Exchange and Cryptocurrency as two popular investment options, similarities and fundamental differences. The stock market, with a few hundred years old, can buy and sell various assets, including goods, currencies, stocks and bonds in specific hours and days of the week. But in the crypto market, as an emerging phenomenon, crypto assets are being traded 2 hours a day in 7 days a week.

Therefore, the success of both of these markets depends on your understanding of their differences and similarities. In this article, we examine the difference between the stock market and the crypto market, the role of brokers and currency exchanges, the similarities and differences of tools used to analyze technical and fundamentalists, and general recommendations for the success of the transaction.

Definition of transaction in the stock exchange

To be careful, the Exchange is a market in which securities, goods, stocks, currencies, derivatives and other financial instruments are traded. The mistake of many people is that they use the word “stock” in the sense of “stocks” to refer to the stock market.

It is not bad to know, however, that in some areas, stock markets may also be called “share exchange” or “bourse”. However, the stock exchange is a general word that can include all traditional financial markets. However, in this article, we put the Stock Exchange as one of the most popular types of stock markets, the basis for analyzing similarities and differences with the digital currency market.

When you buy a stock, you have actually purchased part of its ownership. Therefore, the trading in the stock market means ownership of a stock company that depends on the number of shares purchased by you.

What is the stock market?

The stock market may be an electronic platform or a physical place in which traders attend and trademark. Most countries around the world have active stock markets. The most famous stock exchanges in the world include the New York Exchange (NYSE), Nasdaq London Exchange (LSE) and the Tokyo Stock Exchange (TSE).

In Iran, too, the Tehran Stock Exchange, the Iranian Farabor, the Stock Exchange and the Energy Exchange are the main structure of the Iranian capital market.

The main task of a stock exchange is to ensure fair and orderly transactions as well as the efficient dissemination of price information for each financial asset in which the stock exchange is traded. Stock Exchange provides a platform for companies, governments, and other institutions to provide investors to the public.

The role of brokers in the stock market

We must divide the brokers in the stock exchange space (Broker) and the Brokerage Firm:

Broker

A broker is a broker, a person or company who acts as an intermediary between the investor and the stock market. For example, a StockBroker market agent executes stocks on behalf of customers and investors.

But since Securities Exchange only accept orders provided by official members of the stock exchange, traders and micro -investors need stock exchange services (ie brokers).

Some agents also provide investment consulting services. Brokers may operate independently or hire a brokerage firm.

Brokerage Company

A Brokerage Exchange is an institution that connects the buyer and seller for shares, bonds, transaction securities and other financial equipment. These companies receive a commission for their service.

A brokerage firm can provide a variety of services including financial consulting, market research and investment portfolio management. Brokerage firms may hire brokers or allow customers to deal directly through online platforms.

Definition of transaction in the digital currency market

In the Cryptocurrency Market market, digital units are traded from a currency password instead of the share or ownership of a company. For example, with Bitcoin, you buy and sell units of this digital currency.

Unlike the stock exchange, the trading of digital currencies is not dependent on a market, and even the possibility of buying and selling currency passwords is unusual and without the need for a stock exchange, which is one of the fundamental differences between the two markets.

