The digital currency market is at the peak of excitement. Bitcoin has recently excited everyone by breaking the $ 4,000 and Ethereum record on the $ 4 target route. In this euphoric atmosphere, everyone is talking about great profits and thinks this upward trend will continue. But at the same time, experienced investors are slowly formulating their departure plan.

In a market where everyone is focused on shopping, the main art lies in knowing the right time of sales. Sales are more difficult to buy than buying, because emotions such as fear of losing more opportunities and greed affect rational judgment. This article provides a practical guide to formulating a personal exit strategy and consolidating the profits earned before changing the market.

Is the Bitcoin 2 -year -old cycle finished?

To build an effective exit strategy, we must first know the land we play. The Crypto Market in Year 2 is fundamentally different from the previous cycles, and ignoring these changes can end up losing all your profits.

Old rhythm: Explanation of the Hawing Cycle

Traditionally, the Crypto market was moving with a four -year rhythm set by the House Bitcoin event. These cycles usually included an explosive ascending market after the House and then a long descending market. Many of the old exit strategies were based on the same historical timing and market ceiling prediction over a specified timeframe after the Hawing.

Game Change: Institutional Capital Tsunami

With the approval of Bitcoin and Ethereum ETFs, a flood of institutional capital has entered the market that has changed the rules of the game forever. New actors, such as pension funds and corporations, buy with a long -term perspective, and unlike micro -investors, they are not captives of short -term emotions. This “patient capital” has reduced severe fluctuations and has changed the market structure.

Surely analysts such as Bitwise and Cryptoquant’s Cryptoquant believe that the 4 -year cycle is “dead”. In their opinion, the impact of Hawning has decreased over time and the behavior of “whales” (big investors) has changed; Old whales are selling new institution whales that do not intend to sell quickly. This means that it can no longer be planned to leave the market just by looking at the calendar and we need more dynamic tools.

۲ Key strategy for clever exit from the digital currency market

Since the precise timing of the market ceiling is almost impossible The best approach is to use a predetermined strategy to eliminate emotions from the decision -making process. Here are three main strategies for clever exit from the market.

Strategy # 1: Exit based on the previous program

This method is suitable for investors who are looking for a specific, stress -free framework. In this strategy, you set out your exit rules before reaching the peak of market emotions.

- Price goals: Specify precise price levels to sell part of the assets. For example, selling $ 1 % at $ 6,000 and $ 2 at $ 6,000 for Bitcoin.

- Percentage of Profit: Exit based on the growth rate of investment portfolio. One popular technique is to remove the initial capital after double its value. This will bring you risk to zero and allow you to stay in the market with “net profit”.

- Time -based exit: Determine a specified date for departure, regardless of the price. This method is more risky due to the change in the nature of market cycles but can prevent excessive greed.

Strategy # 1: Strategic exit or DCA on the opposite

Attempts to sell at the highest possible price often lead to loss of opportunity or late sales. The strategy of step -by -step out or average reverse dollar cost solves this problem. In this way, you sell certain amounts of your asset at regular intervals (eg weekly or monthly) with rising prices. This will average your sales price, reduce early sales and help you save your profit regularly.

Strategy # 1: Exit with Technical Green Lights

This strategy is suitable for investors who are familiar with technical analysis and uses objective diagram signals for decision making.

- Failure of Key Support: The ascending market usually remains above important moving averages (such as the 2 -week -old moving average). The decisive failure of these support levels can be the first alarm to change the market trend.

- Moving Loss (Trailing Stop Loss): This tool allows you to move up your losses by raising prices. By doing so, you will lock your profits and allow your assets to grow more at the same time, but if the price returns suddenly, you will automatically get out of the deal.

| Strategy | A brief explanation | Benefits | Disadvantages | Suitable for… |

| Exit based on the program | Sales based on predetermined price, percentage or time. | Complete removal of emotions, creating discipline. | You may lose some of the potential profits. | Investors who are looking for transparent and stressful laws. |

| Step outflow | Selling fixed quantities of assets at regular intervals. | Reduce risk and regret, average sales price. | The average sales price may be lower than the absolute ceiling. | Investors who are prone to emotional decisions. |

| Technical exit | Use chart signals such as failure to exit. | Decision -making based on objective market data. | The need for technical analysis knowledge, the possibility of wrong signals. | Active traders who are fluent in analyzing the charts. |

Beyond Charts: How to read the market mind at the price ceiling?

