We know that in the world of DeFi, financial services are done through blockchain networks and smart contracts instead of centralized institutions like banks. Decentralized exchanges are essential components of the DeFi space, and UniSwap is the largest and most famous decentralized exchange in the world. However, after UniSwap, other options such as Sushi Swap were released. But what is Sushi Swap? What is sushi digital currency? What competitive advantages does it have?

Decentralized exchange Sushi Swap also has its own native token called Sushi (SUSHI). Using Sushi Token, users can use various facilities such as trading digital currencies, participating in important decisions and earning profit. In this article, we teach zero to hundred sushi swap protocol and its digital currency, SUSHI.

What is Sushi Swap digital currency?

SushiSwap is a decentralized exchange protocol where traders can make their transactions directly without the need for any centralized entity. SUSHI digital currency is the main currency of Sushi Swap exchange and this exchange is managed by Sushi token holders. Holders of Sushi Token can participate in related voting and have a role in its decisions.

These votes are done through smart contracts and no centralized entity is involved in them. These contracts automatically calculate voting results. Finally, the accepted decisions are implemented by the core team of Sushi developers. This team is responsible for the development and maintenance of Sushi and implements voting decisions in a way that is in line with Sushi’s goals. Sushi tokens can be obtained in two ways:

- Buying from the digital currency market

- Carrying out collaborative activities such as providing liquidity for liquidity pools

Collaborative activities, also referred to as “farming”, allow users to earn Sushi Tokens by providing liquidity to Sushi’s liquidity pools. This system provides an economic incentive to operate on the Sushi platform and helps the growth of the DiFi ecosystem.

Read more: What is a smart contract?

What is Sushi Swap?

SushiSwap is an Ethereum-based decentralized exchange that uses the Automated Market Maker Model (AMM). AMM is an efficient trading mechanism that allows miners to trade their tokens using liquidity pools. Previously, this model was introduced by the Uniswap decentralized exchange to provide liquidity.

Read more: What is the Ethereum currency?

SushiSwap has also served other DeFi solutions in the past, but now focuses on developing, maintaining and optimizing its own decentralized exchange. To buy and sell different virtual currencies, you can exchange more than 11,000 currency pairs by connecting a digital currency wallet like MetaMask to the decentralized Sushi Swap platform.

History of Sushi Swap

Sushi Swap was launched in August 2020 by an unknown founder with the nickname Chef Nomi. This person took the open source code of the UniSwap protocol and modified it to create SushiSwap. SushiSwap is similar to UniSwap, but with new features.

Also read: What is UniSwap?

SushiSwap initially gave users who deposited their liquidity into liquidity pools, Sushi Tokens. This caused many people to come to this exchange; Because they could get new tokens by providing liquidity. At that time, UniSwap had not released its token yet, and Sushi wanted to take advantage of this opportunity to attract users.

Initially, SushiSwap was able to increase its total locked-up assets more than UniSwap by offering Sushi Rewards. But UniSwap also quickly released its own token, which made many users return to UniSwap.

In September 2020, the founder of Sushi Swap sold some of his Sushi tokens worth $12-14 million. This caused many people to worry that this project is a scam. Eventually, he bought back his sold tokens and handed over control of the platform to Sam Bankman-Fried, CEO of the FTX exchange. In 2022, Jared Gray was introduced as the manager of Sushi.

How does Sushi Swap work?

Sushi Swap exchange has three main functions, which are:

- Digital currency exchange

- Providing liquidity

- Receive rewards

Sushi Swap offers each of these services with solutions that we will review below.

Providing liquidity and receiving rewards based on AMM

As we said, SushiSwap is a decentralized exchange that uses AMM. AMM is a digital asset exchange mechanism that works based on smart contracts. For example, to provide liquidity in the Ethereum/DAI (ETH/DAI) currency pair liquidity pool, Liquidity Providers (LPs) must lock an equivalent value of both ETH and DAI into the pool. In other words, one dollar worth of ETH for every dollar of DAI.

In exchange for providing liquidity, liquidity providers receive LP tokens representing their contribution to the pool. These tokens can be used to receive a portion of transaction fees.

Traders can exchange their ETH for DAI or vice versa in the pool. The value of the pools is calculated using a mathematical formula that tries to maintain balance in the pool. Traders help keep the pool balanced by participating in trades. This makes the amount of both tokens in the pool always equal.

