Imagine you bought a digital currency at a reasonable price and now you don’t know you have to focus on profit or prevent possible loss. This is where the OCO order comes to your job. OCO order in digital currency is a combination order that allows you to set two different conditions for buying or selling at the same time: one for profit and the other to limit the loss.

This tool not only makes the trader calm, but also helps to avoid sudden market fluctuations. OCO order training is a necessity for those who want to manage their transactions smarter and without the need for instant monitoring. So in the following article, we will learn more about OCO order and learn how to use it.

What is OCO order?

OCO order The abbreviation for “One Cancels the Other” means “one, one cancels the other” is a kind of bracket order in financial markets. In this type of order, two trading commands will be logged in simultaneously, and if one is executed, the other is automatically canceled.

Read more: Types of Digital Currency Exchange Order

This structure helps traders benefit or prevent the loss in the oscillatory of the market. The OCO order usually includes a Take Profit order and a Loss Loss.

Read more: What is the loss limit?

In practice, the trader can perform Risk Management better using OCO order. Instead of constantly observing the market, it allows the system to run one based on the market status by determining the loss limit and profit limit in OCO.

Read more: What is the Sweet Profit?

This tool is especially useful for those who have a specific strategy and do not want to make emotional decisions. Using OCO causes transactions and increases control over severe fluctuations.

OCO order in simple language

Suppose you bought a digital currency and you want to make a profit and escape the possible loss. The OCO order does exactly that. You set up two orders at the same time: one for when the price goes up (for profit) and one for when the price drops (to prevent losses). If the price reaches one of the two, that order will be executed and the other order will be removed.

With OCO you no longer have to check the market for a minute. The system automatically decides and free you from worry. Simply put, OCO is like putting two guards in the upper and lower price range.

Define OCO order with example

Suppose you bought bitcoin for $ 5. If the price reaches $ 5, you want to sell and make a profit. But if you make a mistake and the price falls, you don’t want to lose more than $ 5. In this case, you set an OCo order: one for $ 2 for sale and one to stop the loss at $ 2.

If the market reaches $ 5, the sales order will be executed and the loss order will be eliminated. But if the price suddenly drops and reaches $ 5, the loss stop order will be executed and the sales order will be canceled. This way, you are dealing more safely because you stopped the loss and you don’t miss the opportunity.

How does the OCO order work?

The intelligent combination of two types of orders is different: Limit Order or Stop Order. Limited order runs when the market price reaches the desired level or is better, for example, for sale at a higher price than the current market price. In contrast, the stop order is usually used to prevent losses and when the price reaches a certain level, such as the purchase price.

In the OCO order, the two orders are logged at the same time but with a specific condition: If one of them runs, the order will be automatically canceled. For example, if the order is executed at the profit level, there is no need to order a stop, because the transaction has been made and the risk of loss is lost. Also, if the price reaches the loss and the stop order is executed, the limited order will be meaningless and the cancellation will be canceled.

This automatic coordination makes the trader need instant monitoring and at the same time he can implement his trading strategy properly. OCO order is particularly used in the marketplace markets, where the price may move quickly from one level to another. With this tool, risk management and locking of profits are easier and faster, and the likelihood of emotional decision making is reduced.

Difference of OCO order and other orders

The OCO order by combining two independent orders has a different function of ordinary orders such as Limit or Stop Limit. This order creates an automatic and intelligent control of transactions by automating one of the commands after executing another. For this reason, traders need to know the key differences with other orders.

READ MORE: What is Limitine and Stop Limit?

Difference of OCO with Limit order

In Limit’s order, the trader only records a purchase or sale command at a specified or better price. The order is implemented when the market price reaches the desired amount, but there is no guarantee of its implementation, especially in the markets.

In contrast, the OCo order consists of a Limitian order and another (usually stop) order, one of which is activated and the other is canceled. This combination makes the trader both seeking profit and preventing losses, while ordering Limit alone does not provide such a cover.

The difference between OCO and Stop Limit

Limit Stop order comes when the price reaches the stop level, but only if the terms of the designated Limit are set afterwards. This type of order is mostly used for accurate entry or exit from the market, but it only covers one path, not two different modes.

The OCO order is made of a combination of a Limit order and a Limit Stop, but the important thing is that in OCO, if one of the two orders runs, the other will be automatically canceled. Therefore, OCO allows the trader to predict and manage two different scenarios simultaneously, while the Stop Limit order only follows one specific path.

Step -by -step tutorial register OCO order

In this section, we are going to review the video tutorial on the OCO order as a step in several reputable foreign exchange. Exchanges such as Binens and Bitfins have provided their users with the OCO tool. Below, with simple descriptions and image, we will examine the steps to use this type of order.