The role of digital currency exchange rates

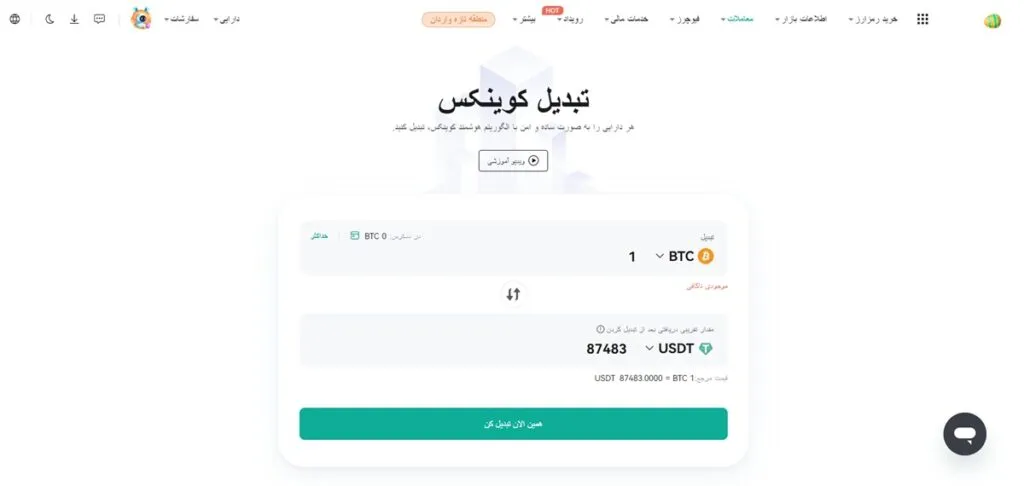

We also need a secure platform for currency passwords that use the same word “Exchange” in English to call them the word “stock”, but in Farsi the word “currency”. Unlike the stock exchange, which can have physical space, currency exchanges usually do not have a place to gather traders to deal with each other and operate online.

Crypto Exchange exchanges are an interface platform that allows the currency to trade. On these platforms you can either trade with other users either directly with the currency exchange or as well as P2P.

Of course, one of the benefits of digital currency trading is that it does not necessarily need to use a currency exchange; You can send and deal with your digital currency directly without using a currency exchange.

Read more: The best Iranian digital currency exchange

Key differences of digital currency and digital currency market

Given the definitions of trading and trading on the stock market (especially stocks) and the crypto market, it is clear that the two markets have significant differences that each factor can be among their advantages and disadvantages. In this section, we examine the difference between the stock exchange and the digital currency.

In the table below, you will find a summary of the differences between the stock market and the digital currency that can help you with the right option to invest in bitcoin or stock exchange:

| Subject | Exchange | Crypto |

| Trading hours | Limited to work days, such as 1 to 2:30 pm | 2 hours of the day, 2 days a week |

| Swing and risk | Less swing, dependent on corporate performance | High fluctuation, dependent on market feelings |

| Legislation | Formal regulatory institutions; Like SEC in the US and the Stock Exchange in Iran | Lacking global coherent structure, variable rules in any country |

| Security | Supervised, with specified frameworks | Exposed to the risk of hacking, fraud and changing the legislation |

| Criticism | Top for large stocks, sometimes limited to small stocks | Top in the main currencies, less in the penis |

| Access | Limited to market hours and formal registration steps | Easier entry, even without authentication in some currency exchanges |

| Fundamental analysis tools | Based on corporate official financial data | Based on project and network qualitative factors |

| Technical Analysis | Common and practical | Very widely used, given the high fluctuations |

Difference in trading hours

The most important difference between the stock exchange and the digital currency is their trading hours. In general, the trading in the capital market can be done in the days and hours of the week; These markets are closed on weekends and official holidays.

In Iran, for example, stock exchanges are open from 9 am to 9:30 pm on Saturday to Wednesday and can trade assets. In the world markets, depending on the type of market and their country, working hours can be different, but they are still limited to weekly and non -working days.

But the trading in the crypto market is made of 1/5 without interruption. In this market you can register your purchase and sales order at any hour of the day.

Read more: The best time to sell digital currency

The difference in the amount of oscillation and risk

The stock exchange and digital currency also differ greatly in terms of fluctuation and risk. Digital currencies are known as their oscillatory, so they are excellent for short -term transactions and excellent tool fluctuations. However, the same high price fluctuation, which is mostly dependent on traders’ emotions, is one of their major risk factor, which, along with profitability, increases the likelihood of losses.

