DeFi or in other words Decentralized finance As a growing financial movement, it has the potential to bring fundamental changes to the global financial system. As this technology expands and develops further, we can expect that DiFi will become an integral part of Digital economy converted and Earn money from DiFi to become widespread in the near future. Therefore, entering DeFi is not only an opportunity to earn money, but it can also allow you to play a role in shaping the future of the financial system.

With these interpretations, it can be said that the field of Difai is being revived in 2024 and as a Investment opportunity It is interesting. These developments clearly show that the DeFi sector is gaining momentum, offering potentially lucrative opportunities for investors curious about how to monetize DeFi. This article intends to review Current ways to make money from DeFi and provide insights on how to get the most out of this space, so stay tuned to the end of this article.

Why should we make money from Difa?

In a world where access to traditional financial services is limited to a select few, DeFi has changed the game by creating equal opportunities for all. These platforms allow people from all walks of life to participate in the growing economy of digital currencies and Create passive income streams by investing in DeFi.

Defy Ba Removal of intermediariesIt has reduced transaction costs and significantly increased the speed of transactions. This allows users, even with small capitals, to operate in the global financial markets and benefit from its potential profits.

Read more: What is DiFi? Introduction to DeFi or Decentralized Finance in plain language

DiFi also offers a wide range of financial instruments such as Lending, borrowing and profiting from digital assets which can be very useful for people living in areas with economic instability. Argentinians, for example, have turned to defi to escape hyperinflation and protect their assets from depreciation.

Comparison of income generation opportunities in DeFi and traditional financial services

In the traditional financial world, investments are controlled by companies, and individuals must trust these companies to manage their assets properly. But in decentralized finance People have full control over how and where they invest. This level of control allows investors to adjust their risk and return ratio based on their preferences and create more diversification in their investments.

Another advantage of DeFi over traditional financial services is Easy access without the need for lengthy authentication processes is Unlike traditional systems that often require identity verification and KYC processes, anyone with internet access can enter this market.

Also, one of the most important differences between DeFi and traditional financial services, Availability and transparency is In DeFi, anyone can access the code of smart contracts and check their performance. This transparency assures users that their assets are managed in a secure and transparent manner. In contrast, in the traditional financial system, information about investments is often not available to the public, and this can reduce investor confidence.

In addition, DiFi allows users to Access your assets at any time and from any place and do their transactions. Meanwhile, in the traditional financial system, access to financial services is usually limited to specific business hours and locations.

What are the methods of making money from Defay?

In the world of DeFi, there are many opportunities for Earn passive income there is These methods allow you to earn money using your digital currencies, without the need for intermediaries or centralized entities. In summary, the common methods of making money from DiFi are:

- staking or staking;

- lending;

- liquidity provision;

- yield farming or profit cultivation;

- Receive airdrops.

In the following, we will explain each of these cases.

staking

Staking or the same investment In the world of DeFi it means Locking digital assets into a smart contract allows users to earn money over time. This process can be compared to opening a savings account in traditional banks; With the difference that in DiFi, your balance increases in the form of tokens.

There are two main types of staking in DeFi: Proof of Stake (PoS) Staking and Incentive staking. In proof-of-stake staking, users are rewarded by holding a certain number of tokens and validating transactions.

But in incentive staking, DeFi platforms offer rewards to users to encourage them to lock up their assets for a long period of time. The longer the assets are locked, the higher the reward will be. This method helps the platforms to have more stable liquidity and also gives users the opportunity to earn more money.

