The selection and comparison of Ripple and Cardano is beyond a regular investment decision; This choice means the choice between the two completely different philosophies for the future of digital money. On the one hand, the Ripple (XRP), in a practical way, wants to make the world’s existing financial system better and faster. On the other hand, Cardano (ADA), in a scientific and academic way, wants to build a completely new, safer and free financial system for the next generation.

This article intends to compare these two projects in all ways – technology, economics, real applications and investment opportunities. In the end, you can determine which of these two is more in line with your investment strategy and your view of the future of blockchain.

Introducing Ripple and Cardano

In the world of digital currencies, Ripple and Cardano as two leading projects have always been of interest. In this section, we are going to take a closer look at these two giants of the crypto world and examine their key features, goals and differences.

Ripple (XRP): Revolutionary on Interbank Payments

Ripple was founded in 2008 by figures such as Chris Larsen and Jed McCaleb with the specific purpose of creating a Chinese block -based alternative to the traditional, slow and costly SWIFT system for international payments. The project was designed from the outset to serve financial institutions, banks and payment service providers, and has a completely organizational nature.

Understanding the distinction between Ripple, Technology Company, and XRP, independent digital asset operating on the XRP (XRPL) office platform is critical. Ripple uses XRPL and token XRP to deliver its products, but it does not have complete ownership or control over this decentralized network; A topic that has been very key to its legal challenges.

Ripple’s main goal is to solve one of the biggest problems of the global financial system, the intercourse. Instead of trying to completely replace the existing system, the project seeks to improve it from within, and this approach shapes its existential philosophy. Read us to read more about Ripple article.

Cardano (ADA): Academic Approach to the China Block World

Cardano was launched in 2008 by Charles Hoskinson, an Ethereum fellow. The story of the emergence of Cardano is rooted in the tendency to fix the defects of the first and second generation blocks, such as low -flexibility bitcoin and the problems of ethereum scalability, through a scientific approach based on careful review.

The development of the project is directed by three independent institutions, the Cardano Foundation, the IOHK Engineering Company and the Emurgo Business Company, which represents a structured, albeit slower process. This structure ensures that each aspect of the protocol, from security to sustainability, is carefully examined and implemented.

Cardano’s great landscape is to create a very safe, stable and integrated platform for complex programming value. Designed to support advanced intelligent contracts and decentralized programs (DAPPS), the platform designs itself as a fundamental infrastructure for the future of digital economics. Read us to read more about the Cardano article.

Cardano and Ripple’s technical comparison

In the China Block world, Cardano and Ripple are two prominent projects, each with a different approach seeking to solve the challenges in financial and digital systems. In this section, we examine and compare the technical aspects of these two platforms.

Consensus algorithm: Two different paths to reach an agreement

The selection of the consensus algorithm directly derives from the philosophy of each project. Ripple has prioritized speed and efficiency for its organizational customers, while Cardano has targeted security and decentralization for a public and open ecosystem.

Ripple (RPCA): The consensus algorithm of the Ripple Protocol (RPCA) is neither the proof of the work nor the stock proof (POS). This algorithm works based on a list of trusted credit meters called the list of unique nodes (UNL) to reach an agreement within 1 to 2 seconds. The consensus process is done through a few rounds of polls with a final 5% final agreement, which guarantees high speed and very low cost of transactions.

Cardano (Ouroboros): Oreroboros is the first stock proof (POS) protocol whose security has been proven in mathematically through academic research. This protocol provides security and decentralization by dividing time into periods called “Era” and “Slot” and random selection of slot leaders to build new blocks. This approach, while maintaining high security, is far more efficient in terms of energy consumption.

China Block Architecture: Integrated General Office against Two -layer structure

The technical architecture of these two Chinese blocks is also a reflection of their different goals. The XRP office is optimized for a specific purpose, while the Cardano architecture is designed for long -term flexibility.

The Office of the General XRP (XRPL): The Ripple General Office is an integrated and single -layer architecture that has been optimized for a primary goal: the rapid transfer and settlement of value. The office has powerful internal features such as decentralized currency exchange (Dex) and token export capability, but its core is designed for payment processing.

Two -layer of Cardano: The key innovation of Cardano lies in the separation of China’s block with two separate layers. The Cardano Settlement Layer (CSL) is responsible for managing the ADA token transactions, while the CCCCL computational layer (CCL) is the location of intelligent contracts and decentralized programs logic. This design enhances flexibility and scalability and allows the computational layer to update without disrupting the settlement layer.

Tokenomics and Economic Model: Comparison of XRP and ADA supply and application

Understanding the economic model and tokenomics of a digital currency is essential to evaluate its sustainability and long -term value. In this section, we compare the supply and applications of the XRP and ADA token to examine their fundamental differences. What is the tokenomics article we recommend to get acquainted with the economy of Crypto projects.

Supply and distribution of Ripple and Cardano

The economic model of each token represents how power and value distribute it in its ecosystem. The XRP model is mostly influenced by a corporate entity, while the ADA model tends to ownership of the community and decentralized control.