OCO Order Registration Training in Baynens

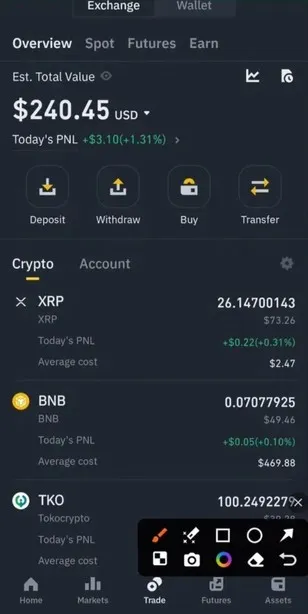

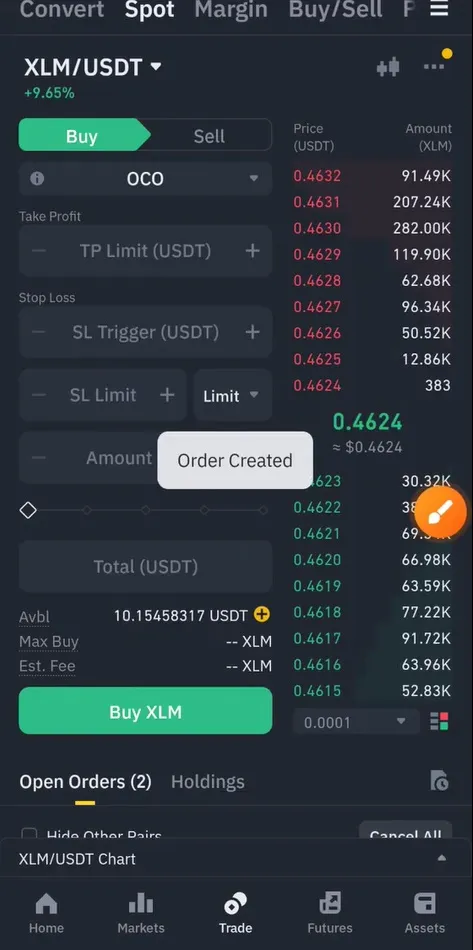

As you can see in the picture below, we first log in to the Binens site.

Then click on the Trade tab.

In the Spot section, we choose a pair of currency.

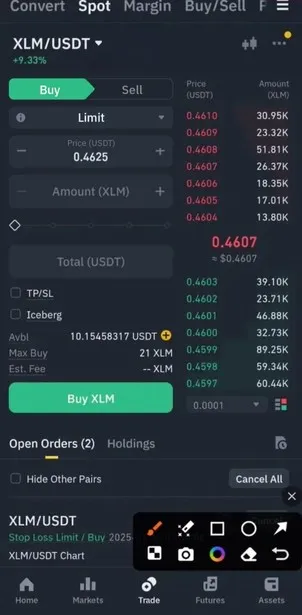

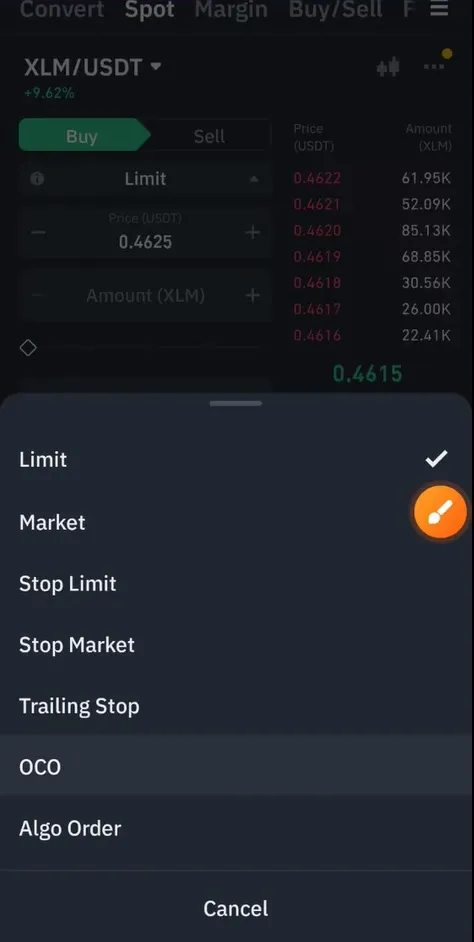

Click Limit to open a new tab.

In the tab created, we select the Oco option.