Liquidity providers are remunerated by fees charged to traders for transactions. In addition, they can also enjoy other bonuses that are specific to each pool. Also, these people can participate in a farm with their LP staking tokens and earn rewards.

Read more: What is staking?

Platform Sushi X Swap (SushiXSwap)

Sushi provides the possibility of exchanging digital currencies through SushiSwap and SushiXSwap. SushiSwap is a decentralized AMM-based exchange launched in 2019. SushiXSwap is also a decentralized AMM based exchange launched in 2022.

SushiXSwap enables cross-chain transactions using the Stargate protocol. Before this, SushiSwap only allowed transactions within a chain. For example, users could exchange Ethereum for Dai on the Ethereum chain and could not transfer Ethereum tokens from one Ethereum chain to another.

But with the introduction of the Stragate protocol, this exchange now also provides the possibility of cross-chain transactions. For example, users can transfer Ethereum tokens from the Ethereum chain to the Arbiterum chain, or Dai from the Phantom chain to the Polygon chain.

Read more: What is Phantom?

Furo platform

Furo helps DAOs reward their contributors tokens over time. Foro does this regularly and automatically, which improves efficiency. In addition, Foro helps to automatically control the token vesting period. The vesting period is the length of time that participants’ locked tokens are released over time.

To control the vesting period, Foro assigns a non-fungible token (NFT) to each contributor’s position. This NFT comes with an expiration date. Contributors can only sell their tokens after the NFT expires.

Read more: What is an NFT?

What is the difference between Sushi Swap and Uni Swap?

Although SushiSwap is a copy of UniSwap, it differs from it in its fee structure and other aspects. The most important differences between uni swap and sushi swap are:

- UniSwap has three levels of fees with percentages of 0.05%, 0.3% and 1%;

- Stablecoin pairs may have a fee of 0.05%;

- Common currency pairs like ETH/USDT may charge a fee of 0.3%;

- Pairs with new tokens may have a 1% fee;

- SushiSwap charges a flat fee of 0.3% from all trading teams;

- DISH token holders pay a fee equal to 0.05%;

- Liquidity providers must pay a fee of 0.25%.

UniSwap will not offer additional rewards until the new token is released. But Sushi provides additional Sushi tokens for staking new tokens. Of course, it should be noted that from the point of view of the volume of transactions, UniSwap is authoritatively ahead of Sushi Swap. The trading volume of UniSwap is about 10 times that of Sushi Swap.

Benefits of Sushi Swap

- Decentralization: SushiSwap is a decentralized exchange, in the sense that it is not under the control of any center and the full control of the assets is in the hands of the users;

- Benefit from Automated Market Maker (AMM): Sushi Swap uses the Automated Market Maker (AMM) mechanism that facilitates fast and efficient transactions without the need for an order book;

- Low fees: SushiSwap has relatively low exchange fees compared to centralized exchanges. In addition, it does not charge any deposit or withdrawal fees;

- sovereignty: Sushi Swap has internal governance mechanisms. The protocol allows Sushi token holders to vote on protocol upgrades and changes. This allows the project community to provide input on the project’s goals and help ensure its long-term success.

Learning how to work with Sushi Swap exchange

To use Sushi Swap, the first condition is to have some tokens of the tokens traded in this exchange (such as Ether) in one of the supported wallets and connect the desired wallet to the exchange. Follow the steps below:

Step 1. Run the Sushi app

Assuming you already have a digital currency wallet, you can access the Sushi Swap interface by simply going to Sushi Swap’s address (sushi.com).

Then click on the ‘Enter App’ option to be redirected to the SushiSwap page where you can connect your wallet.