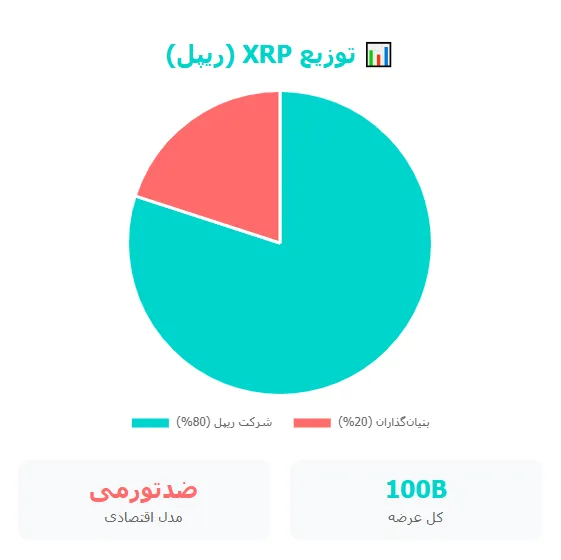

XRP: At the time of its birth, the 2 billion XRP token was pre-extracted. Of this amount, 2% were dedicated to Ripple Labz and 2% to the founders. Ripple puts a large part of his token in an ESCROV account and periodically frees it to finance and market operations. Also, the fees of each transaction are burned in the XRP network, which creates a mild anti -inflammatory pressure.

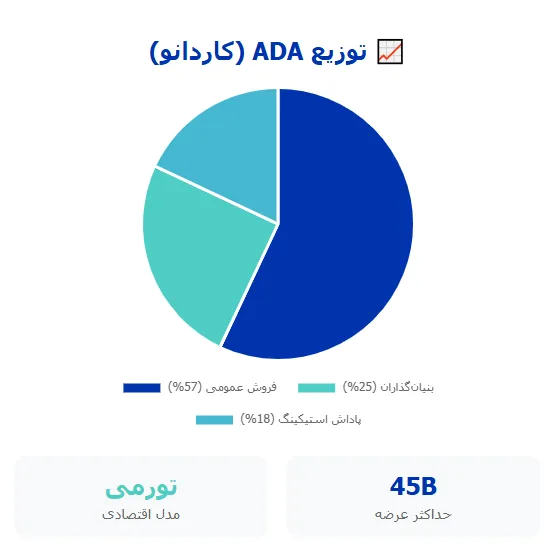

ADA: The maximum supply of ADA token is limited to 2 billion units. Much of the token was distributed through public sales (ICOs), and other parts were allocated to the founding institutions and future sticker rewards. The new ADA tokens enter the cycle as a reward for stickers and operators of sticker pools that provide network security. This predictable inflation model also provides the project’s treasury budget for future development.

The inherent use and value of Ripple and Cardano

The use of a token is the main reason for its demand and valuation in the long run. XRP is a specialized tool for a particular industry, while ADA is a multipurpose tool for an extensive ecosystem.

XRP: The main use of XRP is dual. First, it is required to pay each transaction fee on the XRPL network to prevent spam. Secondly, and more importantly, the key role of this token as a “Bridge Currency” in demand -based liquidity product (ODL) is that it enables immediate converting between Fiat currencies without the need for pre -supplied bank accounts.

ADA: The application of ADA is triple. This token is used to pay the transaction fee on the network. It is also used as the main asset for sticing and providing network security and earning rewards. Most importantly, ADA is a sovereignty token that gives its owners the right to vote on the future of the protocol and how to allocate the Treasury budget.

Comprehensive Ripple & Cardano Comparison Table

The key features of these two projects are compared in the table below to provide a quick view. This table can act as a quick reference to understand their fundamental differences.

| Feature | Ripple | Cardano |

| Year of establishment | 1 | 1 |

| Key founders | Chris Larsen, Jed McCaleb | Charles Hoskinson |

| The main philosophy | Optimization of existing financial system | Building a new and academic platform |

| The consensus algorithm | RIPPLE PROTOCOL CONSENSUS (RPCA) | Ouroboros (Proof-OF-STAKE) |

| Transaction speed | 1-5 seconds | ~ 2 seconds (up to a few minutes to finalize) |

| Scalability (TPS) | ~ 1 (theory) | ~ 1-4 (current), with Hydra higher |

| Architecture | Integrated Office (Single Ledger) | Two -layer (CSL & CCL) |

| Decentralization | Less (dependent on UNL) | More (the extensive network of steak money) |

| Total supply | 2 billion (pre -extracted) | 2 billion (max) |

| Economic model | Anti -Term (Burning Magazine) | Inflationary (sticker reward) |

| Mainly used | Transboundary Payments, Currency Bridge | Smart contracts, DAPPS, DEFI |

| Legal challenge | Relative victory in the SEC file | By the SEC as the possible securities listed |

Comparison of ecosystem and Ripple and Cardano uses

In the world of digital currencies, Ripple and Cardano are two prominent competitors, each offering unique ecosystem and unique use. This section examines the deep examination of the two ecosystems and discusses each of the strengths and weaknesses of each in different fields.

Ripple strengths

The Ripple ecosystem is specifically focused on the financial sector. Its main use is in the RippleNet to facilitate international payments, and cooperation with numerous financial institutions is a certificate of acceptance in this area.