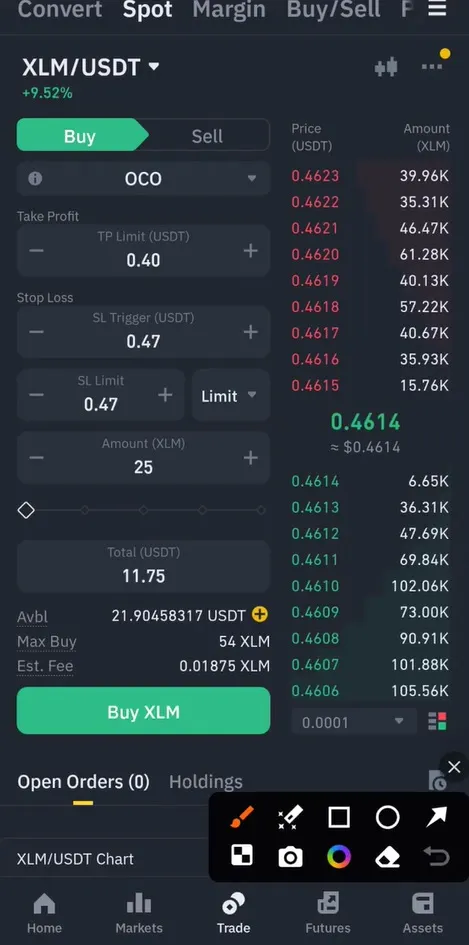

In this section, you need to import values for Take Profit, SL Limit, SL Trigger as well as the number of currencies you want.

After clicking on the Buy option, the Created Order Confirmation Message is displayed, indicating that the process is successful.

OCO Order Registration Training at Bitfins Exchange

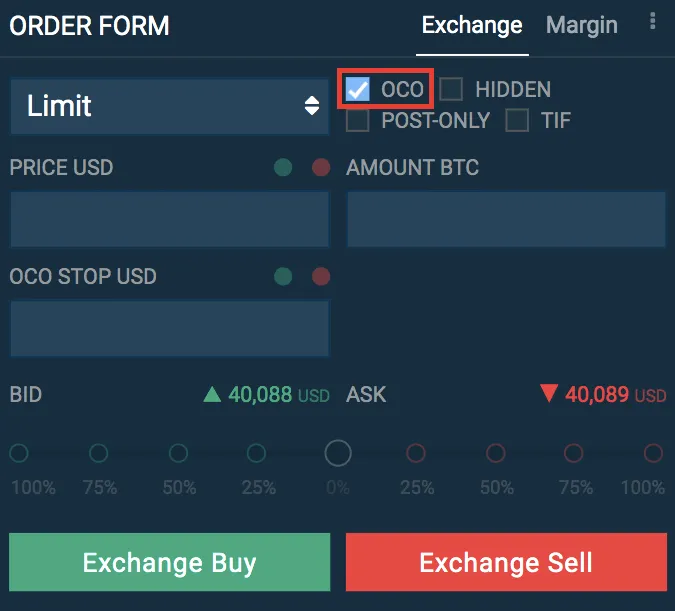

- Enter the Bitfinex platform and go to the Trading section.

- In the ordering section, first select the Limit or Stop order. Then from the drop -down menu, the option Oco Enable.

- Introduce the prices for both orders and specify the amount of currency.

- Button Submit Press up to register your OCO order.

The benefits of ordering OCO

Using OCO order in transactions has significant benefits for traders. This type of order provides a combination of flexibility and risk control. Its most important benefits include simultaneous management of profit and loss, reduced the need for continuous market follow -up, and preventing heavy losses.

Automatic Management of Profit and Loss

By ordering OCO, the trader can pursue two important goals at the same time: registering profit and limiting losses. This type of order allows him to determine both a higher price sales order (profit) and a stop order to prevent losses. As a result, if the market moves in the desired direction, the profit will be recorded, otherwise the system will automatically limit the loss.

This automated management makes trading decisions based on previous planning without the intervention of instant emotion. Even if the trader is not at the time of the event, the OCO order will perform his job. This method is especially useful for those who do not want to enter manual transactions permanently.

Reducing the need for continuous monitoring of the market

One of the main concerns of traders is the constant pursuit of charts and prices. OCO order reduces this need to a great extent, because after registering it, you no longer need to have a permanent presence on the trading platform. The user can safely do other things and be sure that if the price reaches one of the set levels, the system will take action.

This advantage reduces stress, saves time, and increases productivity. Especially in markets that are open for 4 hours, such as digital currencies, using OCO order helps not miss the right opportunities, even when one is sleeping or doing other things. In fact, this type of order plays the role of a trading assistant.