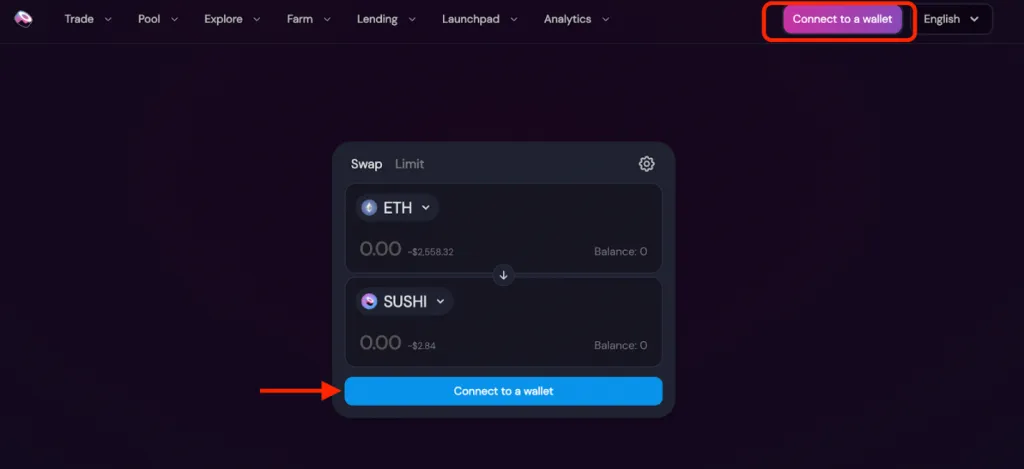

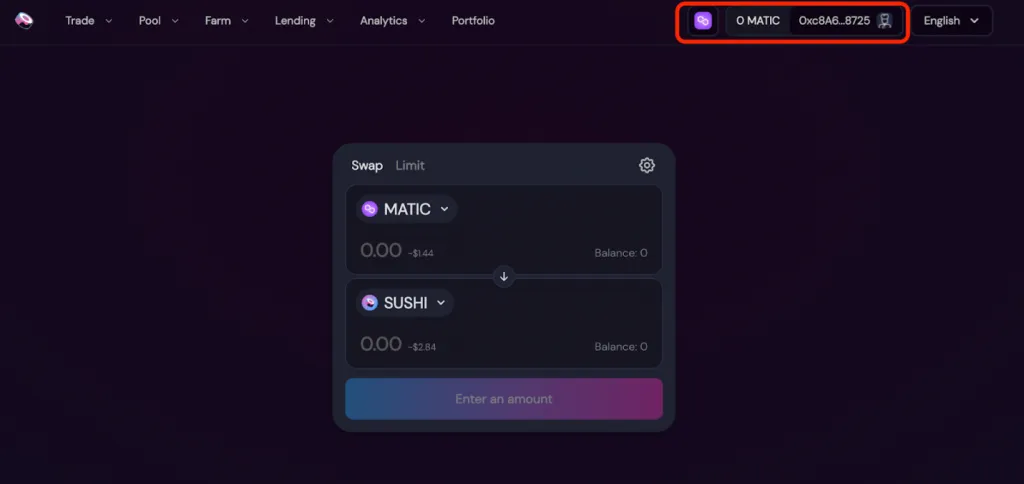

Step 2. Connect your wallet to Sushi Swap

This page is where you can exchange tokens. Click on the “Connect Wallet” option at the top right.

