study time: 2 minutes

Last night, the Federal Open Market Committee (FOMC) cut interest rates for the third time in a row by 25 basis points to a range of 3.50-3.75%, which is a positive signal for risk-on markets, including crypto.

However, Federal Reserve Chairman Jerome Powell said in his press conference that this year’s rate cuts will bring interest rates closer to the “neutral rate” range and that decisions from now on will depend entirely on new economic data.

Following these statements, the possibility of stopping the interest rate reduction process increased significantly; An issue that immediately affected the crypto market. This cautious stance made the probability of keeping interest rates unchanged at the January FOMC meeting jumped to 76%.

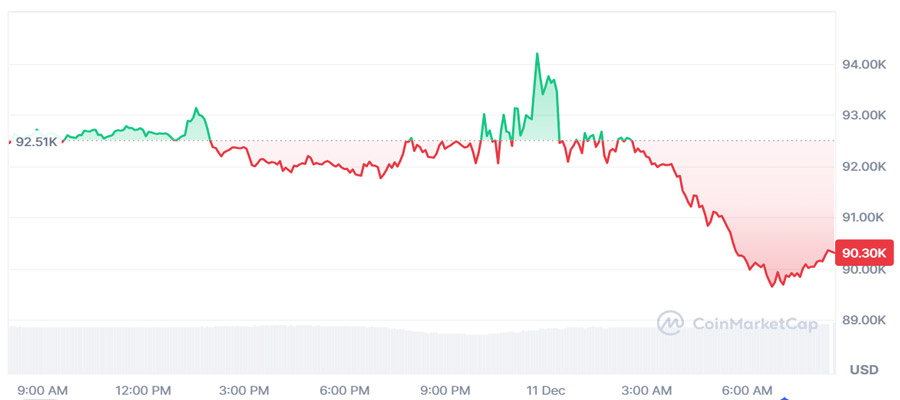

In the meantime, Bitcoin, which had soared to $94,000 before settling down, faced selling pressure and returned to the $90,000 channel. A pattern that has been repeated this year after most FOMC meetings.

This policy uncertainty has turned market sentiment bearish again and could make traders more cautious in the short term.

RCO NEWS