, Coingap analysts expect the price of Bitcoin to reach $2,651,174.63 by 2040. The floor and average price of this year are also predicted to be $29.293123 and $58.2410693 respectively.

Bitcoin price prediction in 2050

If the upward trend similar to the previous years is repeated, at the end of the 2040s and in the 2050s, there is a possibility of increasing the momentum and recording the historical ceiling of 3,454,010.58 dollars. However, Coingap analysts have predicted a floor of $38.107.38 for this digital currency in 2050. Therefore, the average price of the king of cryptocurrencies that year will be in the range of $13.3,307,788.

Bitcoin price history from the beginning to now

The price of Bitcoin has had many ups and downs since its birth in 2009, but it has maintained its upward trend. In the first years, few people hoped for the survival of this digital currency and saw the prices of 100,000 dollars for it. In this section, it is not bad to have a look at the evolution of the price of BTC during its 15 years of life.

2009 to 2013

Bitcoin experienced extreme fluctuations in its first decade of life. This digital currency was launched in 2009 by an unknown person or group under the pseudonym Satoshi Nakamoto. At the time of its birth, this currency had no value and we can say that its price changes started in 2010.

The first important Bitcoin transaction that took place for the purpose of payment was the purchase of two pizzas for 10,000 BTC by a person named Laszlo Hanyecz. These pizzas cost only $42 at that time.

By February 2011, the value of Bitcoin reached $1, meaning that those 10,000 units of the currency were now worth $10,000. In June of that year (July 2019), the price of the crypto king reached $31, but in November 2012 (February 2019), it fell to $2.

Later in 2012, the market rose again and with the emergence of more digital currency exchanges established to buy and sell Bitcoin, its price rose above $13. The first halving also happened in November 2012 and in 2013 we saw the creation of another bull run. Bitcoin ended 2013 at $1,100.

2013 to 2017

In mid-2013, developers launched another digital currency, which is now called altcoin. In 2015, the first cryptocurrency after Bitcoin was born and its name was Ethereum.

Unfortunately, the bull run didn’t last and the crypto market’s upward trend ended with the hacking of the Mt. Gox exchange in 2014, which handled more than 70% of Bitcoin transactions. In this hack, 850,000 BTC units were stolen, causing this digital currency to end the year at a price of around 315.

However, with the occurrence of the second halving in 2016 and the increase in people’s awareness of the great potential of investing in it, the price of this digital currency also rose again. Bitcoin ended the year near $1,000.

Read more: The story of the Mt.Gox exchange hack, the biggest theft in Bitcoin history

2017 to 2021

2017 was the time when the market flourished; In line with the historical Bitcoin price pattern after the halving that we have seen so far, the market turned bullish again. This digital currency reached its new historical ceiling of 20,000 dollars in December of that year.

Unfortunately, like previous cycles, the bull run ended in 2018. Bitcoin touched the $3,200 level at the end of that year. However, markets started to rise again in 2019. With the increasing interest of traders and investors in digital currencies, the price of this digital currency crossed the $7,000 mark and reached over $10,000 in February 2020.

The sharp fall of the markets in March 2020 (Esfand 98) after the start of the Corona epidemic brought this currency back below the level of $4,000. Despite this, after the third halving in May 2020 (May 99), the market turned up again.

Bitcoin started the year 2021 at a price of $29,000 and within a few days it reached above $40,000 and in March of that year (March 99), it climbed to $60,000. The second largest historical ceiling in the range of $68,000 was also recorded in November 2021 (Aban 1400). Part of these gains was due to the launch of the first Bitcoin futures ETF called ProShares Bitcoin Strategy in October of that year (1400).

Read more: What is a Bitcoin ETF?

2022

As the Federal Reserve Bank of the United States begins raising interest rates in early 2022 with the aim of reducing liquidity, the value of the US dollar increased and stocks of technology companies turned negative; The same issue led to pressure on investments in Bitcoin and other digital currencies.

Read more: What is the US interest rate? Introducing the best interest rate prediction sites

Additionally, the collapse of the Terra Luna ecosystem in May shook confidence in the digital currency and dropped the price from around $39,000 to $20,000. After that, the market entered a period of extreme bearish sentiment known as the “crypto winter”. Although the market recovered to the $22,000 level again, the collapse of the FTX exchange in November of that year once again dampened traders’ sentiments and pushed the price below $16,000.