Prevention of heavy losses

One of the main uses of OCO order is to limit the loss in unexpected market conditions. In the event of a sudden price fall, the Stop order, which is part of the OCO, is activated and sells the asset at a certain price to prevent further losses. This rapid and automatic performance can prevent major losses and maintain the trading capital.

In the absence of OCO, the trader may lose the opportunity to respond quickly and the market moves against its prediction. For this reason, ordering OCO is an effective tool for risk control, especially for those who care about capital management. Proper use of this tool can provide more psychological security for the trader and prevent hasty decisions.

Disadvantages and challenges of OCO order

Despite the many benefits, ordering OCO is not challenging and in some circumstances it can be troubled. Technical constraints in some currency exchanges as well as misunderstanding of its performance can lead to incorrect or unwanted cancellation of orders. For this reason, a precise understanding of the mechanism of this tool is essential before use.

Special currency exchanges

Some digital currency exchange currency or stock exchanges still do not fully support or limit OCO order to certain conditions. It may only be active in specific markets, or only for Spot transactions and users may not be able to use it in leverage transactions.

In some cases, the OCO order may not be registered or canceled for technical or crowded reasons. These problems, especially when the market is in sharp fluctuations, can lead to loss of opportunities or unwanted losses. Therefore, users need to make sure their currency exchange features about OCO.

Possible risks in the event of a lack of understanding of OCO performance

If the trader does not properly know which order is Limit and which stop, he may adjust the wrong order at the wrong price. This mistake can lead to unwanted ordering in the wrong direction or losing the trading position.

Some also think that both OCO orders may be implemented simultaneously, while in fact one runs out the other immediately. This improper impression may disrupt transactions planning and increase the risk of transactions. To prevent such errors, it is necessary to teach before using OCO.

Important points in using OCO order

To use the OCO order, it is not enough to get a surface familiarity with its performance. The trader must properly analyze the market conditions, the amount of fluctuations, and the purpose of entering the transaction. It is also necessary to know that OCO is not the best option in all circumstances and that its use should be accompanied by a precise understanding of the risk and possible profit.

Investigating Market Conditions

Before using OCO order, the trader must recognize the overall direction of the market; Because OCO is more effective when the market is on the verge of a specific movement, not in neutral. If the market is in a specific uptrend or downward trend, the OCO can be used at the same time as the OCO and will be protected from sudden fall.

In or without the trend markets, the OCO order may activate one of the two orders, but then the price will return again and cause loss. In such circumstances, it is advisable to use other position management methods. Technical Analysis and the examination of resistance and support levels are a prerequisite for correct decision -making for OCO activation.

Is OCO always the best option?

Although OCO order is a powerful tool, it is not used in any situation. In some short -term transactions or when the trader intends to manually manage the position, the use of separate orders or even manual entry and exit may be more efficient.

OCO is more suitable for those who do not want to monitor the market constantly or for transactions that are likely to have severe fluctuations. Therefore, it is important to examine the type of strategy and timing of the transaction before choosing an OCO.

More risk management with OCO

One of the most important benefits of ordering OCO is the ability to simultaneously control the two profits or loss scenarios. If used properly, it can be part of the trader’s risk management strategy and prevent sudden losses.

But this risk management is only effective when the prices set for orders are reasonable. Inappropriate determination of profit or loss can lead to unfavorable execution of the transaction or loss of opportunities. Therefore, prices must be accurate and based on technical analysis.

Frequently asked questions

OCO order is a combination of a Limit order and a stop order; By running one, the other is automatically canceled.

There are two orders at the OCO order, but there is only one conditional order to activate the Limit.

After selecting the OCO option in the transaction section, you enter the price of the laminate and the price of the stop and register the order.

Simultaneous management of profit and loss, reduction in the need for permanent monitoring and automatic implementation of trading decisions are its benefits.

Yes, some Iranian currency exchanges such as Nubitx, OMP Pinx and Bitpine support OCO order.

Conclusion

OCO order is a practical tool for managing transactions in the markets. This type of order allows traders to plan at the same time for profit and prevent losses, without the need for constant market supervision. The intelligent composition of the two Limit and Stops in the form of OCO adds a lot of flexibility to trading strategies.

Despite the many benefits, using OCO requires a proper understanding of its performance and accurate analysis of market conditions. Although some Iranian currency exchanges support this feature, users must be aware of the limitations and features of each platform. Finally, OCO order is suitable for people who are looking for smart risk management and reducing human errors in transactions and do not want to constantly monitor the market.

RCO NEWS