In contrast, the capital market and stock market (exclusively stock market) are inherently less volatile and are more related to corporate revenues. While the price fluctuations in traditional assets are normal on normal days, it is much lower than the currency’s coding fluctuations. However, the stock market is also not immune to fluctuations, and factors such as market downturn, world news, poor management, national policies and changing industry trends affect them.

Difference in legislation and security

In the stock market, monitoring and legislation is carried out by specific central institutions. In the United States, for example, the Stock Exchange Commission (SEC) and the CFTC Commission on the Financial Markets are responsible for regulating the financial market regulations. Stock companies are also required to provide regular financial reports and comply with information disclosure standards. This coherent legal structure increases investor trust and reduces investment -related risks.

The Iranian stock market is also under the supervision of the Stock Exchange. As a non -governmental institution with independent legal and financial personality, the organization is responsible for legislating and monitoring the enforcement of laws in the capital market. The financial resources of the organization are funded by the fees received and a share of the right to adopt companies on the stock markets.

In contrast, the crypto market faces legislative challenges. Many countries still do not have or are developing a specific legal framework for digital currencies. In the United States, for example, the segmentation of digital currencies as a product or securities has interfered with the tasks between SEC and CFTC.

In addition, although some countries, such as the European Union, have been trying to create a legal framework for the crypto market, with the approval of regulations such as MICA, it is still lower in terms of legislation and security.

In Iran too, although the transaction of digital currencies is not banned, the central bank and other legislative agencies have restricted the activities of these platforms over the past months and are seeking to oversee the space.

Difference in the amount of liquidity and access

Stock markets usually have high liquidity. This means the ability to buy and sell stock quickly with the least impact on market price. However, liquidity can be reduced when trading shares of smaller companies or at certain times of the day when trading volume is lower.

In terms of access, except for the limitation of working hours, harvesting has restrictions on traditional stock markets and is not instantly performed. In addition, it is necessary to open an account in brokers and comply with specific regulations to operate.

Similar to the stock market, popular market currencies such as bitcoin and ethereum usually have high liquidity, but for less well -known currencies there may be less liquidity, which is a factor in price fluctuations. Along with the four -hour access to the crypto market, some currency exchanges do not require authentication, which reduces the barriers to the market.

Difference in analytical tools and decision -making

In the stock market, the fundamental analysis that focuses on corporate financial performance evaluation works better. Investors determine the intrinsic value of stocks by examining the financial statements, revenues, profitability, assets and debt. This information is published regularly and under the supervision of legal entities.

In contrast, Fannattal’s analysis in the Ramsar market examines factors such as market volume, trading volume, token structure, total lock value (TVL), project roadmap, developer team, community size and interaction, network growth rate and token application. This analysis depends more on the qualitative evaluation of projects due to the lack of traditional financial data.

Technical analysis is used in both the stock market and crypto markets, but it is more important in the Ramras market because of its specific features such as high price fluctuations and 4 -hour activity.

Read more: What is the technical analysis

The similarities of the stock market and digital currency market

Aside from the differences we mentioned, the digital currency market and the stock market are similar in some ways that we will examine below.

Need knowledge and skill

Investing in both digital exchange and digital currency markets requires specific knowledge and skills. As an investor to succeed in both of these markets, you need to be able to analyze, understand fluctuations, and predict trends. Therefore, familiarity with analytical tools and the ability to interpret market data helps to make better decisions.

Dependent on market news and feelings

Both crypto markets and stock markets are influenced by investor news and emotions. Economic, political and technology news can have a significant impact on prices in both markets.

Emotions such as the fear of losing, or fomo, can cause severe market fluctuations. These effects on the digital currency market will usually be more severe due to the lack of intrinsic value and more dependence on emotions.

Application of technical analysis

Technical analysis is used in both digital currency and stock markets. You can analyze the trends and determine your entry and exit points in transactions by examining the price charts and using technical indicators such as moving average, RSI and McD (MACD). These tools are used in both markets to predict pricing and trading decisions.