Read more: Know the 6 biggest cryptocurrency crashes

2023

Fortunately, in 2023, with the end of the bear market, the price of Bitcoin increased by more than 150%. In the first quarter of that year, the price went from about $16,500 to $24,500. However, due to the instability caused by the collapse of traditional crypto-friendly financial institutions such as Silicon Valley Bank, as well as the liquidity problems of companies such as Silvergate Capital, the extreme price volatility remained strong.

Following these events, the price briefly fell to the $20,000 level, but the market recovered after the world’s largest asset management company, BlackRock, submitted an application to launch a spot bitcoin ETF in the United States.

With the approval of this request approaching at the end of 2023, which had been rejected several times before by lawmakers, the price of this currency crossed the $44,000 mark in December (Azer 1402).

2024

Bitcoin started 2024 at around $42,000. With the approval of the first Bitcoin spot ETF in January (Dec 1402) and investors predicting a repeat of similar cycles following the fourth halving in April 2024 (May 1403), prices started to rise again.

Examining the historical cycles shows that usually after the halving, the price of this digital currency spends more than 100 days in a certain range, and then its powerful upward movement begins. The 180-day period after the halving ended in late October and rose as predicted in early November, reaching an all-time high of $47.103,900 in a short period of time.

The price of this currency increased by more than 25% after the re-election of Donald Trump as the President of the United States on November 5. The new Trump administration is seen as a crypto-friendly government compared to the administrations of Joe Biden and Kamala Harris. One of the reasons for this is the advisory role of Tesla CEO Elon Musk in the new Trump administration.

Trump has also suggested that the new administration adopt friendlier policies towards digital currencies. The creation of a national strategic bitcoin reserve and the appointment of financial supervisors with a positive view of this area are some of these policies.

With the victory of Donald Trump in the 2024 US presidential race, the crypto market witnessed a significant growth. Countries such as the United States, China, the United Kingdom, El Salvador, and Ukraine have about 470,000 BTC at their disposal, which shows their belief in this valuable currency. In addition, countries such as Argentina, Singapore, Vietnam and the UAE have also shown their support for this technology. All of these factors could make for a much brighter outlook for Bitcoin.

The future of Bitcoin digital currency price from the perspective of analytical websites

In addition to the Coingap website, which we mentioned at the beginning of this article, there are other analytical sites that use proprietary algorithms, artificial intelligence, and technical and fundamental indicators to predict the future price of digital currencies. In this section, we examine these predictions.

Coinpedia

If everything goes according to Coinpedia’s prediction, we should expect a $610,000 Bitcoin by 2030:

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | $85,000 | $127,023 | $169,046 |

| 2026 | $111,156 | $152,031 | $192,907 |

| 2027 | $138,697 | $189,127 | $239,558 |

| 2028 | $174,662 | $261,222 | $347,782 |

| 2029 | $201,355 | $330,361 | $459,368 |

| 2030 | $238,152 | $424,399 | $610,646 |

Kevin Children’s

CoinCodex is a site known for its cautious predictions. However, with the help of technical indicators, expect the price of BTC to rise above $200,000 by 2030:

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | $104,746 | $149,340 | $177,384 |

| 2026 | $97,642 | $111,506 | $143,092 |

| 2027 | $77,111 | $87,202 | $114,624 |

| 2028 | $76,257 | $104,901 | 139,061 dollars |

| 2029 | $136,962 | $240,635 | $305,028 |

| 2030 | $162,955 | $228,591 | $287,841 |

block dog

The BlockDag site has presented its prediction of the future price of BTC as follows:

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | $101,204.13 | 39/110,211 dollars | $64.218.119 |

| 2026 | $133,957 | $138,780 | $163,464 |

| 2030 | $162,955 | $228,591 | $287,841 |

| 2040 | $438,248 | $677,460 | 1.19 million dollars |

| 2050 | 1.4 million dollars | 1.77 million dollars | 1.2 million dollars |

Chanjli

Changelly is also one of the most popular websites for analyzing and predicting the future price of digital currencies. Based on the expectations of the analysts of this site, we will probably see Bitcoin at $700,000 by 2030 and $3 million by 2050:

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | $100,206.69 | $116,380.02 | $108,293.36 |

| 2026 | $133,957 | $138,780 | $163,464 |

| 2030 | $645,119 | $668,343 | $774,474 |

| 2040 | $2,693,654 | $2,845,409 | $2,940,256 |

| 2050 | $3,414,491 | $3,699,032 | $3,888,726 |

Crypto News

Unlike the other websites we have reviewed so far, CryptoNews believes that Bitcoin will reach $3 million by 2030 with a very optimistic forecast.

