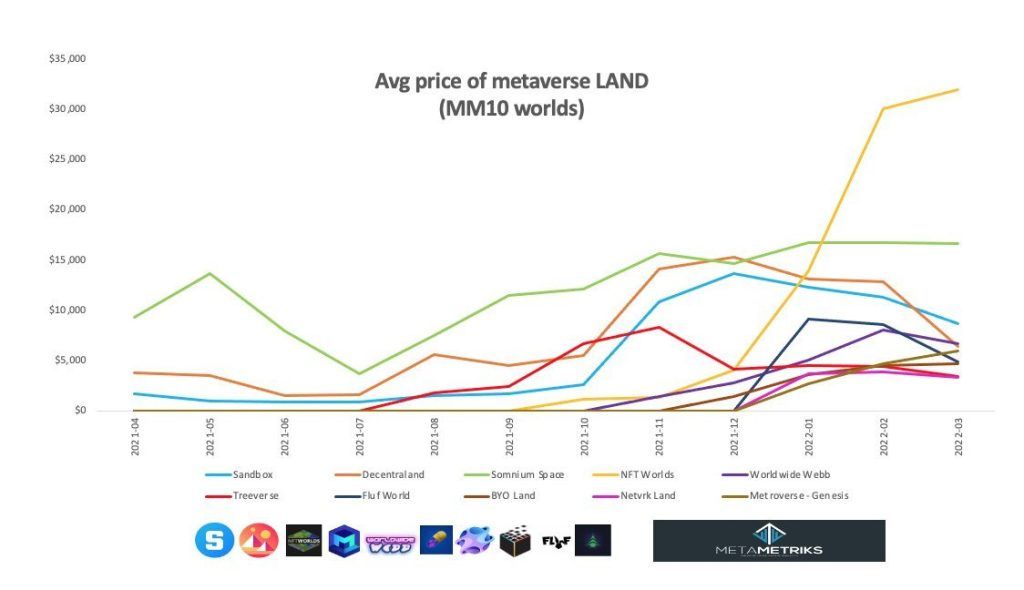

According to the latest statistics, the price of virtual land that is sold on active platforms in the field of metaverse has decreased by an average of 18% during the last month. However, the one-year return on investment in these virtual lands is still higher than that of Ethereum.

According to Crypto News, according to the data of the statistical platform Meta Metriks, the average purchase price of land in the top 30 active platforms in the Metaverse, including Dicentraland and Sandbox, decreased by 18% from the peak of 10,473 over the past month. The dollar has now reached 8,945 dollars.

The price of these licensed lands has decreased while the value of tokens associated with active platforms in the Metaverse field has also decreased over the past 6 months.

For example, the current price of digital currencies Dicentrand (Mana), Sandbox and Oxy Infinity are between 55 and 65% away from the historical highs that were recorded in November.

Let’s also add that the average purchase price of these lands in March is four times higher compared to last year.

Also read: 11 Metaverse projects and income-generating games in 2022 that you should keep an eye on

The prices of lands available in Dicentraland, Sandbox and blockchain game Fluf World have experienced the biggest fall over the past month and have decreased by 49, 23 and 44% respectively. On the other hand, the price of land available in Metroverse and “NFT Worlds” platforms has grown by 27% and 6% respectively during this period.

Despite the decrease in the dollar value of Metaverse lands over the past month, a one-year investment in these lands still has a better return than buying and holding Ethereum in the same period.

Until the end of March (April 11), the one-year investment return on Metaverse lands was 2.6 times better than that of Ethereum, while the price of these lands decreased in the last month, but the price of Ethereum increased during this period.

RCO NEWS