What is the most appropriate for each market?

Given the differences and similarities and features of the financial markets, you can choose between the capital market or the crypto or even both of them.

Digital currency market for risky trays

Unlike the stock market, the rise and fall of prices in the currency market is sometimes very severe, which, along with the opportunity to profit, also increase the risk of damage.

Therefore, the digital currency market is suitable for investors who are highly risk -taking due to high price fluctuations and lack of traditional support. This market is more suitable for people who are capable of managing emotions and rapid decision -making in swing conditions.

Stock market for conservative investors

Due to legal oversight, strong structures and mechanisms to control price fluctuations, the stock market is more suitable for investors seeking sustainable and long -term growth.

For example, according to the rules of the Iranian Stock Exchange, the daily volatility range for most stock exchanges is set at between 2 %. Although in certain conditions, such as the reopening of the symbols after long -term stopping or at the time of initial release, the range of volatility may be temporarily increased or even eliminated, most of the price changes are not as high as the crypto market.

In the world markets, the highest daily price fluctuations were recorded for the Dow Jones Industrial Index, with a 2 -unit crash, equivalent to 4.9 percent per year.

Read more: What is the Dow Jones index

General advice based on age, experience and capital

A young Trader with a long -term horizon and a higher risk tolerance can devote a higher percentage of its capital to vibrant markets such as digital currency.

In contrast, investors close to retirement or less risk tolerance, should focus on more sustainable assets such as corporate stocks and investment funds.

However, due to the intrinsic difference between the stock exchange and the digital currency, diversification to the portfolio of investment and the proper allocation of assets based on financial goals and individual risk tolerance is recommended to all individuals of any age and capital horizon.

Recommendation for beginner investors

If you are a beginner investor, it is best to start by investing in the stock market through index funds or ETFs. These tools allow portfolio diversification at low cost.

If you would like to enter the digital currency market, it is also recommended that you allocate a small percentage of the investment portfolio (eg 1 or less) and after acquiring sufficient knowledge. To do this, the use of test accounts and consultation with financial experts can also help reduce risk.

Read more: What is Bitcoin ETF

Frequently asked questions

Probably digital currencies. Unlike the stock market where some stocks have high prices or require minimum inventory in the brokerage account, you can invest in the crypto market for even $ 1 or $ 2. Therefore, to start with low capital, the digital currency market has easier access.

Yes. In addition to separate business and currency exchanges, even platforms such as ETORO and Robinhood have been set up that provide access to equity and raws. It is even recommended that you invest in both markets simultaneously for diversification.

Digital currencies are inherently more volatile than stocks, and on the other hand, factors such as lack of real financial backing, dependence on market emotions, lack of integrated legal framework, and lack of transparency in some projects all increase the risk of this market than more traditional financial markets such as stocks.

Since stock markets operate under the supervision of specific institutions such as the SEC and the Stock Exchange, and companies have to provide clear financial information, the overall security of the stock market can be more than a crypto. There are no such rules for the currency market, and users are at risk of hacking, phishing, and theft of their assets.

Probably no. The stock exchange and crypto have different features and applications and can be complementary instead of competition. Therefore, digital currencies do not replace the stock exchange, but they are a parallel option for investment.

Conclusion

The stock market and digital currency are an opportunity for investment, but differ in structure, risk, legislation and access. Stock Exchange operates under the supervision of official institutions, has specified trading hours, and price fluctuations are more limited. The active 4 -hour digital currency market has higher fluctuations and lacks a comprehensive legal framework in many countries that increases its risk.

Despite the differences, there are similarities between the stock exchange and the crypto; Both require knowledge, experience, and careful analysis. Dependence on market emotions and technical analysis in both show that without education and strategy, you may be harmed. So, whether you are a stock exchange investor or a crypto trader, having a program, controlling emotions and continuous learning are the main tools of your success.

RCO NEWS