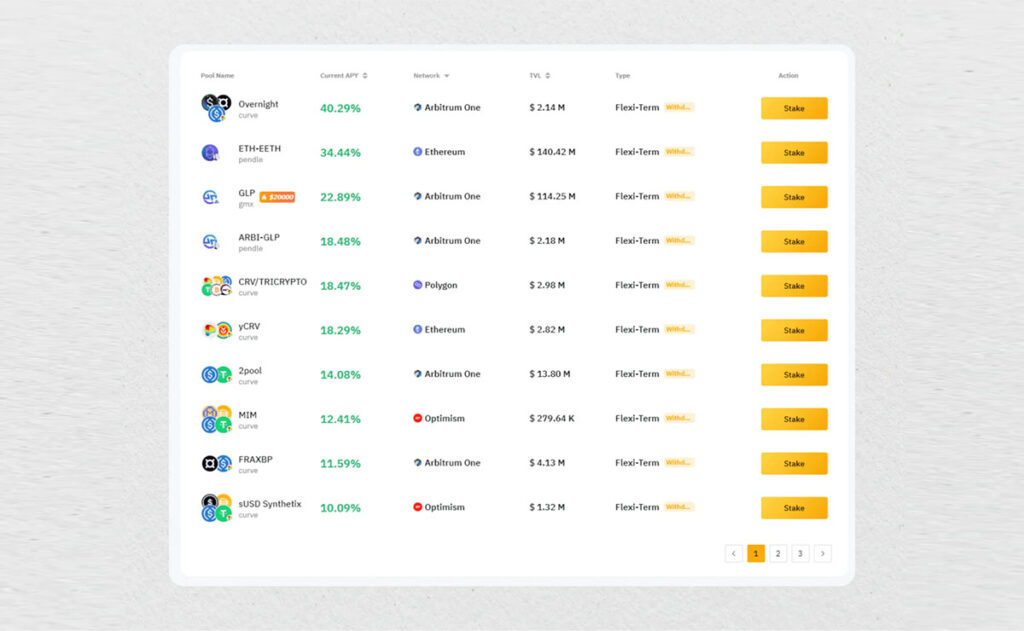

Although staking’s rate of return (APY) varies on different platforms and for different assets, in general, these rates in DeFi are usually higher than in traditional financial systems. For example, some platforms offer returns of up to 20% or even more, while rates of return in traditional finance are typically lower. Valid platforms such as centralized exchanges Binance and Coinbase and decentralized exchanges Uni swap and pancake swap They are one of the best options for staking and making money through DiFi in 2024.

Lending

In the traditional financial world, Lending and borrowing They are the basic foundations of the economic system. These concepts have been successfully implemented in the DeFi world as well. Using lending protocols, users can lock their digital assets in smart contracts and lend to others and earn a profit in return.

The process is done in such a way that users lock their assets in a platform, borrowers receive these assets as loans and pay interest to the platform. This profit is then distributed among the lenders based on the amount of their foreclosed assets.

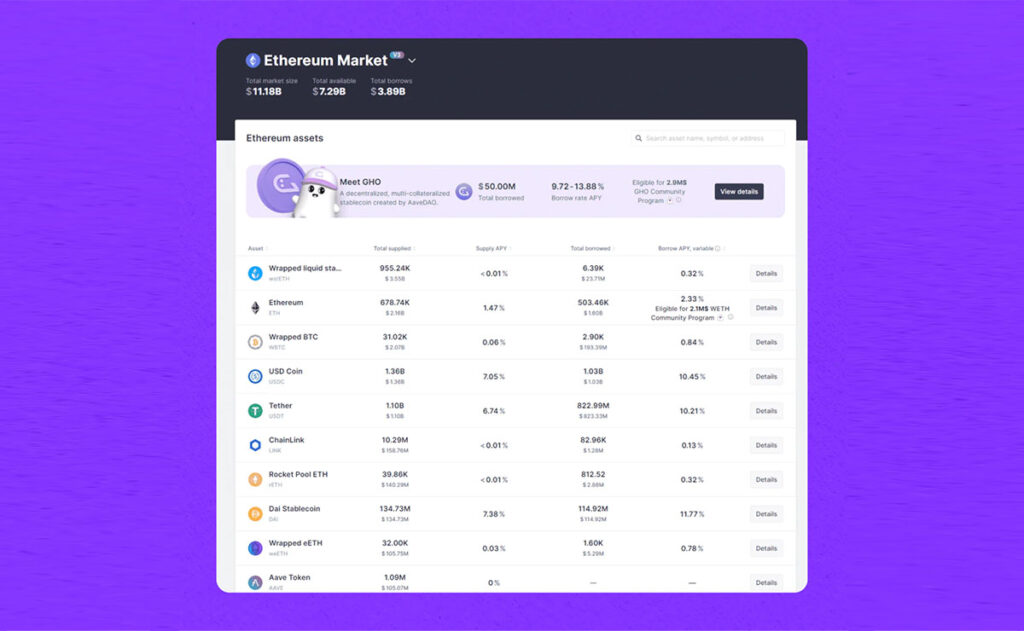

Annual interest rates on DeFi lending protocols can range from 1% to more than 20%, indicating a high potential for passive income generation in this area, especially compared to traditional bank accounts that have much lower interest rates. One of the important advantages of lending on DeFi is reducing the risk of default, because borrowers must provide collateral equal to or more than the loan amount to receive a loan, and smart contracts guarantee the repayment of interest from these collaterals.

