Data from the latest Solidus Labs report on rag money scams estimates that 8% of all Ethereum network tokens and 12% of BNB China tokens are scams; A significant figure that has affected nearly 2 million investors in 2022.

According to CryptoSlate, in this report, Solidus Labs takes into account data from January 1st to December 1st, 2022 (January 11, 1400 to December 10, 1401) and also shows that more than $11 billion of Ethereum transactions were directly related to fraudulent tokens. Or they were part of the money laundering process of money laundering.

According to this data, Solidus Labs estimates that 8% of all Ethereum tokens are programmed to run rogue money.

Assessing the amount invested in these tokens, the report also shows that BNB China hosts the largest number of fraudulent tokens, accounting for 12% of all tokens in the network.

Also read: How to identify RugPull projects?

117,629 fraud tokens in 2022

The report confirms that research conducted in the cryptocurrency industry has identified 24 rogue money cases in 2021 and 262 cases in 2022. However, Solidus Labs Threat Intelligence smart contract threat scanning tool has detected more than 200,000 fraudulent tokens between September and December 2020.

This tool has identified 83,268 fraudulent tokens between January and December 2021 (December 99 to December 1400). The number of these tokens recorded a 41% increase in the first 11 months of 2022 and increased to 117,629.

A more widespread damage than the collapse of FTX and Terra

Solidus Labs has compared the impact of these fraudulent tokens to major events of 2022, including the crash of Terra that initiated the bear market, as well as the collapse of the FTX exchange.

The results of this report indicate that 1.93 million investors have lost their capital due to fraudulent tokens. This number is more than the total number of investors who were affected by the collapse of Terra and FTX.

Regardless of the impact of fraudulent tokens, the FTX exchange crash has had the biggest impact on the cryptocurrency industry, affecting more than a million investors. The Celsius and Blockchain bankruptcies are in second and third place, affecting 600,000 and 572,000 investors, respectively.

Considering the importance of these numbers, Terra’s collapse almost seems like a minor crisis, as it only affected about 40,000 investors. Of course, the consequences of the collapse of the Terra network cannot be underestimated just by citing these statistics.

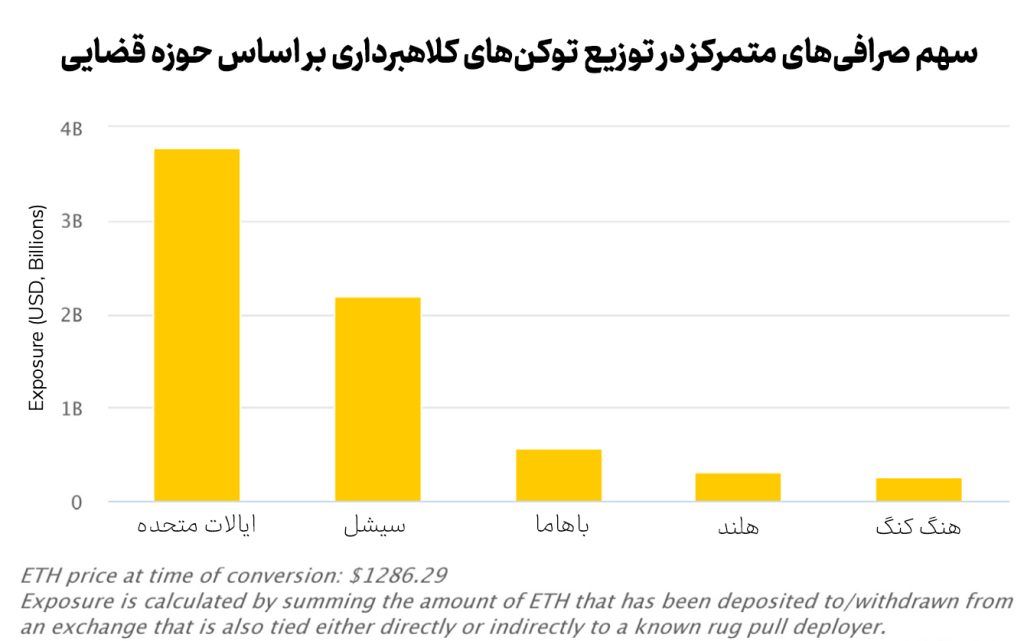

The share of centralized exchanges

According to this report, 99% of these fraudulent tokens are not detected using common approaches. These frauds have preferred to be based in centralized exchanges and have managed to deposit and withdraw funds from 153 different centralized digital currency exchanges.

Also, this report provides a breakdown of the exchanges in question. According to this data, centralized exchanges based in the United States accounted for the largest share of fraudulent tokens with about $3.75 billion.

Seychelles, located in the east of the African continent, is in second place with just over $2 billion, while the Bahamas is in third place with $500 million.

RCO NEWS