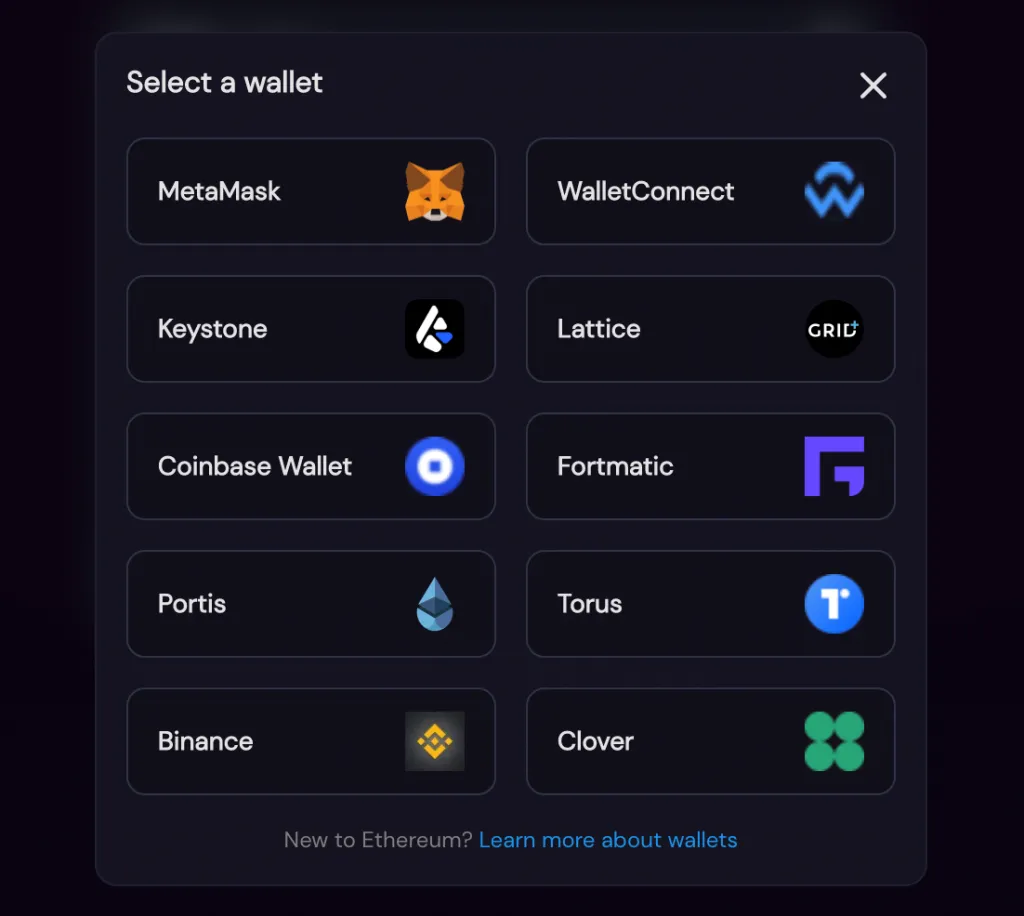

Step 3. Choose a wallet

Select your personal wallet from the list of supported wallets.

Note that WalletConnect supports a number of wallets, including TrustWallet. In this example, we will use the Metamask wallet; Because this wallet is the most popular browser-based wallet and most Dapps support it.

Read more: complete tutorial of MetaMask wallet; Installation and use steps

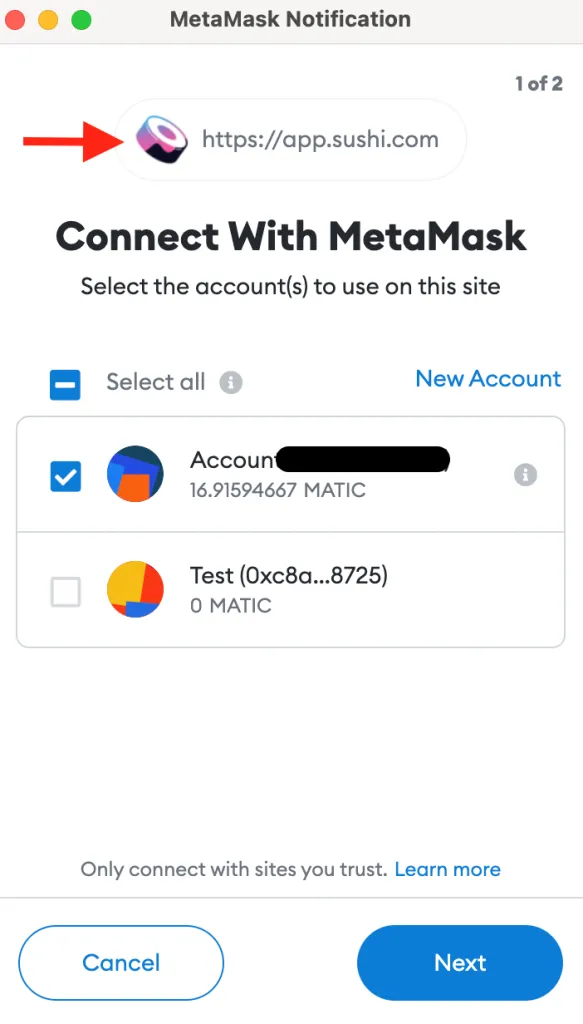

Assuming you’ve already created your Metamask account on the browser, a window will pop up asking for permission to connect your wallet to Sushi.

Note that there are two notifications coming from Metamask. You need to click Connect to connect to Sushi.

After that, your wallet will be connected to Sushi Exchange.

