Latest update: Review of halving effects; From the dramatic increase in fees to the future of the Bitcoin price

4th bitcoin halving per hour 3:40 am on saturday May 1st It happened with the mining of block number 840,000. With the occurrence of this event, the Bitcoin mining reward decreased from 6.25 units to 3.125 units. This predetermined event in the Bitcoin blockchain, which occurs once every four years (every 210,000 blocks), will reduce the inflation rate of Bitcoin and limit its supply in the market.

Unique features of Having 2024

The halving 2024 was different from similar events in the past in several ways:

- The number of digital currency users has grown by about 400% since the previous halving in 2020.

- Contrary to the past, the price of Bitcoin reached its highest level before the halving and recorded a record of $73,600.

- Miners had better control over their costs due to the price growth before the halving.

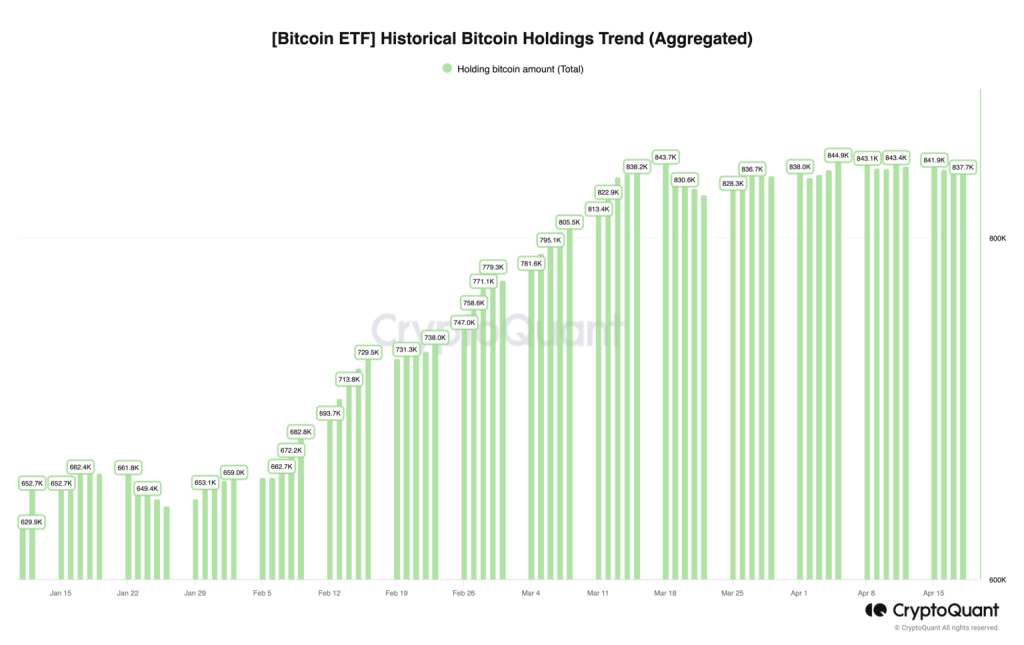

- The 2024 halving is the first halving event to occur after the launch of exchange-traded funds (ETFs) for spot bitcoin trading in the United States.

- Bitcoin mining is now much more decentralized geographically than in 2020 when it was 80% concentrated in China.

Increasing transaction fees after halving and launching Runes protocol

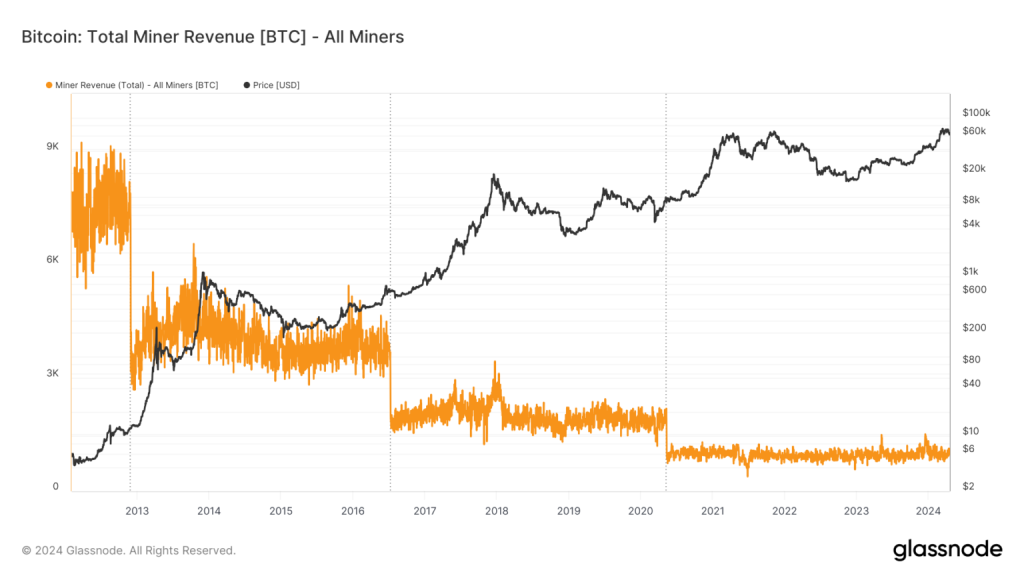

During 15 blocks after halving (from block 840,000 to 840,014), the average fee received by miners per block has reached 21.74 bitcoins. The main share of this increase is related to transaction fees, which averaged 18.62 bitcoins per block.