| year | Potential price floor | Average price potential | Potential price ceiling |

| 2025 | $54.887.126 | $44.217.160 | $35.547 |

| 2026 | $83.365.167 | $63.487.262,487 | $02.378,923 |

| 2027 | $83.568.214 | $10.410,793 | $700,409.09 |

| 2028 | $95.209,267 | $28.139,613 | 1,219,252.39 dollars |

| 2029 | $27.323,034 | $33.871,323 | $70.1,993,376 |

| 2030 | $21.378,850 | $12.176,788 | $11.3,051,796 |

Bitcoin price predictions by famous people

Crypto market traders and investors also follow the predictions of famous figures such as Peter L. Brandt, Cathie Wood and others. Therefore, in this section, it is not bad to have a look at the opinion of these people about the future of Bitcoin.

Read more: Who are the popular faces of digital currencies?

Bitcoin price prediction by Hal Finney; 10 million dollars

In January 2009, when Bitcoin was just born, Hal Finney was among the first to receive a Bitcoin transaction from Satoshi Nakamoto. He was among the constant supporters of the king of the crypto world. Hal Finney believes that if this digital currency can become a legal currency and govern the global payment system, its value will theoretically be equal to the entire capital of the world.

For his prediction, Mr. Finney used the value of global wealth, which was estimated between 100 and 300 trillion dollars, and said that considering the maximum supply of 21 million units, its price could reach 10 million dollars. In his conversation with Satoshi Nakamoto, he wrote:

As an interesting thought experiment, imagine that Bitcoin succeeds and becomes the dominant payment system worldwide. In this case, the total value of this currency should be equal to the total value of the wealth in the world. According to current estimates, the total wealth of the world’s households is estimated between 100 and 300 trillion dollars. Given the limited supply of 20 million coins, each bitcoin should be worth approximately $10 million.

Bitcoin price prediction by Peter Brent; 200 thousand dollars

Peter Brent, an expert trader and the author of the Market Wizard series of books, in February 2024 (Bahman 1402) tweeted with an analysis of the 15-month Bitcoin channel: ) ends, increased from $120,000 to $200,000.

He also wrote in another tweet about the price until the delivery date of 2025, that we will probably see the level of 125 thousand dollars.

Bitcoin price forecast by Chamath Palihapitiya; 500 thousand dollars

Chamath Palihapitiya, one of Bitcoin’s early investors and renowned venture capitalist, sees Bitcoin as not just a cryptocurrency, but a potential global reserve currency that is distinct from traditional national systems.

In one of the episodes of the All-In podcast on May 31, 2024 (11 June 1403), he predicted that the price of the king of digital currencies will reach 500 thousand dollars by October 2025 (October 1404).

Bitcoin price forecast by Jurin Timmer; 1 million dollars

Jurrien Timmer, head of Fidelity’s Global Macro fund, said that the price of Bitcoin will reach $1 million between 2038 and 2040.

Mr. Timmer has used a demand model based on Metcalfe’s Law for this prediction. This law says that the value of a network financial asset is equal to the square of the number of users of that network. Emphasizing network effects, this law applies mostly to technologies such as the Internet and social media. However, Mr. Timmer believes that this law can also be applied to Bitcoin.

Bitcoin price forecast by Kathy Wood; 1.5 million dollars

Following the approval of 11 spot bitcoin exchange-traded funds, including the ARK 21Shares fund, in January 2024, Cathy Wood, CEO of Ark Invest, spoke of her optimism for the future of the BTC price. In an interview with CNBC, he said that the price of this digital currency is likely to reach $600,000, and there is even a potential of $1.5 million in more optimistic market conditions.