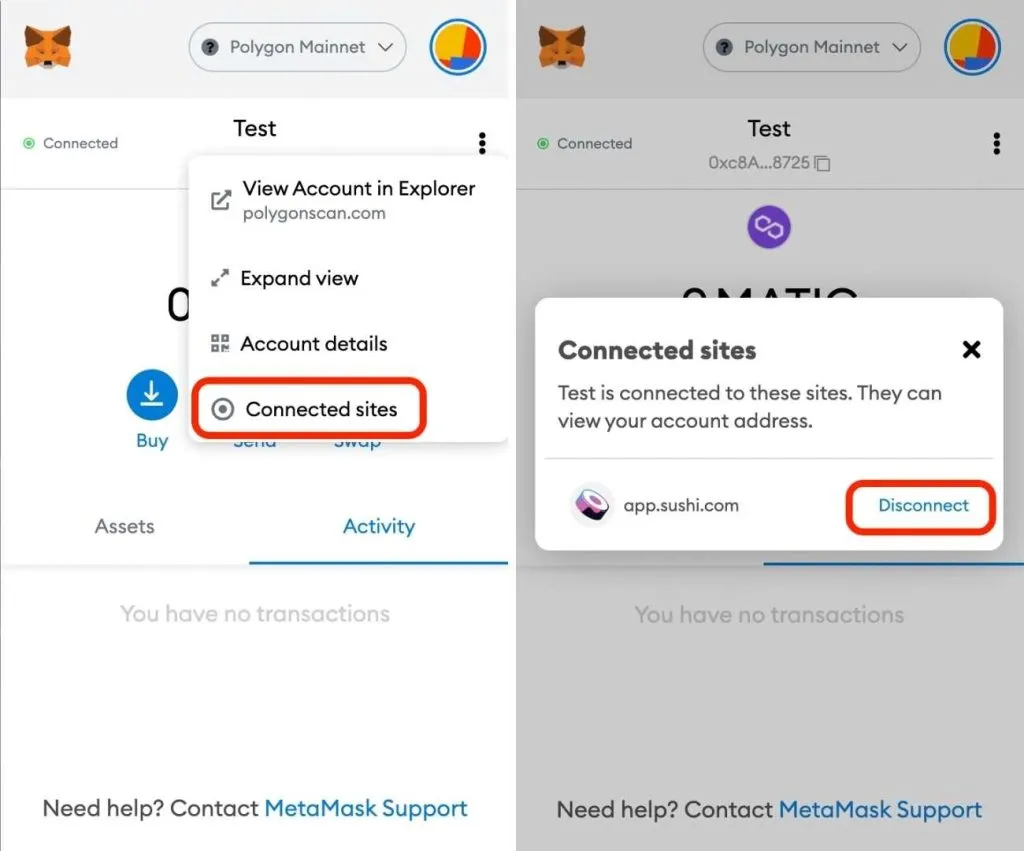

Note that you need to separate your wallet from the DApp as well. You can do this through your wallet. If you use Metamask, go to the three-dot menu below your account picture and select Connected Accounts.

How to become a Liquidity Provider (LP) on Sushi Swap?

To add liquidity to Sushi Swap, you can do the following steps:

Step 1. Choosing currency pairs to provide liquidity

The first thing you need to do is decide which tokens you want to offer as cash. They may be tokens that you already have in your wallet that you want to use to earn rewards. Note that when providing liquidity for a DEX, you must provide the same value of two different tokens.