Price is the last thing to move. To anticipate the market ceiling, we need to look at data that shows the emotions and behavior of investors “under the skin” of the market.

Pulse Psychology of Market: Indicat of fear and greed

This index measures the emotions governing the market on a scale of 1 (severe fear) to 1 (severe greed). The numbers above 1 or 2, which indicate “severe greed”, have historically been a strong alert signal. This situation shows that the market is overwhelmed, micro -investors have been imported without analysis and the likelihood of a large price correction is very high. According to Warren Buffett, “When others are greedy, you fear.”

۲ Index of China you need to know

Endogenous or Anchin data provides us with the most transparent and honest information from the network status. The following two indicators are very useful for identifying the market ceiling.

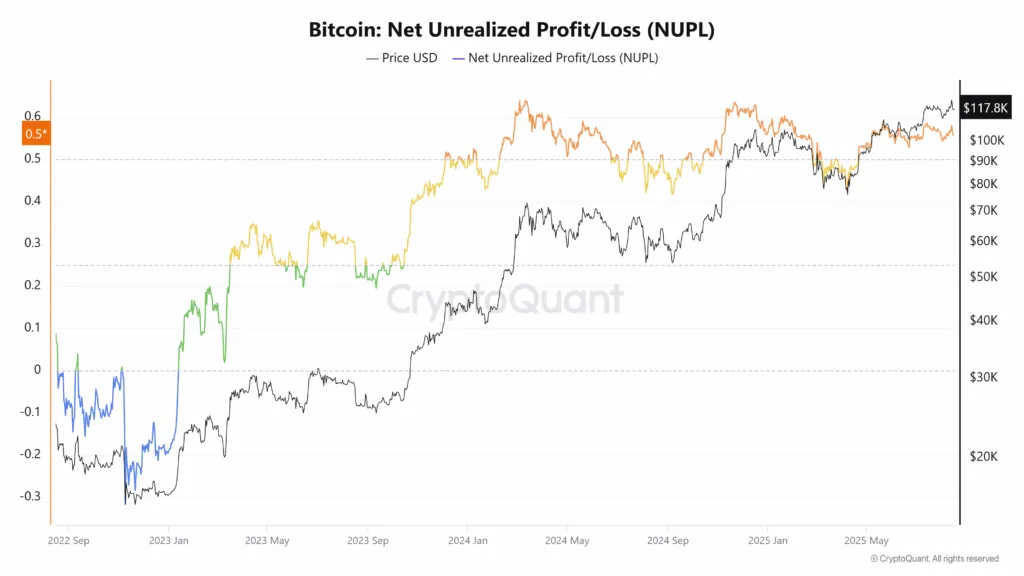

NUPL index (net profit/losses unable to be realized)

This index shows what percentage of owners of a currency are in profit or loss. When NUPL enters the Euphoria area, it means that almost all investors are in large and unprecedented profits. At this point, the incentive to sell and store profits reaches its peak, and the number of new buyers decreases, which is a classic sign of proximity to the market ceiling.

This index shows the profitability status of the total bitcoin owners. As you can see in the chart, the index is displayed in different colors: blue for losses, green for balanced profits, yellow for significant profits and orange for high profits. Currently, the index is at+ 0.5, which indicates the high profit status of most investors.

Historical experience shows that when the NUPL reaches high levels of 0.5 (bold orange color), the market is on the verge of serious correction. At this point, the vast majority of investors are in large profits, and sales pressure to make profits intensified. As the chart shows, in previous periods, when this index reached its peak, we have immediately seen significant price modification.