Some of the best DeFi projects for lending include platforms such as Compound Finance, Aave, Maker and DYDX and are

Liquidity Provision

Providing liquidityis another way to earn passive income in DiFi. This method involves participating in decentralized exchanges to create liquidity pools or LPs. These pools are formed using Automated Market Maker (AMM) protocols and contain pairs of tokens of equal value.

Read more: What is an Automated Market Maker (AMM)?

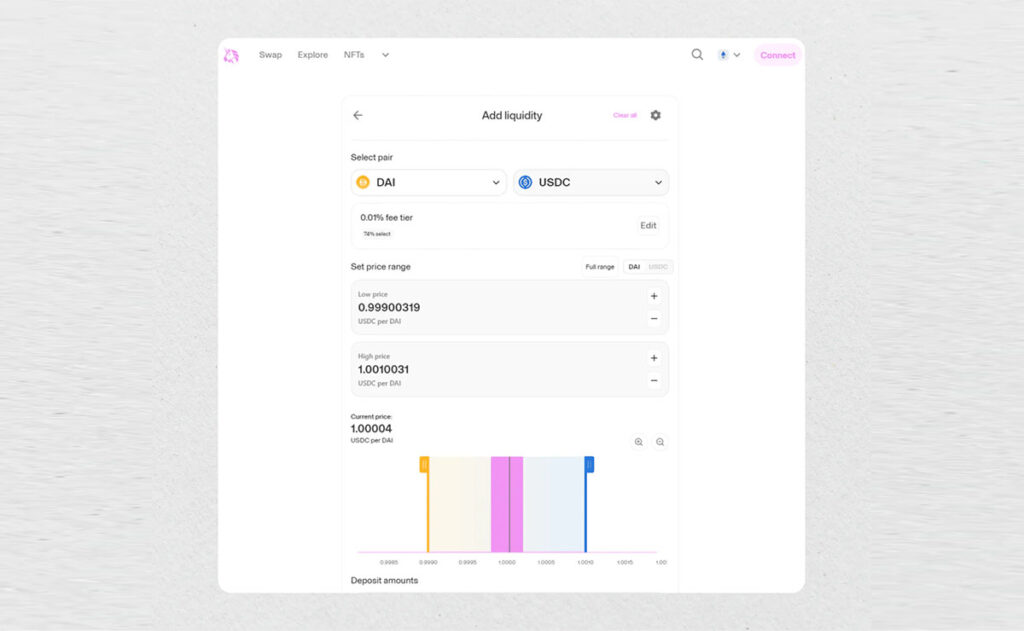

For example, in a DAI/USDC liquidity pool, users can provide a total of $1,000 in liquidity by providing $500 DAI and $500 USDC. In return, they receive LP tokens that represent their share of the liquidity pool. These tokens can be converted into initial share and income from exchanges.

Liquidity providers earn a portion of the exchange fee or commission proportional to their share in the liquidity pool. The more transactions in the pool, the more they earn. However, liquidity providers face the risk of impermanent loss or unrealized loss due to price fluctuations of tokens in the pool. To reduce this risk, users can choose pools with high liquidity or pools that include stablecoins and less volatile pairs.

Some of the popular platforms that provide liquidity pool in DeFi are: Curve, Uniswap, PancakeSwap, Compound Finance and Balancer.