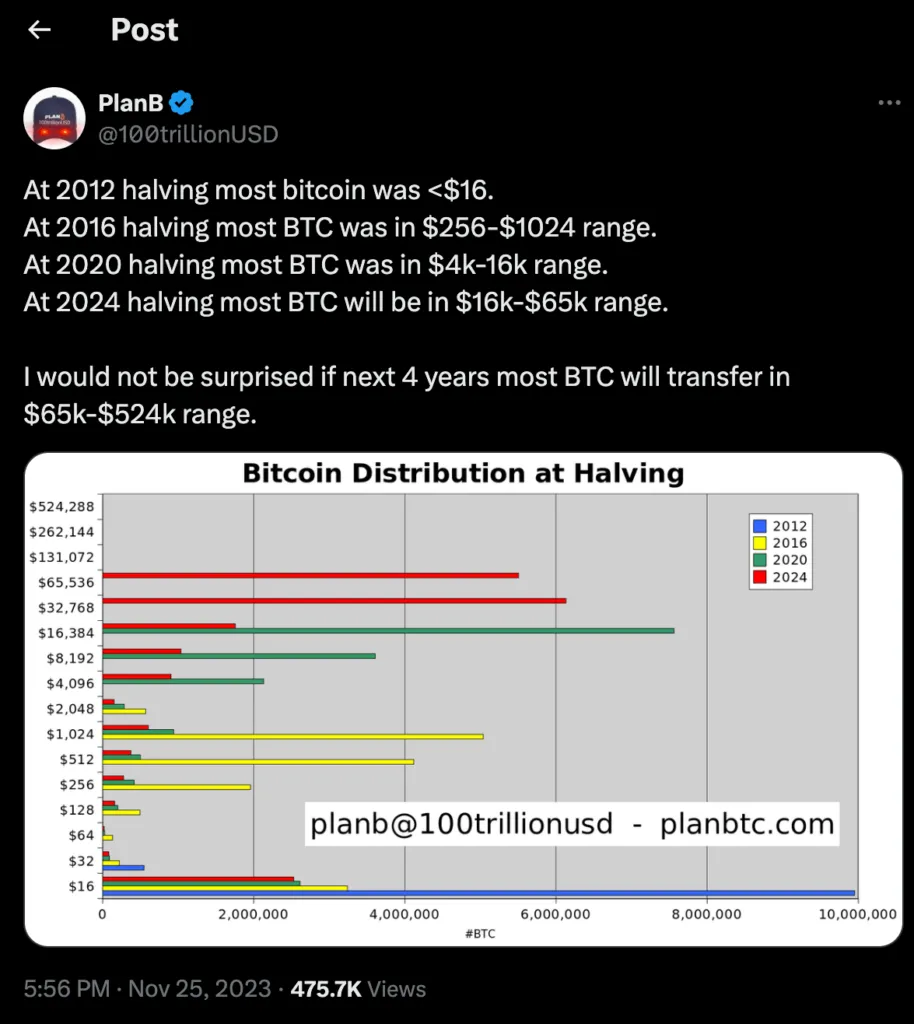

Bitcoin price prediction by Plan B; 524 thousand dollars

You must know PlanB because of his famous Accumulation to Flow (S2F) model. Based on this model, which has been proven to be correct until today, this user wrote in a new tweet, referring to the previous halvings of Bitcoin, “I will not be surprised if you see the price of Bitcoin trading between 65,000 and 524,000 dollars in the next 4 years.”

Bitcoin price prediction by Arthur Hayes; 1 million dollars

Arthur Hayes, the former CEO of the Bitmex exchange and one of the most controversial figures in the crypto market, wrote in a post on Twitter that:

At this point in time, there is no excuse for not longing digital currencies. How many more times do you have to be told that the fiat in your pocket is a piece of dirty junk? Have faith in our Lord and may He free you from bondage.

Bitcoin price = 1 million dollars

What is Bitcoin?

Bitcoin (Bitcoin) is a blockchain network and has a cryptocurrency with the symbol BTC, which is centralized as money and a form of payment between individuals, groups and institutions without the intervention of an individual. This feature eliminates the need for the presence of a trusted third party such as a bank in the transactions of this currency.

This cryptocurrency was born in 2008 by an unknown person or group of people with the pseudonym Satoshi Nakamoto. Since then, Bitcoin has been one of the most recognized and valuable assets in the crypto space. To learn more about this digital currency, we recommend reading the following article:

Read more: What is Bitcoin? A comprehensive guide to understanding Bitcoin

Factors affecting the price of Bitcoin

There are various factors that affect the price of BTC. The most important factor is the supply and demand system. This currency is known as a rare and anti-inflationary asset due to its limited maximum supply of 21 million units and halving events. Even assuming that demand remains constant over time, a decrease in the supply of new coins will result in an increase in price.

Other intra-chain factors such as mining difficulty and whaling activity also affect price trends. With the high volume of this digital currency, whales have the power to move the price with several buy or sell orders. As more miners enter the network, the difficulty of mining bitcoins also increases, which ultimately leads to a decrease in miners’ income. In this case, small miners sell more of their bitcoins to compensate for their costs, which ultimately affects the supply and demand process.

In addition to internal factors, external factors such as laws and policies of countries, macroeconomic variables such as soft interest rates and inflation and actions of central banks, news and rumors about this digital currency all affect investors’ feelings towards the future and cause price fluctuations.

What is the bitcoin cycle?