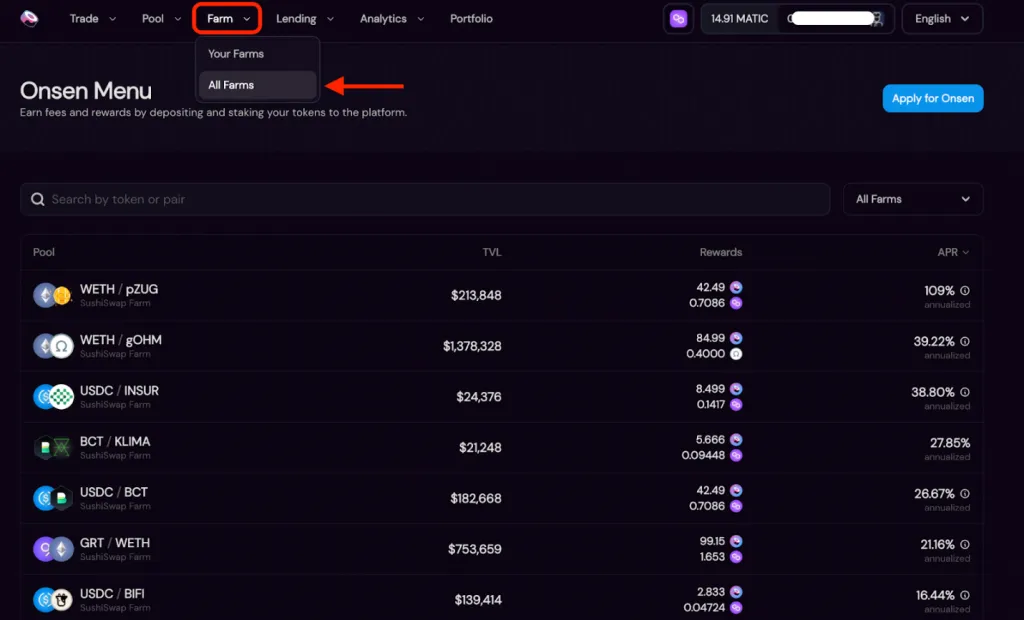

On the other hand, you should keep in mind that incentive pools are in the DEX farm option. Most DEXs, including SushiSwap, have a list of incentive pools where users can deposit LP tokens generated from cash deposits. This process is called “yield farming”.

But there are still other things to consider. Not all tokens offered by DEX are trustworthy. The truth is that anyone can list their newly created token on a DEX. Also, you are facing the risk of impermanent loss, which cannot be overcome. But offering liquidity to high-APR pools is still worth the effort.

After considering all these aspects and deciding on a currency pair to deposit into the liquidity pool, you should check that you have the same amount of currency pairs in your wallet. You can also use the Swap section of Sushi Swap to get the tokens you need to deposit cash.

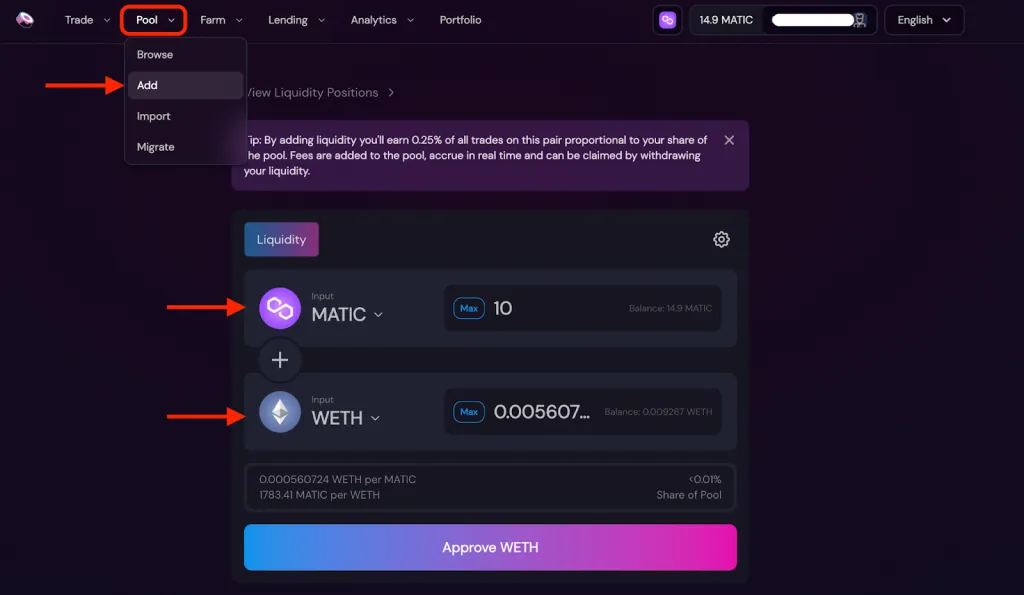

Step 2. Add liquidity in Sushi Exchange

From the top menu, go to the Pool section and the Add tab and select the currency pair you want to deposit as cash. You must also enter an amount of each token of the same value.

After selecting these details, click on Approve Token to allow the exchange to access your tokens. Read the notification carefully and then click on Confirm.