The main reason for this sudden growth of fees is the launch of the new Runes protocol at the same time as the halving. Users have flocked to the protocol to mint tokens, driving up demand and fees. The current average fee for medium priority transactions is about $94 and high priority is about $100.

According to MSN, increasing fees as a part of miners’ income can create a new dynamic in mining. This change is likely to affect the activity of miners, especially in areas where the cost of electricity is higher than the benefits of mining.

Experts believe that higher fees could help target the development of second layer solutions, such as the Lightning Network, which focus on reducing costs and speeding up transactions.

Challenges and solutions of Bitcoin miners after halving

According to beincrypto, with the reduction of the mining reward from 6.25 to 3.125 bitcoins, miners will face significant challenges at first. Some of the miners will have to close their operations because it will be impossible to continue the activity from an economic point of view, and some will even face a loss.

This scenario is considered a kind of game theory. Initially, if 1000 profitable miners mine 6.25 bitcoins, after the halving, the profitability will drastically change with the reward dropping to 3.125 bitcoins between the same number of miners. This change forces miners who are unable to bear the loss to stop operations.

Eventually, this attrition may reduce the number of miners to, for example, 600 miners. For these remaining miners, reduced competition for 3.125 bitcoins could restore profitability and stabilize the mining space.

The impact of ETFs on demand

Recently, there have been significant changes in the structure of the Bitcoin market, especially with the introduction of Bitcoin exchange-traded funds. These funds have played an important role in integrating Bitcoin with traditional financial markets.

ETFs have been an important way for traditional investors to interact with Bitcoin in a legitimate and familiar way as a portfolio diversifier. These financial tools have proven that Bitcoin is here to stay and will not go to zero!

This integration has not only stabilized price volatility and demonstrated Bitcoin’s stable presence in the financial ecosystem, but has also paved the way to meet the growing demand of institutional investors. In total, Bitcoin ETFs currently hold more than 837,700 Bitcoins worth $53.61 billion, which has significantly increased market liquidity.

Bitcoin price future after 2024 halving

Analysts believe that despite the short-term fluctuations, the halving event can be the basis for a long-term upward trend in the digital currency market.

At the same time as Bitcoin halving, many major companies in the field of digital currency have presented their predictions and opinions about halving in separate reports, which you can read below:

- Coinbase: With the introduction of Bitcoin ETF, the role of halvings may become less.

- Binance: Surveys show people are optimistic about Bitcoin halving.

- Greyscale: Miners may sell their bitcoins in the short term to cover losses and reduce the price.

- Bitwise: If the previous patterns are repeated, Bitcoin will be volatile or even bearish in the short term (first three months) after the halving.

- JPMorgan: Bitcoin halving news has been anticipated and we will probably have a temporary drop after the halving.

- Bernstein: Temporarily reducing the upward trend but restarting for the price of $150,000

- Cryptodatacom: Short-term decline; But an important event for the long-term trend of Bitcoin.

Full version of this report: Major companies’ predictions and opinions about Bitcoin halving

Despite all the excitement and speculation, Bitcoin’s price hasn’t changed much since the halving. Data from CoinGecko shows that Bitcoin price is currently in the $64,000 range, down 5% in the past 7 days. The price has not changed in the last 24 hours, which included the fourth reduction in mining rewards since the birth of Bitcoin.

The most recent Bitcoin price record of around $74,000 was recorded last month. After the halving, Bitcoin does not seem poised for an uptrend, but a bear attack also seems unlikely.

Although immediate price spikes after halving are not always evident, the general consensus is that halving will have a positive effect on Bitcoin’s value in the long run, as it has in the past.

During Bitcoin’s first halving on November 28, 2012, the price was $12 and later reached a high of $1,242, representing an impressive 9,937% gain. The second halving started on July 16, 2016 at the price of $664 Bitcoin and finally reached $19,804, which represents an increase of 2,903%. The last halving on May 11, 2020 saw Bitcoin at $8,571 and its next peak was $68,997, representing a 705% increase.

According to beincrypto, Bitcoin price history shows that the price movement was relatively slow during the halving, but 9 to 12 months later, a major price increase occurred. This seems to be due to miners earning less bitcoins to sell on the market than the demand for bitcoins; Therefore, the halving is an event that, once it happens, is considered a buy signal for Bitcoin.

RCO NEWS