Yield Farming

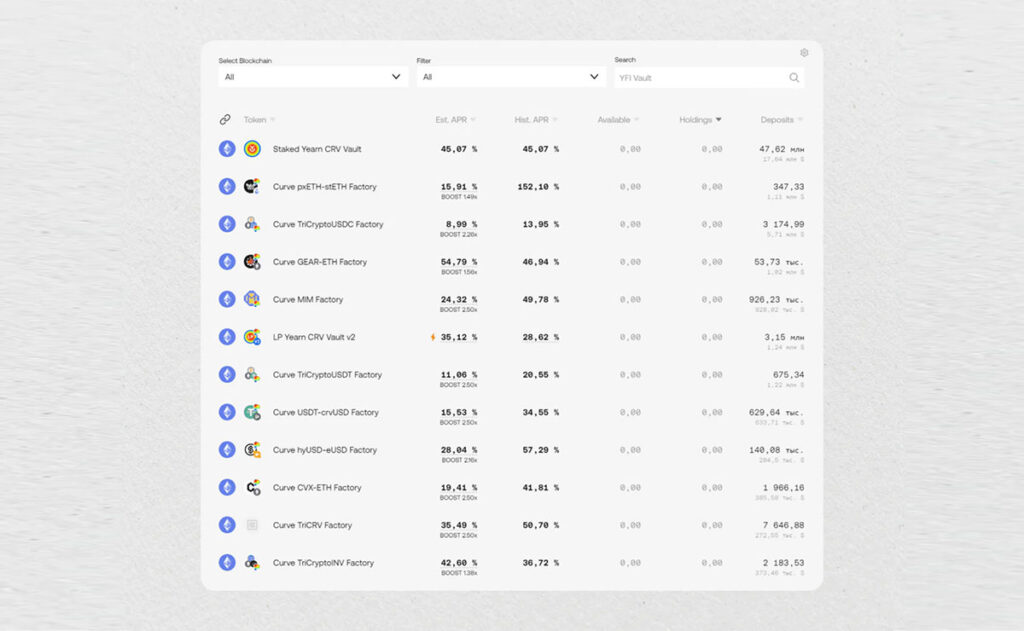

Yield farming or profit cultivation It is a popular and somewhat complicated way to earn passive income in the DeFi sphere. In this way, LP tokens are locked into certain farms and earn additional rewards in addition to the rewards they receive from providing liquidity to liquidity pools. in fact, Profit cultivation is a combination of staking and liquidity provision to maximize profits.

To start yield farming, users must first earn LP by providing liquidity to a pool. LP tokens are then staked in various revenue generating activities such as lending protocols or engaging in leveraged trading strategies. These activities generate additional rewards through new tokens or interest payments. Users can then increase their earnings by reinvesting them in the farm or withdrawing them.

Profit cultivation strategies can range from simple one-step methods to complex multi-step methods. For example, a 3-step strategy could include:

- Obtaining a loan using tokens as collateral;

- Adding received loans to a liquidity pool on a DEX and receiving LP tokens;

- Staking earned LP tokens for more returns.

Popular DeFi platforms for profit cultivation in 2024 include: Yearn Finance, MakerDAO, Aave and Uniswap.

Receive Airdrop

In the DeFi world, Airdrops A popular way to distribute tokens to community members is often for free. This strategy is implemented with different goals that include Creating awareness about projects, Reward early adopters and TDecentralization of token ownership will be

Airdrops are done in different ways; Among them are airdrops that are awarded to wallets that have already been associated with the project, and airdrops based on specific tasks that users must perform to receive tokens, such as joining social networks or testing protocols.

Read more: What is Airdrop? Learn how to earn free digital currency

To increase the chances of receiving an airdrop, DeFi enthusiasts should actively participate in various protocols, keep tokens of promising projects in their wallets, and interact with project communities on social networks.

The value of airdrops can vary greatly; For example, the UniSwap airdrop in 2020 awarded each user 400 UNI tokens, which at the time were worth around $1,200. However, users should be aware of certain risks and considerations, including fraud, taxes and fees Gas pay attention

Read more: How to get airdrop? Roadmap to becoming an Airdrop Hunter

Finally, Airdrops are considered a side-opportunity to make money on DiFi and should not be considered as the main source of income. These types of earnings are unpredictable and should be considered as a supplement to other more reliable ways to earn money in DeFi.

What are the advantages and disadvantages of making money in DiFi?

DeFi, by using blockchain technology, has been able to make major changes in the way of investing and earning money. By eliminating intermediaries and creating new opportunities, this system has provided people with the possibility of achieving higher profits and more control over assets. Next, we will examine the main benefits of generating income in DeFi:

- Higher profitability: Due to the lack of entry barriers, DeFi allows for higher returns than traditional investments.