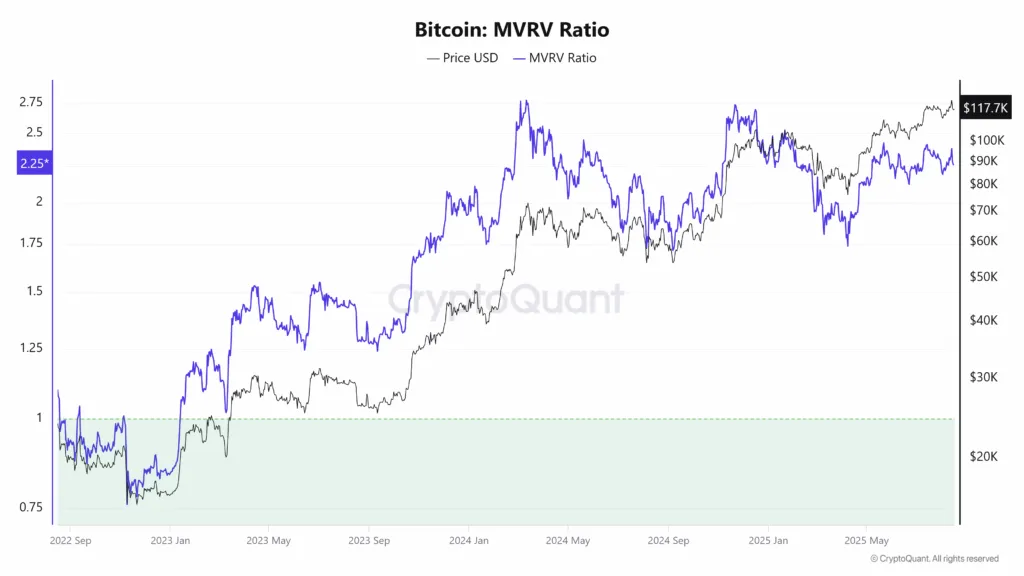

Ratio MVRV index

This index shows the ratio of the current Bitcoin market value to its realized value, indicating at what level the price is. As you can see in the chart, the green area (below 1) represents the price and opportunity of shopping, while the high levels of 1.5 (which reached up to 0.5 in the past) represent the market saturation and proximity to the price ceiling.

Currently, the index is at+ 1.5, indicating that the market is entering the risk area. Historical experience shows that when this ratio crosses the border 1 and moves to 1.2, the market is on the verge of a large correction. The index actually says how far the current price is from the average price of historical purchases and whether we are forming a price bubble. The higher this number, the higher the sales pressure to return to the balance.

The strongest sales signal is issued when several indicators from different areas (technical, emotions and anchor) alert us simultaneously. These “signals convergence” is an optimal point for implementing an exit strategy.

| Type of signal | Index name | Sales signal | In simple terms it means… |

| Market Psychology | Fears | High number (severe greed) | The market is too excited and the risk of correction is high. |

| Anchin | NUPL index | Entry into the euphoric area (blue) | Almost everyone is in big profits and potential sellers are many. |

| Anchin | MVRV Z-Score index | Login to the red box | The current price is dangerously away from its intrinsic value. |

Crypto Final Exit Checklist

All of the above concepts can be summarized in a simple and practical checklist. Before pressing the sales button, take these three steps:

- Step 2: Personal Schedule Review: Have I reached my own price or percentage of profit? Have I achieved my initial financial goals from this investment?

- Step 2: Market excitement assessment: Is the index of fear and greed above 1? Crypto news is drawn to the public and non -specialists talk about it?

- Step 2: Data verification: Are Anchin Indicators (Nupl, MVRV) in the danger zone? Is the price broken an important support level in the technical chart?

If your answer to most of these questions is “yes”, it’s time to put aside emotions and implement your exit strategy with certainty.

Summary: Set aside the greed and do the plan

Success in an upward market is not achieved by buying, but consolidated by smart sales. Your biggest enemy on this path is not market whales or sudden falls, but your uncontrolled greed. Having a predetermined exit plan is the only one that can protect you from devastating and emotional decisions at the height of market emotions.

Bring your app on paper today before it is too late. Specify your price goals, select the indicators you will pursue, and keep your strategy committed. Remember, no one can predict the exact market ceiling, but with a well -planned program, you can make sure you get out of the game with a reasonable and satisfactory benefit.

RCO NEWS