But the Ripple ecosystem is evolving. A new and powerful narrative for its growth is the token of real -world assets (RWA) on the XRPL platform. Expert analysis shows that this is a huge growing market in which the XRP is at the forefront, and assets such as bonds and treasury have now been sought to its office.

This trend shows that the XRP goes beyond a spectacular payment tool, turning into an infrastructure for the new generation of digital assets. This significantly increases the potential for long -term demand for this token.

Cardano’s strength

The Cardano ecosystem is wider but younger. With the activation of smart contracts, the field was provided for the development of a decentral ecosystem, including decentralized currency exchanges (Dex), lending protocols and an NFT market.

The platform also pursues real -time uses such as Ethiopian supply chain tracking and digital identity projects, indicating its ambition to solve real -world problems, even if it is slower. Cardano’s focus is on the potential and extent of the applications that technology makes possible.

Ripple and Cardano’s legal challenges

Among all the above, Ripple’s legal battle with the US Stock Exchange (SEC) has reached a turning point, while Cardano has faced new ambiguities.

Ripple’s legal battle with sec

One of the most important events in the history of Ripple was the complaint of the US Stock Exchange (SEC) Commission (SEC), claiming that XRP was not registered. This case had a heavy shadow over the future of the project and had reduced Ripple prices in recent years.

In year 3, Judge Analissa Torres was a turning point in this legal battle. The ruling stated that the planned XRP’s planned sales at public currency exchanges are not an example of securities. This vote, though not a complete victory, brought significant legal transparency to the US market; An advantage that many other penis is devoid of.

This legal transparency has reduced the risk of investing in XRP for institutional and micro investors and paves the way for a broader acceptance.

Cardano and law enforcement problems

While Ripple has been out of the shadow of the lawsuit, Cardano has faced new uncertainties. In his complaints against currency exchanges such as Binens and Kevinbis, SEC explicitly referred to ADA as one of the digital currencies, which he considers a securities.

Although no direct legal action has been taken against the Cardano institutions, this classification creates a potential risk for its future in the US market. This uncertainty can have a negative impact on its listing and the willingness of institutional investors.

Interestingly, understanding the legal risk between these two assets is reversed. Until recently, the XRP was a risky asset, but now with relative legal transparency, it is Cardano that is facing a shadow of regulatory in the United States. One of the drawbacks to Cardano is the low price of Cardano by investors.

Investment Analysis: Which project has the greater growth potential?

Now it’s time to look at these two projects from the perspective of investment. Each of the Ripple and Cardano has unique opportunities and risks that can determine the future of their price.

Ripple’s strengths and weaknesses

Strengths: Expert analysis view XRP strengths as transparent and proven, strong focus on institutional market, volume of growing transactions, advance in RWA market, and new legal transparency. The possibility of confirming a stock exchange (ETF) for XRP is another large catalyst.

Figures: Ripple’s main risks are its relative focus and its success on Ripple’s commercial performance. Its success depends on persuading the conservative bank to accept new technology, which is a major challenge.

Cardano opportunities and risks

Strengths: Cardano’s strengths are in very safe and decentralized technology, a methodical and research -based approach (which is attractive to risk developers) and a very strong, active and motivated developer community and database.

Figures: As numerous analyzes show, its main weakness is the low speed of development and influence in the market. The project is described in strong research articles and in real traffic and is trying to define its unique competitive advantage over faster and larger competitors such as Ethereum and Solana. Investing in it is a bet that its strong research culture will ultimately come to a conclusion, which is not guaranteed.

Frequently asked questions

Yes, in terms of the transaction finalization, the XRP with a time of 1 to 2 seconds is significantly faster than Cardano, which may take up to a few minutes for full security. This difference is due to their different consensus mechanisms.

No. XRP is already extracted. The ADA also cannot be extracted by the Pow, but you can “sticker” to get a reward in exchange for participating in the stock proof.

The Ripple is more focused because of the Unl system controlled by a limited number of validation. Cardano is much more decentralized with thousands of independent stickers that provide network security.

This is the subject of the discussion. Experts believe that the XRP has a more transparent way to make money because of the institutional acceptance and RWA market. Cardano’s potential is very broad but less defined and depends on its victory in the competition of smart contract platforms.

Conclusion

Finally, the choice between the two giants of the Crypto world leads to a simple conclusion. This choice between the XRP, a functional token focused on the organizational market with a transparent business model and less legal risk, and ADA, a decentralized, multipurpose and rich platform with long -term long -term ambitions, is greater. One is a specialized tool and the other is an all -function platform.

The final answer to the question “Which one is better?” It depends on your profile and philosophy of investment. There is no single answer to everyone.

- Choose XRP if: You are a pragmatic investor, believe in the integration of China’s block with traditional finances, value a transparent use, and have no problem with a more focused model for business concentration.

- Choose Cardano if: You are a long -term and ideological investor, you believe in the power of decentralization and academic accuracy, you are patient and want to invest in a platform with extensive potential, while taking the risk of its backward competitors.

RCO NEWS