- Global access: DeFi can be used by anyone with Internet access, and this feature has made it possible for people around the world to participate without the need for traditional financial services.

- Full control over assets: In DeFi, users have full control over their assets without the need for intermediaries and can make their own financial decisions as they wish.

- Transparency and security: Using blockchain technology, DeFi has transparency and immutability of transactions, which contributes to the trust and security of investors.

While earning passive income through Defi has many attractions, it should also be aware of its disadvantages and potential risks. The most important disadvantages of DeFi are:

- Dangerous swings: The digital currency market is very volatile and rapid changes in asset values can affect passive income.

- Risks of smart contracts: DeFi platforms depend on smart contracts that can be attacked by hackers and lead to loss of funds.

- Technical complexity: Participating in DeFi requires technical knowledge and a deep understanding of the relevant protocols, which can be challenging for newcomers to the cryptocurrency world.

- Legal uncertainties: Laws and regulations related to DeFi are still evolving and may change in the future to affect investments.

Read more: Are you planning to get a loan from Defay? 3 threats you should know

Step-by-step training to enter DiFi and earn money from it

DeFi allows you to earn money by participating in decentralized financial projects, without the need for traditional intermediaries such as banks. But to be successful in this field, you need to follow certain steps carefully and adhere to appropriate strategies. Here are five key steps to start making passive income from DeFi.

Get a digital wallet

The first step to enter the world of DeFi is to have a digital currency wallet. This type of wallet allows you to interact with decentralized applications (Dapps) and smart contracts on Ethereum or other blockchains.

Choosing a secure wallet such as MetaMask or Trust Wallet is very important, because the security of your digital assets depends on choosing the right wallet and maintaining the private keys properly.

Choose the right strategy

After setting up a wallet, you need to choose a suitable strategy for making passive income. This strategy should be in line with your financial goals and risk tolerance.

For example, if you are looking for a stable return, borrowing may be a good option. On the other hand, profit cultivation can bring more returns, but it also entails more risks.

Research about DiFi projects

Before allocating any digital assets, you should carefully review DeFi projects and protocols. Due to the large number of projects in the market, sometimes it is difficult to recognize the reliable projects with growth potential.

When researching, consider the reputation of the project, the results of security audits, and the level of community engagement with it. Also, examining the project’s tocnomics and development team members can help you better understand the project’s potential for success.

Allocation of assets to liquidity pools or staking

After choosing the right project, it’s time to allocate your digital assets. It is better to spread your investment among different tokens and platforms to reduce possible risks. Also, it is important to fully understand the risks associated with each liquidity pool and base your decision on this information.

Portfolio monitoring and balancing

As with any investment, you need to regularly monitor the performance of your portfolio and be aware of any changes or updates that may affect it. Also, it’s best to stay up-to-date on the latest developments in the DeFi space in order to make the most of your income potential. If needed, rebalance your portfolio according to your goals and risk management strategy.

Frequently asked questions

Definitely yes! You can earn through passive income, for example by acting as a transaction confirmer or providing liquidity to a liquidity pool on various platforms.

Yes! Staking on DeFi can be profitable, but how profitable it is depends on factors such as the assets you are staking, market conditions, and the rewards and risks of the platform. Therefore, it is important to thoroughly investigate each staking opportunity.

Relying on blockchain technology, DiFi enables financial activities to be carried out automatically and without human intervention. In addition, DeFi also enables the integration of financial services with non-financial products. This technology will also play an important role in connecting the virtual and physical worlds in the Metaverse.

Summary

DiFi has opened up a new world of opportunities for users to earn money from digital assets. Strategies such as liquidity provision, staking, profit cultivation, and lending allow users to earn significant returns on their investment while participating in the dynamic Web3 ecosystem.

However, investing in DeFi is not without risk. Due to the emerging nature of this industry and the existence of some security problems, the necessity of careful research and investigation is felt more and more before any investment. The extreme volatility of the digital currency market, the complexity of some protocols and the possibility of fraud are among the challenges that users will face. Therefore, familiarity with the basic concepts of DeFi and risk management is the key to success in this field

RCO NEWS