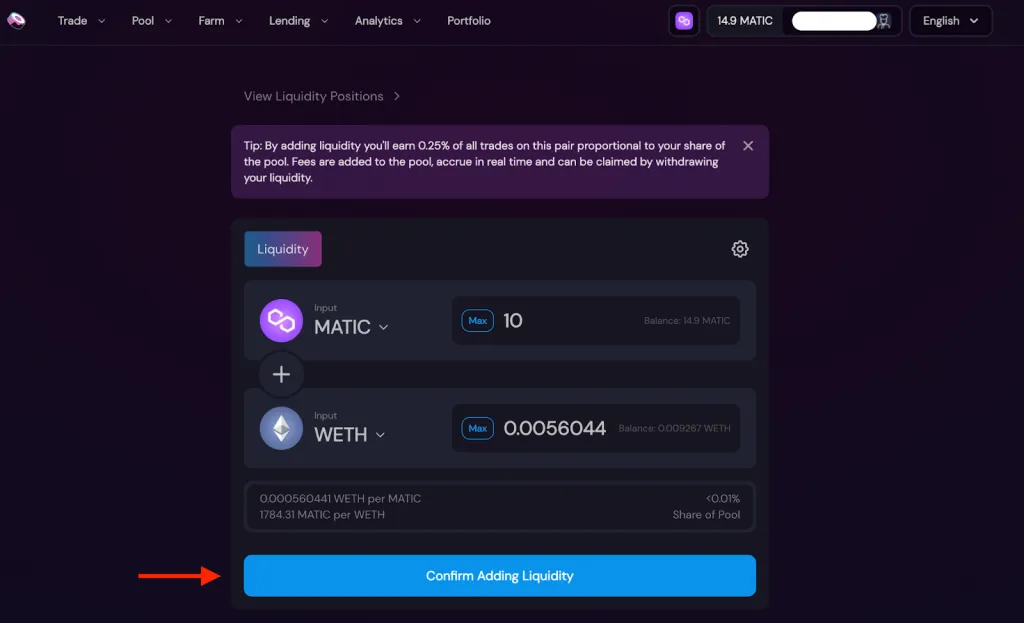

After confirming the tokens (if this is the first time you are using these tokens to provide liquidity, this process is required for both tokens), return to the SushiSwap interface and click Confirm Adding Liquidity.

You will be shown a window with information about what you deposited for cash. This information includes the amount of each token entered as well as your share of the cash pool. Click on “Confirm Supply”.

Then you need to confirm the transaction from your wallet; Because depositing cash to DEX carries a transaction fee. Click on “Confirm”.

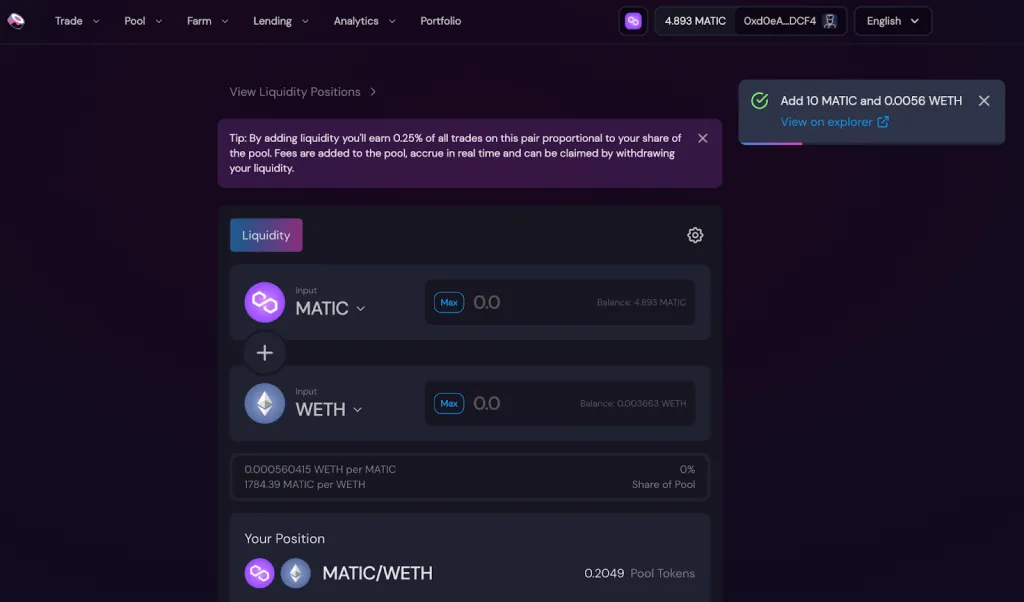

After returning to Sushi, you will be shown information about cash.