The Bitcoin cycle is a recurring pattern of market behavior with relatively distinct ups and downs. Influenced by various factors such as market sentiment, regulatory changes, technological developments and the broader global economy, these cycles involve periods of buying and selling.

Historically, this currency has 4-year cycles that occur due to halving. In each halving event, the reward for mining this currency is halved, which affects the speed of supply of new coins. Usually, after 100 to 180 days after each halving, its main price growth begins.

The fourth halving event of this currency took place in April 2024, which increased the block mining reward to 125.3 units. The next event is planned for April and May 2028.

Read more: What is bitcoin halving in simple words

Is it worth investing in Bitcoin?

As the largest digital currency by market capitalization, Bitcoin holds a large share of investments. Therefore, short-term and long-term investment opportunities on this digital currency should not be ignored. According to the price predictions we presented in this article, this currency will have a much higher price growth in the coming years.

The increase in values over the past years has also accentuated the role of the king of digital currencies as an “inflation hedge”. Therefore, it can be considered as a way to preserve capital value.

However, the crypto market is famous for its extreme fluctuations, which can bring heavy losses along with high profits. Therefore, before investing in cryptocurrencies, you must do your own research Do thorough research and use risk management techniques to avoid losses.

Is it safe to invest in Bitcoin?

The safety of investing in Bitcoin should be examined from various aspects such as government legislation and the involvement of individuals in its management, security issues of storage and the uncertainties of the crypto market.

In terms of legislation, it should be said that there is no specific global framework for this digital currency. Each country, depending on its policies, has applied certain rules on the transactions of this currency. But due to its decentralized nature, you can be sure of the security of its transactions because no country has a role in its management. Bitcoin is powered by blockchain technology, which is known for its transparency and is not controlled by any central authority.

But in terms of security, it all depends on you. When storing bitcoins in personal wallets, you are responsible for keeping the recovery phrase safe. Regarding crypto exchanges and DeFi protocols, you should also check their security and validity before choosing the desired platform.

Regarding the uncertainties of the crypto market, it should be said that investing in Bitcoin is not the same as buying shares of stock companies that have criteria such as profitability, tangible assets, cash flow and other things to measure its value. For this reason, we mostly see extreme price fluctuations for this cryptocurrency, which can affect the “safety” of investing in it.

Is it too late to buy bitcoin?

At first glance, the growth of Bitcoin to levels above 100,000 USD seems very difficult, but the history of this digital currency has proven otherwise. Of course, although 2025 has the potential for attractive profits, newcomers to this market should also keep in mind that the best opportunities usually emerge in quieter and slower market cycles. Current BTC price levels indicate that we are nearing the top of this bull market. Therefore, if history repeats itself, a bear market and falls of several tens of percent compared to the price ceiling will be on the way.

Is it too late to buy Bitcoin now that we are at the beginning of 2025? Can’t answer with certainty. If you are looking for quick and several hundred percent profit, you can choose other digital currencies. However, any drop in the price of Bitcoin can be a good buying opportunity, but at the same time, you should also recognize when to exit the market and start a bear trend.

If your intention is to invest in Bitcoin with a long-term goal, you will not have to worry much about its prices falling. The king of digital currencies is a unique and rare asset that will increase in value as it approaches its maximum supply of 21 million units. In addition, we still do not have anything like the decentralized network of Bitcoin and its high security in traditional financial systems, and even different countries such as the United States are trying to increase their share of the circulating supply of this digital currency.

Frequently asked questions

Considering Bitcoin’s position as the king of digital currencies and the view of many countries like the United States, buying this currency can be considered a good investment opportunity.

If history repeats itself, I will have to wait until 2030 for a $200,000 Bitcoin.

According to the prediction of various analysis websites, we should wait for Bitcoin at 500 thousand dollars by 2030. Some well-known crypto figures have also predicted prices of $1 million for this digital currency by 2030.

Summary

Bitcoin’s price history shows increasing investor confidence and wider acceptance of this digital currency among small and large traders. Each four-year halving cycle reduces the supply of new coins, while demand continues to increase. Other factors such as macroeconomic variables, government policies and mining also affect the future price of Bitcoin.

There are various experts and analytical websites that have predicted the future price of Bitcoin for the coming years such as 2025 to 2050 with the help of technical indicators, algorithms and artificial intelligence tools. Studying these predictions will help you get a comprehensive view of what other people active in the crypto market expect about the future of BTC. Of course, you should never invest in digital currencies by relying solely on the prediction of a person or group. Before doing this, be sure to do your own thorough research and educate yourself on risk management techniques.

RCO NEWS