Your funds are now in the liquidity pool and are no longer in your wallet. If you want to use your funds, you need to go to the cash section in Sushi and withdraw it.

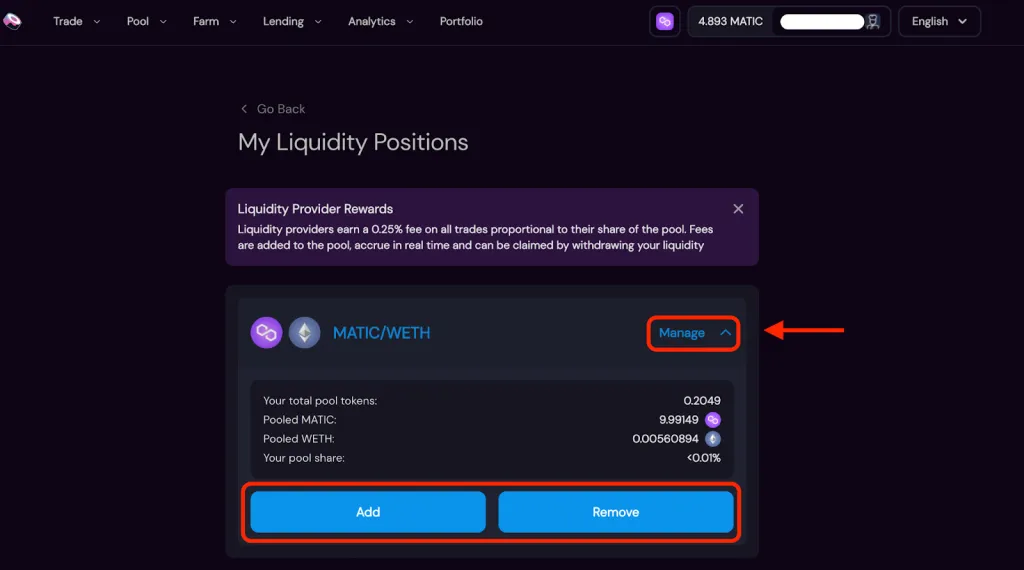

Step 3. Checking the liquidity provided and withdrawing it

To view your liquidity pools, go to the Pool section and the Browse tab. From this section, you can withdraw your locked assets and reward by clicking on “Remove”. Also, if you want to add more cash to that pool, click on the “Add” option.

Buy sushi

To buy sushi currency like any other digital currency, you have two ways: to buy some other coin (for example, Tether) from an Iranian exchange and convert it to sushi in a foreign exchange, and to buy sushi from an Iranian exchange from the beginning.

Using foreign exchanges has always been challenging for Iranians and has become more difficult in recent years. Strict authentication requirements have severely limited the number of international exchanges suitable for Iranians, and on the other hand, domestic exchanges support most of the famous coins and tokens. The set of these factors has made Iranian exchanges a more reasonable option for Iranians.

If you intend to buy sushi currency, you can use the sushi swap purchase page of Aruzdigital website. Finally, we recommend that you do enough research before investing in any currency and weigh all aspects and consider your loss limit.

Frequently asked questions

Sushi Swap is a decentralized exchange whose liquidity is provided by users and managed in a decentralized manner.

SUSHI digital currency is the native currency of Sushi Swap exchange, which has the role of a governance token and its holders can participate in protocol decisions.

UniSwap is the largest decentralized exchange in the world, and in terms of market size and number of active users, it ranks higher than Sushi Swap.

summary

In this article, we explained what sushi is and how it works. Although this decentralized exchange has serious competitors such as UniSwap, it offers various advantages to its users, as you read in this article.

Ultimately, it is up to SushiSwap leaders, community members, and cryptocurrency market forces to decide the future of Sushi. Time will tell what the future of this digital currency will be like and where it will go.

RCO NEWS